Week Ahead: Central bank showdown

- Home

- Week Ahead: Central bank showdown

- Fed and BoC expected to CUT interest rates

- Updated Fed dot plot and economic projections in focus

- BoE and BoJ seen leaving rates unchanged

- NAS100: Forecast to move ↑ 2% & ↓ 1.5% post Fed decision

- USDCAD, UK100 & USDJPY on breakout watch

Major central bank decisions could present fresh trading opportunities in the week ahead.

The Federal Reserve (Fed), Bank of Canada (BoC), Bank of England (BoE) and Bank of Japan (BoJ) will be under the spotlight.

These high-impact events will be complemented with top-tier data from across the globe:

Monday, 15th September

· CN50: China retail sales, industrial production, house prices

· CAD: Canada manufacturing sales

· USDInd: US Empire Manufacturing

Tuesday, 16th September

· CAD: Canada CPI, housing starts

· EUR: Eurozone industrial production, ZEW survey expectations

· GER40: Germany ZEW survey expectations

· GBP: UK jobless claims, unemployment

· US500: US retail sales, industrial production

Wednesday, 17th September

· CAD: BoC rate decision

· EU50: Eurozone CPI

· UK100: UK CPI, retail price index

· US500: FOMC rate decision

Thursday, 18th September

· AUD: Australia unemployment

· NZD: New Zealand GDP

· ZAR: South Africa rate decision

· TWN: Taiwan rate decision

· GBP: BoE rate decision

· US30: Initial jobless claims

Friday, 19th September

· CAD: Canada retail sales

· JPY: BoJ rate decision, CPI

· NZD: New Zealand trade

Here are 4 assets that could be shaken by 4 central bank announcements:

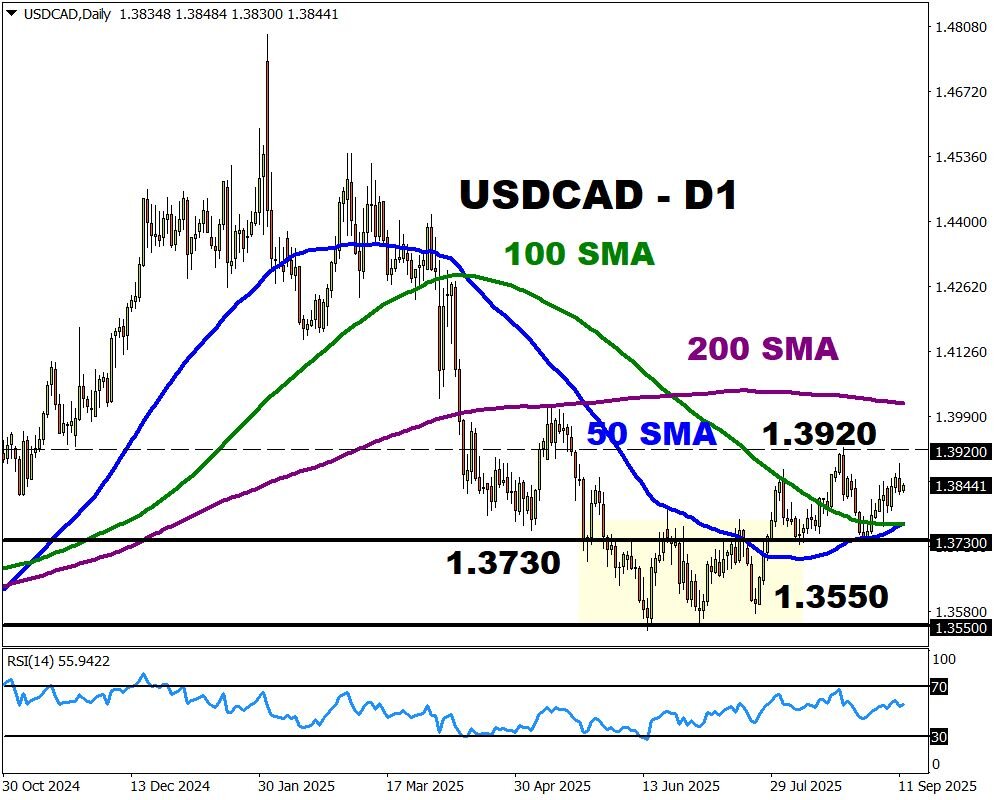

1) BoC meeting: USDCAD

The Bank of Canada is expected to cut interest rates by 25 bps at its meeting on 17th September.

