US CPI & ECB preview: Markets set for wild Thursday?

- Home

- US CPI & ECB preview: Markets set for wild Thursday?

- Political risk in Asia/Europe and Middle East tensions in focus

- US CPI forecasted to move US500 ↑ 1% & ↓ 1.5%

- September Fed cut fully priced in, 80% chance of another cut in October

- ECB expected to leave rates unchanged on Thursday

- Over the past year EURUSD has moved ↑ 0.4 % or ↓ 0.3% post release

Asian markets rose on Wednesday, while European shares flashed green after the S&P500 hit a record high in the previous session.

It’s been a week marked by political risk in Japan and France, while escalating tensions in the Middle East have left investors on edge. Still, monetary policy expectations seem to be keeping US equities buoyed, with fears about the health of the US labour markets reinforcing bets for lower interest rates.

Traders have fully priced in a US rate cut this month, with the odds of another rate cut by October around 80%.

On Thursday, all eyes will be on the latest US CPI report, which could further influence Fed cut bets.

Markets are forecasting:

- CPI year-on-year August 2025 vs. August 2024) to rise 2.9% from 2.7%.

- Core CPI year-on-year to remain unchanged at 3.1%.

- CPI month-on-month (August 2025 vs July 2025) to rise 0.3% from 0.2%.

- Core CPI month-on-month to remain unchanged at 0.3%.

Signs of rising inflationary pressure may cool bets around the Fed cutting interest rates, pressuring the US500 as a result. Other key data, including the PPI, Initial jobless claims and Michigan Consumer Sentiment may also impact these expectations.

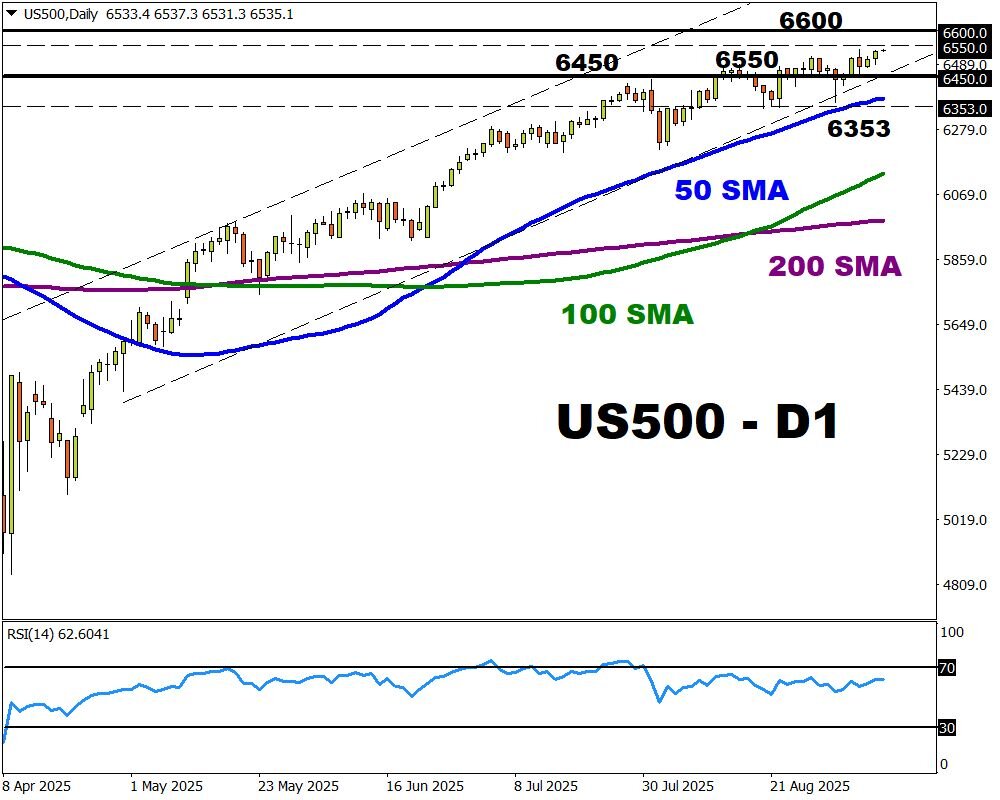

FXTM’s US500 is forecast to move 1% up or 1.5% down in a 6-hour window after the US CPI report. Key technical levels can be found at 6600, 6550 and 6450.

