Daily Market Analysis and Forex News

Broadcom hits fresh all-time highs ahead of key earnings

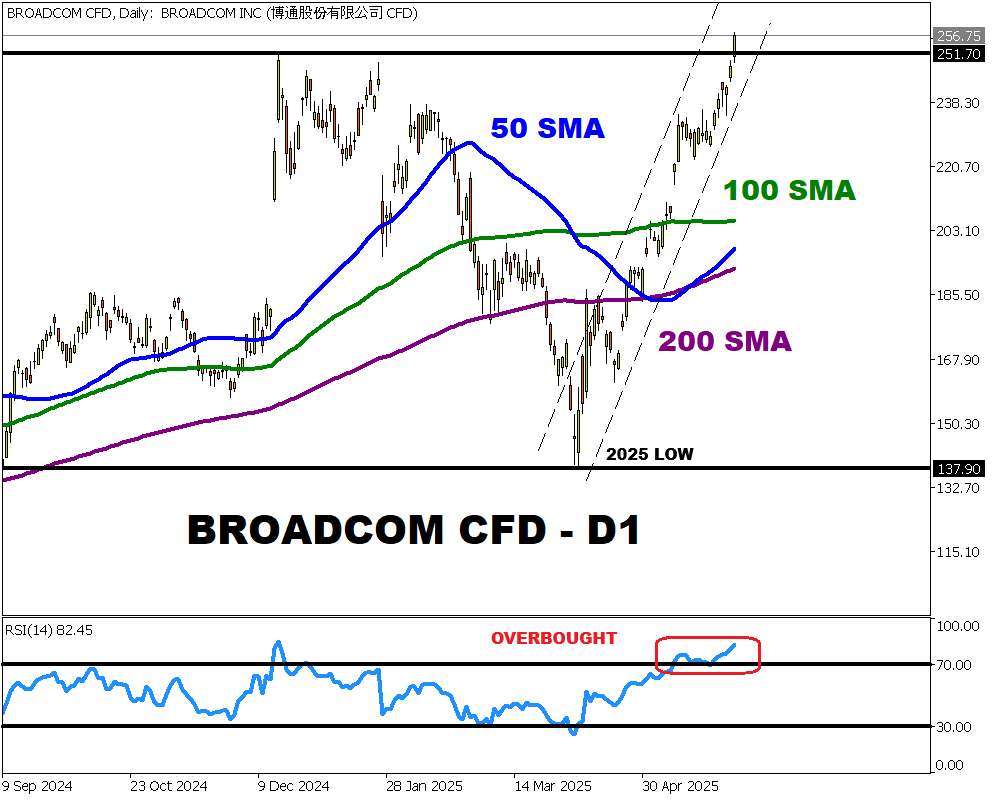

Broadcom shares ↑ 85% from 2025 low, recently touching a fresh ATH

Company to release fiscal Q2 earnings after US markets close Thursday 5th June

Beyond earnings, all eyes on hyperscalers collaboration and VMware

Broadcom share price forecasted to move 6.5% up/down post earnings

Wall Street analysts remain firmly bullish on stock

Broadcom is set to release its fiscal Q2 2025 earnings after US markets close on Thursday 5th June.

Shares of the chipmaker are up over 10% year-to-date, recently touching a fresh all-time high above $256.

Zooming out, Broadcom shares have rebounded more than 85% from the 2025 low – fuelled by demand for AI.

Broadcom fiscal Q2 earnings: What to look out for

Broadcom designs, develops and supplies various semiconductor devices with Nvidia, Qualcomm and TSMC among a handful of its biggest competitors.

Its core customers are the trillion-dollar titans - Apple, Microsoft, Meta, Amazon and Alphabet.

The chipmaker’s earnings release may reconfirm the strong demand for artificial intelligence following Nvidia’s blowout earnings last week.

Market expectations…

Wall Street expects the chipmaker to post strong earnings thanks to robust demand for AI.

Revenue: forecasted at $15 billion versus $12.5 billion a year ago

Earnings per share (EPS): forecasted at $1.56 versus $1.10 a year ago

Key challenges

- Ongoing uncertainty around tariffs could disrupt supply chains and company profits.

- Intense competition from Nvidia, which is now the most valuable company in the world.

Hyperscalers and VMware integration

Investors will be paying close attention to Broadcom’s AI-related revenues and collaboration with leading hyperscalers which could boost revenue streams.

On June 3rd, Broadcom announced that it is now shipping its new Tomahawk 6 switch series chips, delivering world’s first 102.4 terabits/sec of switching capacity in a single chip

- VMware momentum is expected to roll over into Q2 with the segment expected to contribute roughly $4.3 billion in revenue.

How will Broadcom react to earnings

Markets currently predict that Broadcom’s stock could move 6.5% up or down when US markets reopen on Friday, 6th June.

BULLISH: Should Broadcom’s past quarterly results and forward guidance boost confidence in its business outlook, this could push prices higher.

Using Tuesday’s closing price of $256.75 as a reference point, a 6.5% climb would see this stock reach a fresh all-time high at $273.44.

BEARISH: Should Broadcom announce disappointing results, prices may tumble.

A 6.5% decline from $256.75 may drag prices to $240.1.

Over the next 12 months….

Wall Street analysts remain bullish on this stock.

46 “Buy” calls

4 “Hold”

1 “Sells”

Ready to trade with real money?

Open accountاختر حسابك

ابدأ التداول مع وسيط رائد يمنحك المزيد.