Daily Market Analysis and Forex News

Fed meeting preview: Will “dot plot” and Powell disappoint?

Fed expected to leave rates unchanged for 4th consecutive time

Updated “dot plot”, SEP and Powell under the spotlight

Hawkish messaging from Fed may boost USD while weakening Gold

US500, NAS100 and Bitcoin forecasted to move over 1.5% up/down

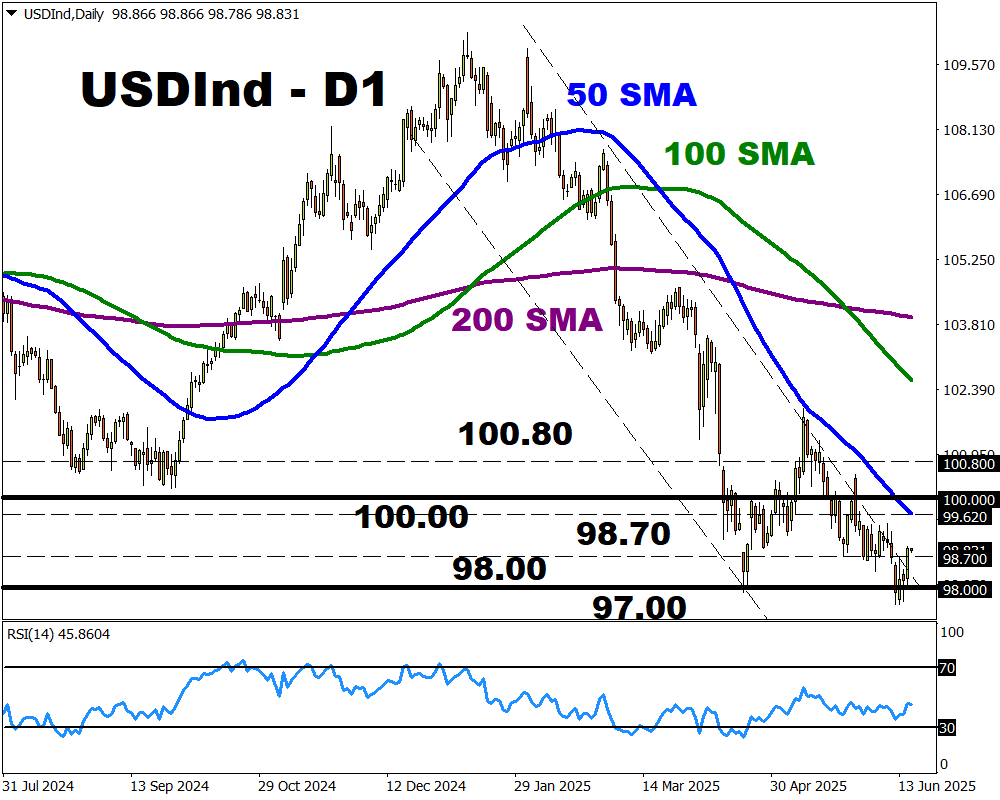

USDInd: Technical levels – 98.00, 98.70 and 50-day SMA

Global markets remain gripped by geopolitical risk amid tensions in the Middle East.

All eyes are on the Israel-Iran conflict, with the risk-off mood scattering investors away from riskier assets. President Donald Trump has met with his national security team, fuelling talks around the US potentially joining Israel’s attack on Iran.

Amidst this chaos, the Federal Reserve will hold its rate decision on Wednesday, 18th June.

Markets widely expect the central bank to leave interest rates unchanged in June. In fact, traders are not expecting a potential rate cut until September.

Note: Traders see a 70% probability that the Fed will cut rates in September.

So, all eyes will be on the updated “dot plot”, Summary of Economic Projections (SEP) and Powell’s press conference for clues on future moves.

A trip down memory lane…

In March, the Fed’s dot plot indicated that officials anticipated two additional rate cuts in 2025 and two more in 2026.

These forecasts were based on concerns over Donald Trump’s tariffs hitting the US economy.

But much has changed since then.

President Donald Trump’s April 2 “liberation day” announcement, followed by a 90-day pause set to expire in July, added a fresh layer of uncertainty.

The Israel-Iran conflict, which kicked off last week has boosted oil prices and fuelled fears around supply disruptions.

These factors may fan concerns about rising inflation, leaving little room for the Fed to cut rates as initially expected this year.

Traders are currently pricing a Fed rate cut by October with the odds of a second cut by December at 82%.