Here is how these assets are forecasted to react in a 6-hour period after the US CPI report.

Source: Bloomberg.

- USDInd: ↑ 0.4 % or ↓ 0.5%

- NAS100: ↑ 1.5 % or ↓ 1.3%

- XAUUSD: ↑ 0.9 % or ↓ 0.4%

- BITCOIN: ↑ 2.8 % or ↓ 2.0%

ECB meeting preview: No changes expected

Markets widely expect the ECB to leave rates unchanged, especially with the political risk in France. However, any clues on future policy moves may trigger EURUSD volatility.

Inflation in the Eurozone has stabilized around the 2% target but growth remains sluggish.

Traders are currently pricing in a less than 40% chance that the ECB cuts rates by the end of 2025.

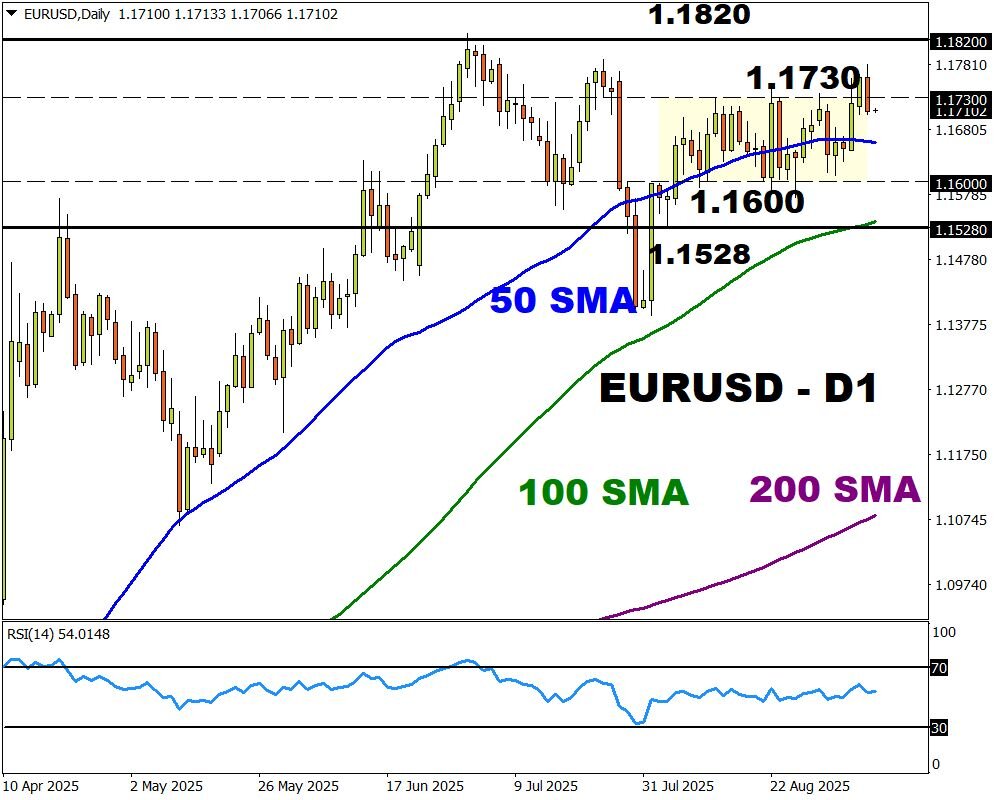

Looking at the charts, the EURUSD is back within a range with support at 1.1600 and resistance at 1.1730.

- A breakout above the 1.1730 resistance may trigger a move toward 1.1820.

- Weakness below the 50-day SMA may spark a selloff toward 1.1600 and 1.1528.

Bloomberg’s FX model forecasts a 77.0% chance that EURUSD trades between 1.1599 – 1.1838 over the next one-week period.