Daily Market Analysis and Forex News

US Copper hits records on Trump’s 50% tariff threat

US copper hits fresh all-time highs

Trump announces 50% tariffs on copper imports

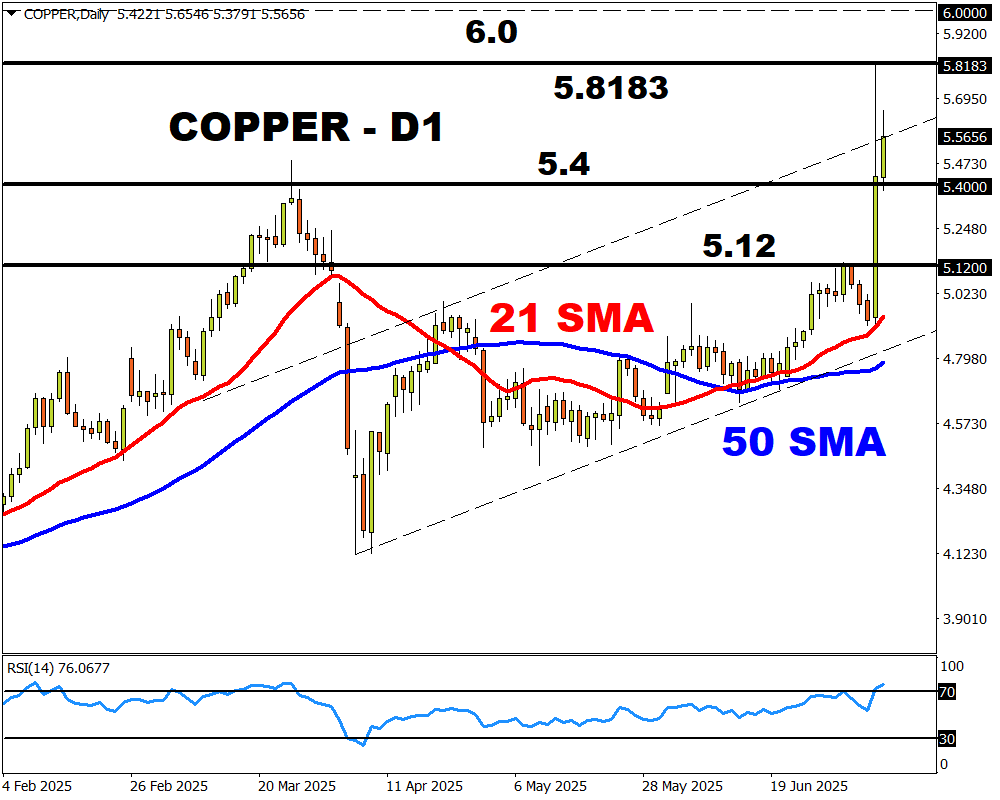

Prices firmly bullish on D1, but RSI overbought

Copper futures in New York surged to records on Tuesday after Trump announced a higher-than-expected 50% tariff on copper imports.

Prices jumped as high as $5.818, pushing 2025 gains to more than 36%.

Note: FXTM Copper tracks Copper futures on the New York Mercantile Exchange’s COMEX division.

The prospect of steep tariffs may fuel more buying of copper before the levies officially come into effect. However, no date has been confirmed yet.

Still, this development could spark major supply-chain ripples through global metal markets. This is already being reflected in LME copper, which has dropped as much as 2% before later rebounding.

Note: LME (London Metal Exchange) copper serves as a global benchmark for copper prices.

Copper prices are firmly bullish, but the Relative Strength Index (RSI) is heavily overbought.

BULLISH – Should $5.4 prove to be reliable support, prices may push back toward the all-time high at $5.8183 and the next psychological level at $6.0.

BEARISH – Weakness below $5.4 could trigger a decline back toward $5.12.

Ready to trade with real money?

Open accountاختر حسابك

ابدأ التداول مع وسيط رائد يمنحك المزيد.