Daily Market Analysis and Forex News

Market’s focus on Trump’s tax bill and NFP

Senate passes Trump’s tax bill, next obstacle – House Republicans

USDInd ends H1 ↓ 10%+, worst performance in over 50 years

Gold rebounds on dollar weakness & Fed cut bets

US economy expected to add 110,00 jobs in June

NFP forecasted to move XAUUSD ↑ 0.7% or ↓ 1.3%

The market rally lost steam on Tuesday as investors monitored trade talks and Trump’s tax bill.

US markets opened mixed despite the S&P 500 securing its best trading quarter since 2023. In the FX space, the Dollar Index extended losses after seeing its worst first-half performance in over 50 years. A weaker dollar propelled gold prices back above $3350 while Bitcoin dipped below its 50-day SMA.

Here is what you need to know:

Trump’s Tax Bill Passes US Senate

Donald Trump’s big, beautiful tax bill passed the Senate on Tuesday after an aggressive push by Republican leaders.

Trump’s tax bill would decrease federal tax revenue by $4.5 trillion from 2025 through 2034, translating to extra cash for households and businesses. Should this jumpstart economic growth and fuel inflation, the Fed could struggle to cut interest rates.

However, the bill is also estimated to add nearly $3.3 trillion in US deficits over a decade, something that may intensify fiscal worries.

Note: The House will need to vote on the Senate-passed version of the bill ahead of Trump’s self-imposed 4 July deadline.

If this deadline is missed, it may spark fears around significant tax hikes, a debt-ceiling crisis and market instability amid uncertainty over the US fiscal outlook.

All eyes on US jobs report

Due to the Independence Day holiday on Friday, the US jobs report has been pulled forward to Thursday, 3rd July.

The US economy is expected to have created 110,000 jobs in June, lower than the 139,000 May, while the unemployment rate is expected to rise to 4.3% from 4.2% in the prior month.

A weaker-than-expected report may support bets around lower US interest rates, further weakening the dollar toward 96.00 and 95.20.

While a stronger-than-expected report may lend support to the dollar, potentially pushing prices back above 97.70 and toward the 50-day SMA.

Commodity spotlight – Gold

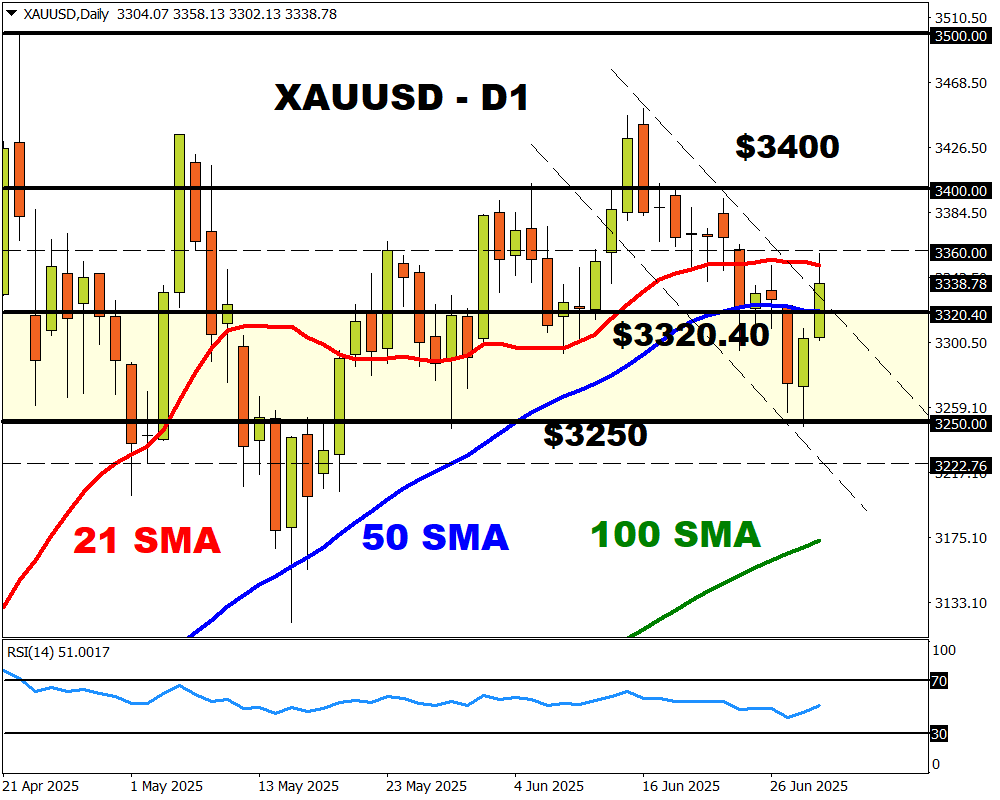

Gold has gained for the second consecutive day thanks to a weaker dollar. However, its outlook may be influenced by Thursday’s US jobs report and developments revolving around Trump’s tax bill.

XAUUSD is forecasted to move 0.70% up or 1.3% down in 6-hour window after NFP report.

Still, a solid close above $3360 may open a path toward $3400.

Weakness below the 50-day SMA could see a decline toward $3250.

Ready to trade with real money?

Open accountاختر حسابك

ابدأ التداول مع وسيط رائد يمنحك المزيد.