Central bank preview: BoJ & ECB in focus

- Home

- Market Analysis

- Central bank preview: BoJ & ECB in focus

- BoC & Fed expected to cut interest rates

- BoJ & ECB seen leaving rates unchanged

- USDJPY forecasted to move 0.8% up or down 0.4% post BoJ

- EURUSD trapped within range with support at 1.16 and resistance at 1.17

Major central bank decisions could present fresh trading opportunities across FX markets this week.

The Bank of Canada (BoC), Federal Reserve (Fed), Bank of Japan (BoJ) and European Central Bank (ECB) will be under the spotlight.

As discussed previously, the BoC and Fed are expected to cut interest rates on Wednesday 29th October.

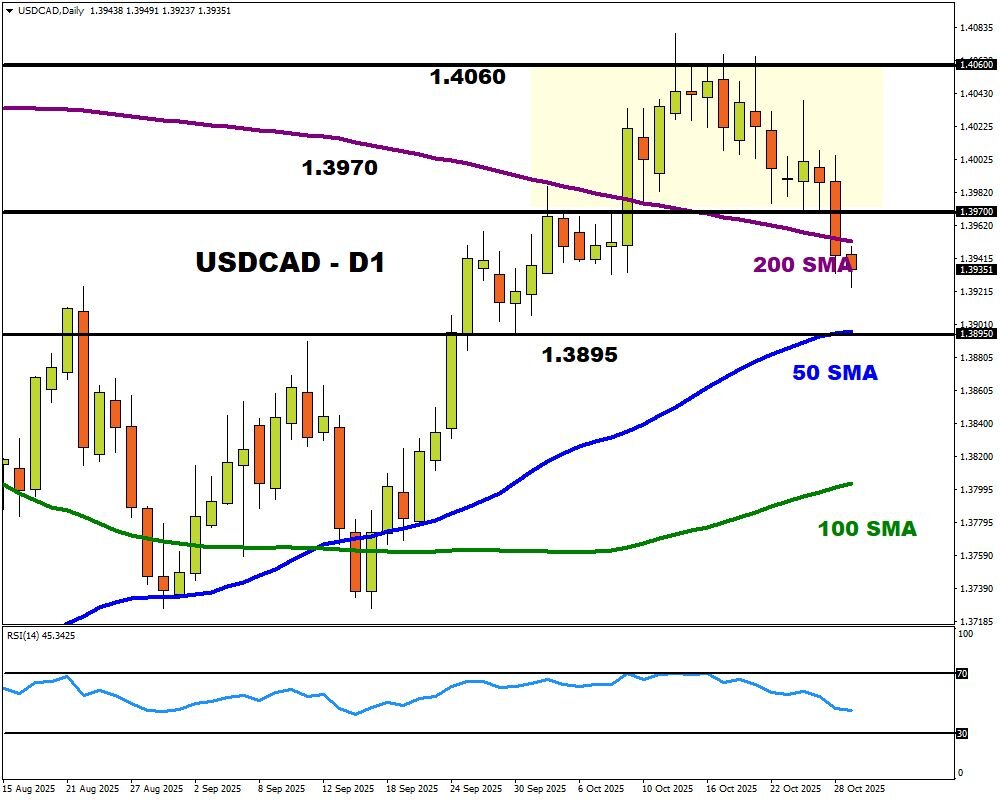

This may trigger significant price swings on the USDCAD which has recently experienced a breakdown below the 1.3970 support.

US equities may also receive a boost if the Fed moves ahead with a 25bp rate cut.

FXTM’s US500 recently touched a fresh all-time high above 6900 with the next key level of interest around 6950.

Note: US equities may also be influenced by big tech earnings. Meta, Alphabet, Microsoft publish their earnings after US markets close on Wednesday. Apple and Amazon reveal their earnings on Thursday 30th October after the closing bell.

BoJ meeting: USDJPY

The BoJ is expected to leave interest rates unchanged at its first meeting since Sanae Takaichi became prime minister.

Given how she is an advocate of easy monetary policy, this has reduced the odds of the BoJ hiking rates in Q4. Should the BoJ strike a dovish note, this may weaken the Yen – boosting the USDJPY higher.

Note: The USDJPY is forecast to move as much as 0.8% up or down 0.4% in a 6-hour window post BoJ decision.

(Source Bloomberg)

Bloomberg's FX model points to a 74% chance that USDJPY will trade within the 149.98 – 154.37 range over the next one-week period.

ECB meeting: EURUSD

The European Central Bank is expected to leave rates unchanged on Thursday with policymakers recently signalling little urgency to cut further.

But any fresh clues offered on future policy moves may rock the EURUSD.

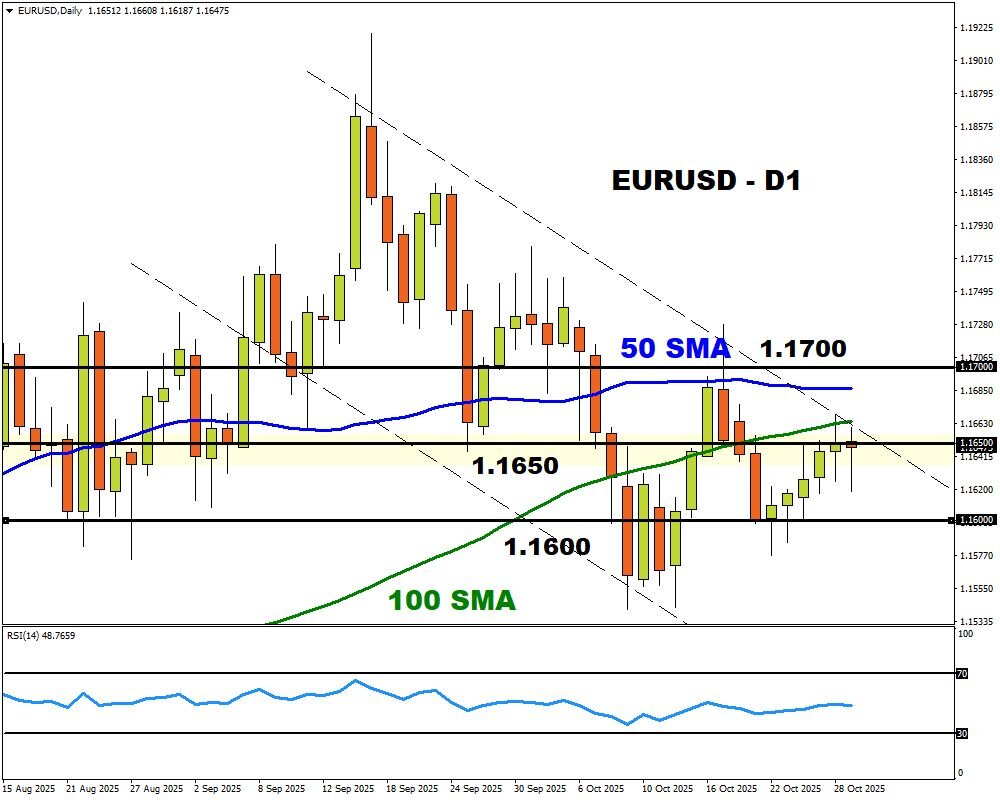

Looking at the charts, the EURUSD remains in a bearish trend. Support can be found at 1.1600 and resistance at 1.1700.

- Weakness below 1.1650 may open a path toward 1.1600 and 1.1550.

- A breakout above 1.1650 could see prices test the