Don’t miss Hang Seng volatility

Hong Kong’s leading stock index may see huge fluctuations this month.

Take advantage with FXTM.

Trading is risky. Past results are not an indicator of future performance.

FXTM’s Market of the Month: Hang Seng Index (HSI50_m)

Every month, our analysts examine current market trends to highlight a new market for your consideration - to help you unearth new opportunities, spread your risk and grow as a trader.

This month, it’s the turn of the Hang Seng Index (HSI50_m).

Trade nowComing up...

October

Wall Street 30 Index

WSt30_m

November

Hang Seng Index

HSI50_m

December

Stay tuned!

What is the Hang Seng Index (HSI50_m)?

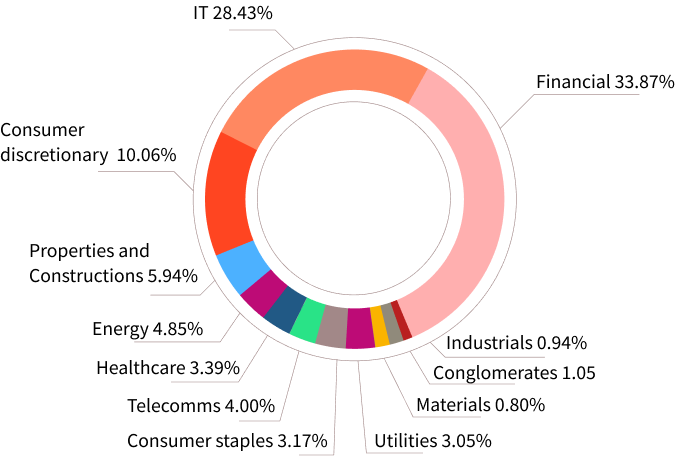

The Hang Seng is an index of the 50 largest and most actively traded companies listed on the Hong Kong Stock Exchange. It serves as the benchmark index and major indicator of Hong Kong’s economic performance, as well as the wider Asian market.

The Hang Seng is largely dominated by finance companies, reflecting Hong Kong’s role as Asia’s premier financial hub. Its biggest constituents are HSBC, Alibaba-SW and Tencent.

Why trade the Hang Seng Index?

It’s been a tough year for Hong Kong’s flagship stock index. After peaking in late January at 22,700, it’s dropped 11% to around 17,000.

The Chinese government is embarking on new stimulus measures to try and boost the ailing economy, while geopolitics and the US Federal Reserve will also play a key role in the Hang Seng’s prospects.

Whatever the outcome, expect heavy fluctuations in the HSI50_m.

Your trading cheat code for the rest of 2023

It’s been a busy year for forex and commodities markets.

Download our mid-year report for free to unearth the opportunities, out analysts have their eyes on for the rest of the year.

Already an FXTM trader? Download free by logging in and heading to ‘eBooks’.

Trading is risky

Hang Seng trading strategies

Here are 3 popular trading strategies you can use to take advantage of HSI50_m volatility.

Trend trading

Trend trading relies on technical analysis to identify the direction of market momentum. This is usually a medium-term strategy, as you’ll keep the position open for as long as the trend continues.

Breakout trading

Breakout trading is the strategy of entering a given trend as early as possible, ready for the price to ‘break out’ of its range. Breakout trading is commonly used to take advantage of short to medium-term market movements.

Reversal trading

This is based on identifying when a current trend is going to change direction. A ‘bullish reversal’ indicates that the market is at the bottom of a downtrend and will turn upward. A ‘bearish reversal’ indicates that the market is at the top of an uptrend and about to turn down.