Potential scenarios

As stated earlier, the Fed is expected to vote unanimously to hold rates steady, marking the fourth straight meeting where rates have been kept unchanged.

Due to the Fed seeing upside inflation risks, the updated “dot plot” may signal just one 25-basis point cut for 2025. Fed Chair Jerome Powell strikes a hawkish note.

The Fed expresses concerns over the outlook for the US economy and trims growth forecasts, signalling two 25-basis point cuts for 2025. Fed Chair Jerome Powell opens the door for a potential rate cut down the road.

How will markets react to the Fed meeting?

A hawkish signal from the FOMC’s June 17-18 meeting could boost the USD while hitting US equities, commodities and Bitcoin.

A dovish signal from the Fed meeting may weaken the USD while supporting US equities, commodities and Bitcoin.

Taking a deeper dive…

Here is how these assets are forecasted to react in a 6-hour period after the Fed decision.

Source: Bloomberg.

USDInd: ↑ 0.6 % or ↓ 0.3%

US500: ↑ 1.7 % or ↓ 1.5%

NAS100: ↑ 2.0 % or ↓ 1.8%

XAUUSD: ↑ 0.8 % or ↓ 1.0%

BITCOIN: ↑ 2.4 % or ↓ 2.3%

Technical spotlight: USDInd & XAUUSD

FXTM’s USDInd could be gearing up for a rebound after securing a daily close above 98.70.

This may signal a move back toward the 50-day SMA at 99.62. However, weakness below 98.70 may open a path back toward 98.00.

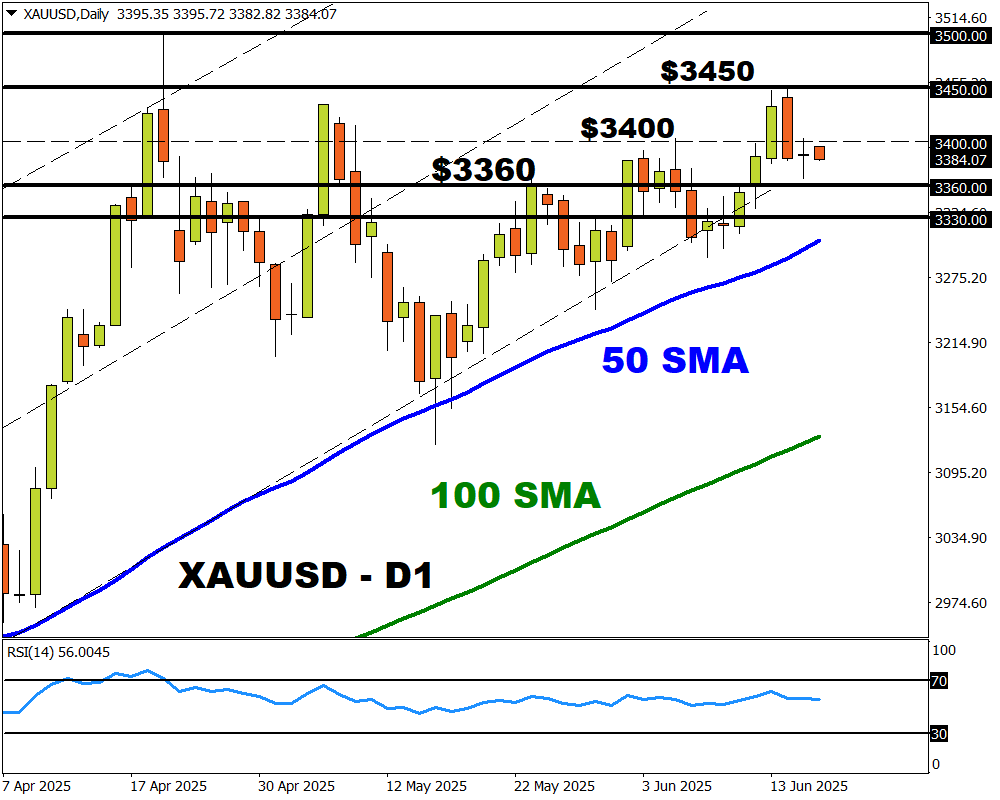

Gold’s outlook remains influenced by the ongoing geopolitical developments and the outcome of the Fed meeting.

Prices seem to be under pressure below the $3400 psychological resistance level.

Sustained weakness below this point may open a path back toward $3360, $3330 and the 50-day SMA.

Should prices push back above $3400, this may trigger an incline back toward $3450.

Ready to trade with real money?

Open accountاختر حسابك

ابدأ التداول مع وسيط رائد يمنحك المزيد.