FED preview: Markets set for disappointment?

- Home

- FED preview: Markets set for disappointment?

- Fed expected to cut rates for first time in 2025

- Updated dot plot and economic projections in focus

- Traders are pricing in 73% chance of three rate cuts by end of year.

- Over the past year USDInd has moved ↑ 0.7 % or ↓ 0.3% post Fed

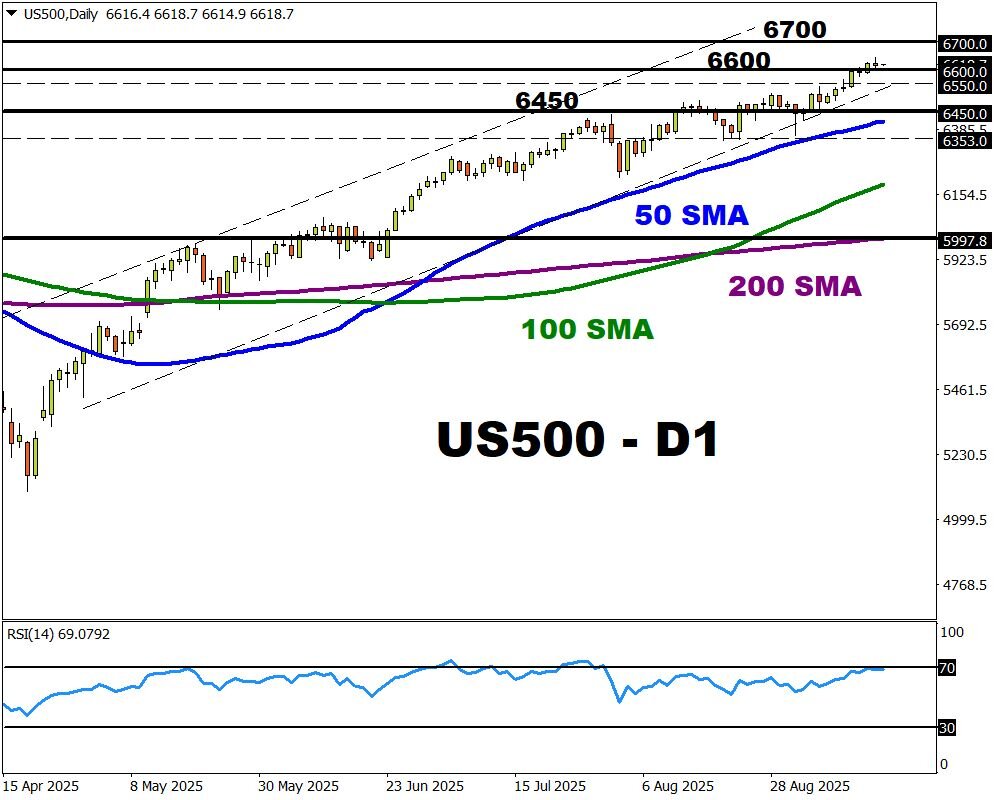

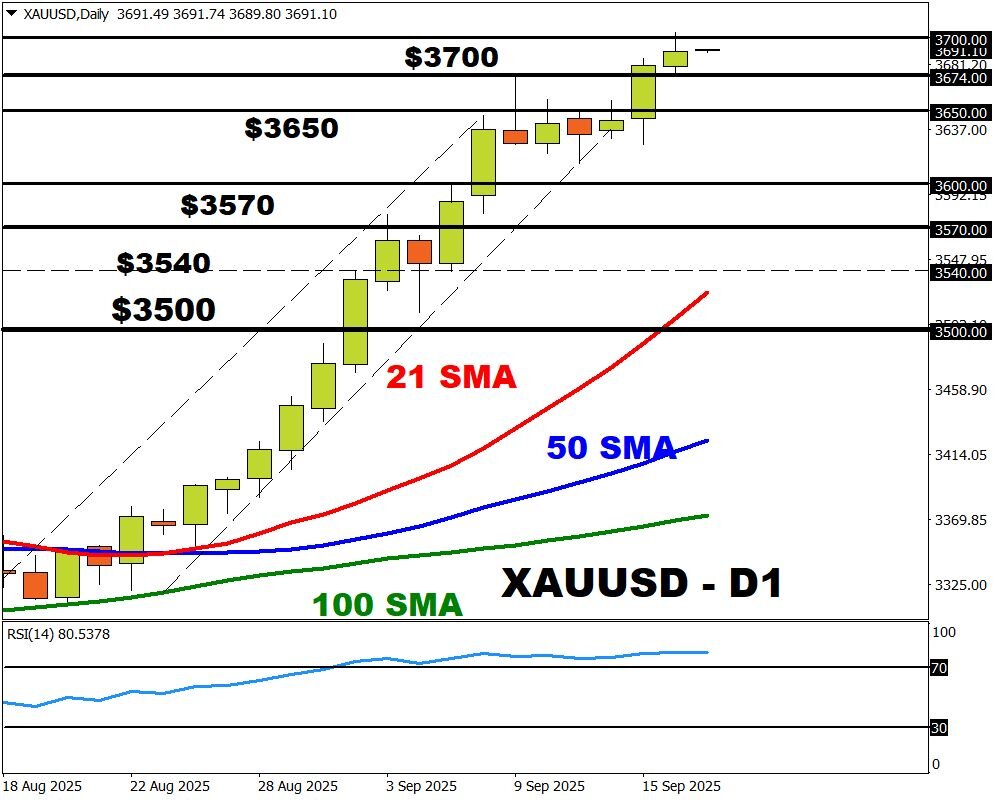

- XAUUSD & US Indices to see heightened volatility

The Federal Reserve is widely expected to deliver its first cut of 2025 when it meets on Wednesday.

A combination of weak economic data and signs of cooling price pressures has paved the way for lower interest rates in the world’s largest economy.

However, much attention will be directed toward the dot plot, policy statement and Powell’s press conference for clues on future policy moves.

When is the Fed meeting?

Wednesday, September at 18:00 pm GMT while Powell’s press conference will be at 18:30 pm GMT.

Expected values…

Fed funds target range: Cut by 25 bps to 4.00%–4.25%

Fed Policy outlook:

Traders are pricing in an 83% chance of another rate cut by October and a 74% chance of a third cut by December.

But the question on investors’ minds is how aggressively the Fed will be on rates beyond September.

Back in June, the dot plot showed Fed officials in favour of two 25bp rate cuts in 2025. But traders are expecting 75bp points worth of cuts this year.

The dot plot may need to match or exceed these dovish expectations to keep equities and gold prices buoyed.

Anything less could trigger a technical correction.

Potential market impact…

Dovish tilt: supports risk assets (US equities), softens USD, lowers yields; constructive for gold/silver.

Hawkish tilt: pressures equities, boosts USD, lifts yields; headwind for precious metals.

Here is how these assets are forecasted to react in a 6-hour period after the Fed decision.

Source: Bloomberg.

- USDInd: ↑ 0.7 % or ↓ 0.3%

- NAS100: ↑ 2.0 % or ↓ 1.5%

- US500: ↑ 1.6 % or ↓ 1.1%

- XAUUSD: ↑ 0.5 % or ↓ 1.1%

- BITCOIN: ↑ 2.7 % or ↓ 2.0%

Looking at the charts, FXTM USDInd, US500 and XAUUSD could be set for significant price swings. Key price levels have been identified on the charts.