This is based on sluggish economic growth and cooling inflationary pressures which eased to 1.7% in July 2025.

Traders have fully priced in a BoC cut this month with the odds of another cut by December at 80%.

Note: The USDCAD is forecast to move as much as 0.1% up or down 0.3% in a 6-hour window post BoC decision.

Looking at the charts, the USDCAD remains in a range on the daily charts with support at 1.3730 and resistance at 1.3920.

Bloomberg’s FX model forecasts an 80% chance that USDCAD trades between 13729 – 1.3944 over the next one-week period.

2) Fed meeting: NAS100

FXTM’s NAS100 may be heavily influenced by the Federal Reserve rate decision on Wednesday 17th September.

Markets widely expect the Fed to cut interest rates for the first time in 2025 amid persistent weakness in the US labour markets and tame inflation.

But much focus will be on the updated dot plot and economic projections which may shape expectations around future policy moves.

Traders have fully priced in a Fed rate cut for September and October with the odds of another rate cut by December around 87%.

Note: The NAS100 is forecast to move as much as 2% up or down 1.5% in a 6-hour window post Fed decision.

Looking at the charts, the NAS100 recently hit a fresh all-time high above 24,000 – pushing 2025 gains to 14%.

A solid break above 24,000 may open a path toward 24,500 and higher. Weakness below 24,000 could trigger a decline back toward the 21-day SMA.

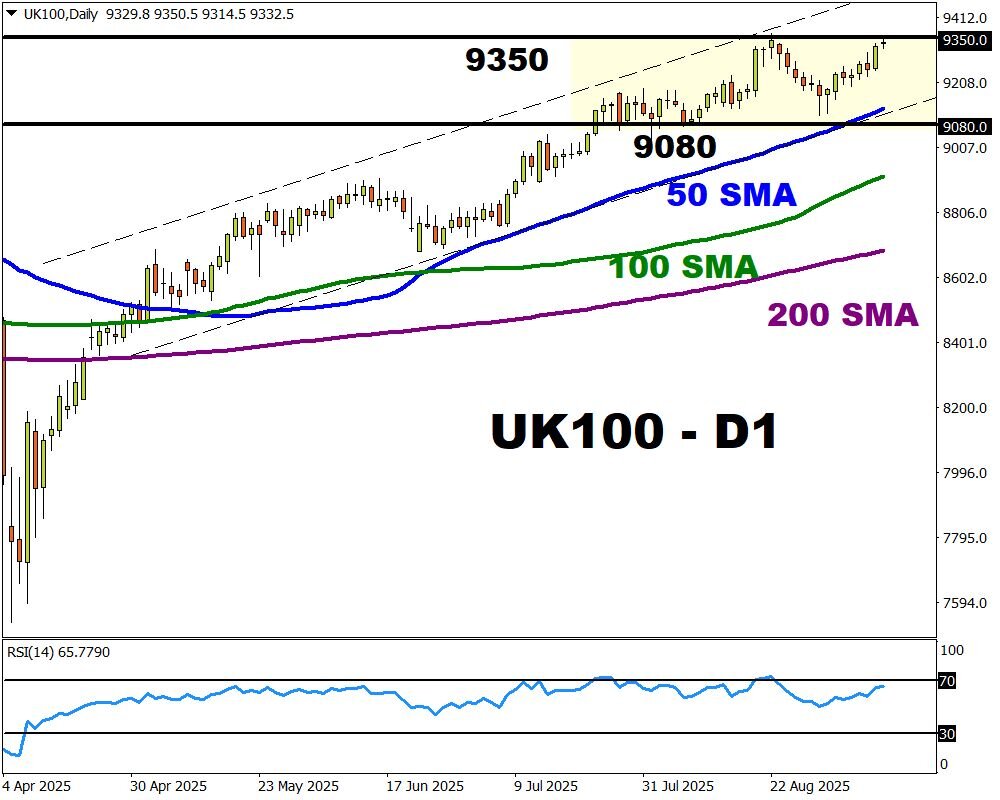

3) BoE meeting: UK100

No changes to interest rates are expected when the Bank of England meeting on Thursday 18th September. However, any clues offered regarding future policy moves may spark volatility.

