The Gender Gap in Investing

A gap still exists between men and women when it comes to both trading and investing, and there could be many reasons for this. Here, we explore the latest research and statistics to uncover potential reasons behind this disparity – not just in investing habits, but in financial literacy.

On average, women tend to have weaker financial outcomes than men. Usually, the gender gap relates to differences between salaries paid to men and women by employers. But there is a similar concern that makes this divide even worse: underrepresentation in both long-term investing and more active trading.

If women are less likely to participate, they may face greater long-term disadvantages. This could make achieving financial independence more difficult and increase the risk of financial hardship later in life, particularly due to having lower pension savings compared to men. According to a 2024 Prudential report, the median retirement savings for women in the US is $50,000, significantly lower than the $157,000 median for men.

And yet, when woman do participate, they often outperform men.

While investing has long been seen as a male-dominated space, the world of trading - buying and selling assets more frequently to take advantage of market movements - follows a similar pattern. Fewer women trade, but the ones who do frequently outperform their male counterparts. Why? A typically lower risk tolerance and greater caution often lead to more thoughtful, informed decision-making and fewer rash moves.

"In both investing and trading, we consistently see that women may be underrepresented - but they are often more successful. A lower risk tolerance and more deliberate approach often leads to better outcomes over time. It's not about playing safe - it's about playing it smart," says Alison Cashmore, Transformation Director at Exinity.

How many women are investing?

However, the number of women who invest is growing rapidly. According to a study from 2021 by Fidelity, 67% of women invest outside of their retirement accounts, a significant increase from 44% in 2018.

Despite this progress, only 33% of women consider themselves investors, according to the same study.

Women tend to trade and invest less than men

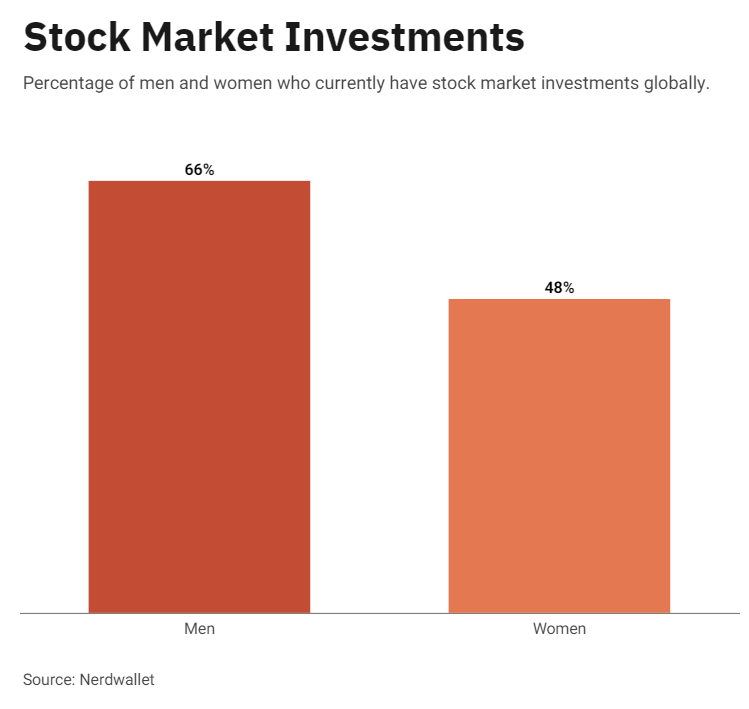

In the UK, for example, only 29% of women reported trading stocks and shares online, compared to 47% of men. This trend is reflected globally as well. A NerdWallet survey found that 48% of women currently have stock market investments, while the figure rises to 66% for men. One possible reason is that fewer women see trading or investing as a top financial goal — according to YouGov, 62% of men consider it a high priority, compared to just 55% of women.

"Despite the progress we’ve seen, the gender investing gap remains a stubborn reality. It’s not just about income differences—it’s about opportunity, confidence, and engagement. Women are just as capable as men, but they haven't always been invited into the financial conversation in the same way," explains Alison Cashmore

Younger women invest more

Encouragingly, younger women are beginning their investment journeys earlier than previous generations. A 2022 Fidelity study revealed that women aged 18 to 35 typically opened their first retirement account at 20 and their first brokerage account by 21.

In contrast, women aged 36 and older started later, opening retirement accounts around age 27 and brokerage accounts closer to age 30.

Younger women are more open to investing than older women

Women aren't uninterested in investing but often lack confidence because the industry hasn’t effectively engaged them. However, according to a study by BNY Mellon from 2021 shows that change is underway — 60% of women aged 18–30 are open to or already investing, compared to 45% of women over 50 — but progress remains slow.

Women report lower confidence in investing compared to men

Numerous studies indicate that women tend to have lower confidence than men when it comes to financial matters, particularly investing. The 2020 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), which annually measures financial literacy among U.S. adults, found that women generally report less confidence than men across most areas of personal finance. For instance, when asked about investing, 32% of women responded with “don’t know,” compared to just 22% of men.

The 2021 study by Fidelity echoed these findings, revealing that just 33% of women felt confident managing their own investments.

"Many women are already investing—but they don’t see themselves as 'investors.' That speaks to a branding problem in our industry. We need to reframe what it means to invest and make the language and tools more inclusive," says Alison Cashmore.

Women focus on long-term wealth, not quick wins

An N26 study of European investors found that only 23% of women prioritised short-term gains, while 43% focused on long-term wealth.

This attitude also extends into trading, where women are more likely to conduct deeper research and make fewer high-risk trades. The N26 study also showed that many women plan to grow their investments in the coming year.