Traders are currently pricing in a 20% chance of a BoE cut by November with this jumping to only 42% by December.

Should the central bank adopt a cautious stance towards rate cuts, this may weigh on the UK100 as Sterling appreciates.

Regarding the technicals, FXTM’s UK100 is trading close to all-time highs with resistance around 9350 and support at 9080. A breakout could be on the horizon.

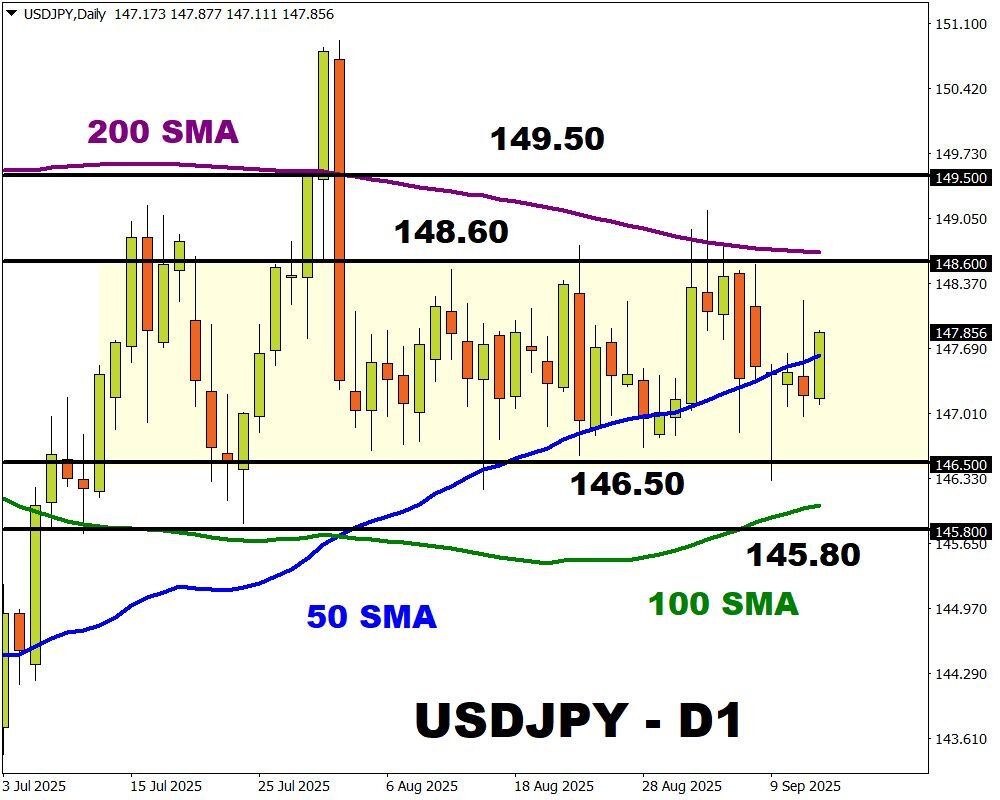

4) BoJ meeting: USDJPY

The BoJ is expected to leave interest rates unchanged thanks to political uncertainty. However, the economic environment looks ready for a rate hike amid easing trade uncertainty and rising inflation for above target. Traders see a 62% chance of a BoJ rate hike by December 2025.

Should the BoJ hint at making a move later this year, this may boost the Japanese Yen – dragging the USDJPY lower as a result.

Note: The USDJPY is forecast to move as much as 1% up or down 0.5% in a 6-hour window post BoJ decision.

Bloomberg’s FX model forecasts a 74.4% chance that USDJPY trades between 145.92 – 149.64 range over the next one-week period.