Women prioritise social responsibility when they invest

According to a UBS survey, 71% of women consider sustainability when making investment decisions, compared to 58% of men. A 2020 Money Crashers survey found only 19% of women would invest in a company lacking social responsibility, versus 51% of men. Among women aged 30–40, 61% choose investments based on social or environmental impact (Simple). As financial power shifts, the future of socially responsible investing appears to be female led.

"Women are showing us that investing doesn’t have to be purely transactional. They’re aligning their money with their values, and that’s pushing the industry toward a more sustainable, purpose-driven future," declares Alison Cashmore.

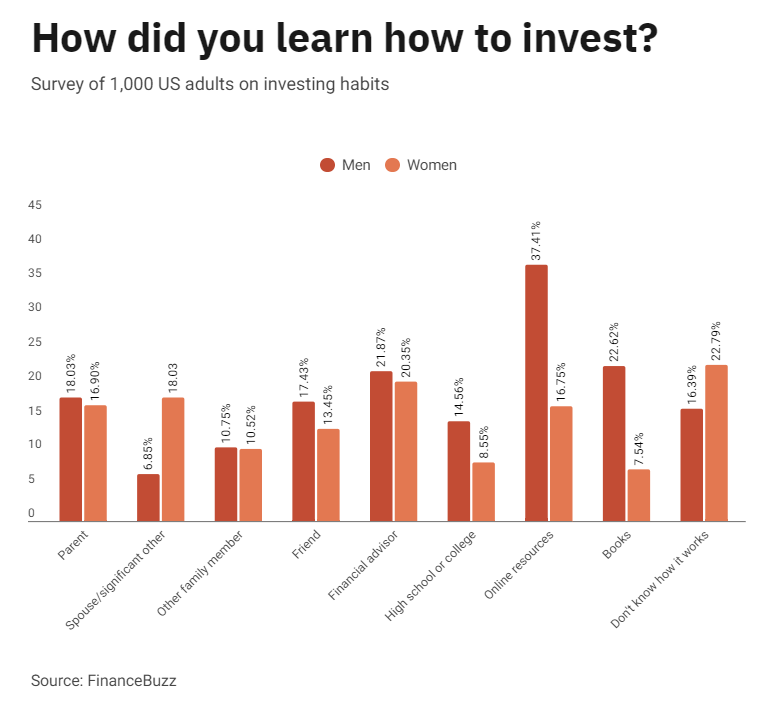

Women and men learn about investing from different sources

A study by FinanceBuzz shows that 18% of women have learned about investing through their spouse. However, this is only the case for 7% of men. Also, men are more than twice as likely to teach themselves about trading and investing via online resources, and they are three times more likely to learn about investing from books. These differences may be explained by the fact that women still take on most household and childcare responsibilities, leaving them with less time to study or pursue new learning opportunities

Men and women value different features when deciding where to invest

Both value excellent customer service, but women place greater importance on working with a human advisor than men. Both men and women value low fees, but men prioritise commission-free trading more highly.

Financial Literacy

Knowledge gaps in investing and risk

Many women are unaware of the gaps in their financial knowledge. According to the 2020 TIAA Institute-GFLEC P-Fin Index, 37% identify investing as their weakest area, with an average score of 43% on related questions. However, only 15% say the same about understanding risk – despite scoring lowest in that category. This reveals a clear disconnect between perceived and actual knowledge.

Financial literacy increases with age

Financial literacy is lowest among Gen Z women and highest among Gen X and baby boomers. The 2020 TIAA Institute-GFLEC P-Fin Index showed, that on average Gen Z women answered just 37% of index questions correctly, compared to 51% for Gen X and 53% for baby boomers. While it's difficult to separate generational from age-related effects in a single dataset, the results are striking—especially considering the complexity of today’s financial landscape and the importance of early financial knowledge.

Financial literacy increases with household income

Perhaps not surprisingly, the same study showed that financial literacy tends to be greater among women with higher household incomes. Women with household incomes of $100,000 or more scored 25 percentage points higher on the P-Fin Index than those earning below $25,000.

International Differences in Financial Literacy

Germany has the highest level of financial literacy among women

A study by Allianz from 2023 researched the financial literacy levels between men and women among seven developed countries (Australia, France, Germany, Italy, Spain, the UK and the US). The study showed that Germany is the only country where women seem to be more financial literate than men (22% vs 12%).

Research shows that individuals who take charge of financial decisions tend to have higher financial literacy. Real-life money management builds confidence and skills—especially for women, who become more financially savvy when given the freedom to manage their own finances. A supportive environment is just as crucial as economic and regulatory factors in shaping financial outcomes.

Nearly 3 in 5 women in Germany are sole financial decision makers

According to the same Allianz study, 58% of women in Germany are the decision makers for the household finances. This might be related to the fact that a vast majority of German women work part-time (47%), and most likely do most of the household work, including managing the finances.

Only 1 in 3 women feel financially confident

The Allianz study also showed that just 33% of women feel confident about their finances, compared to 46% of men. Not all countries show a confidence gap: In Germany and much of continental Europe, women report higher financial confidence than in Anglo-Saxon countries—possibly due to stronger social welfare, especially for young mothers.

Why the Gender Gap in Trading and Investing Matters

The gender gap is finance is real—and it matters. While women already face income disparities, and lower engagement in investing and trading only widens the wealth gap. At the current pace, it could take over two centuries to close the financial gender divide.

But women hold the power to shift this trajectory. Trading and investing are key tools for long-term financial growth and independence. Despite persistent stereotypes, data shows women often outperform men and make more consistent, risk-aware, and ultimately more profitable decisions.

In today’s high-inflation environment, letting money sit idle is not just unproductive—it’s expensive.

"This is about more than money—it's about freedom, security, and equality. If we don't address the trading and investing gap, we risk leaving half the population financially vulnerable for generations to come," concludes Alison Cashmore.

Sources

Next Articles

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.