GBPUSD slips ahead of UK CPI report

- Home

- Market Analysis

- GBPUSD slips ahead of UK CPI report

- GBPUSD ↑ 7% year-to-date

- UK CPI expected to climb 4% in September

- Traders only pricing 40% chance of BoE cut by December

- GBPUSD forecasted to move ↑ 0.1% or ↓ 0.3% post CPI

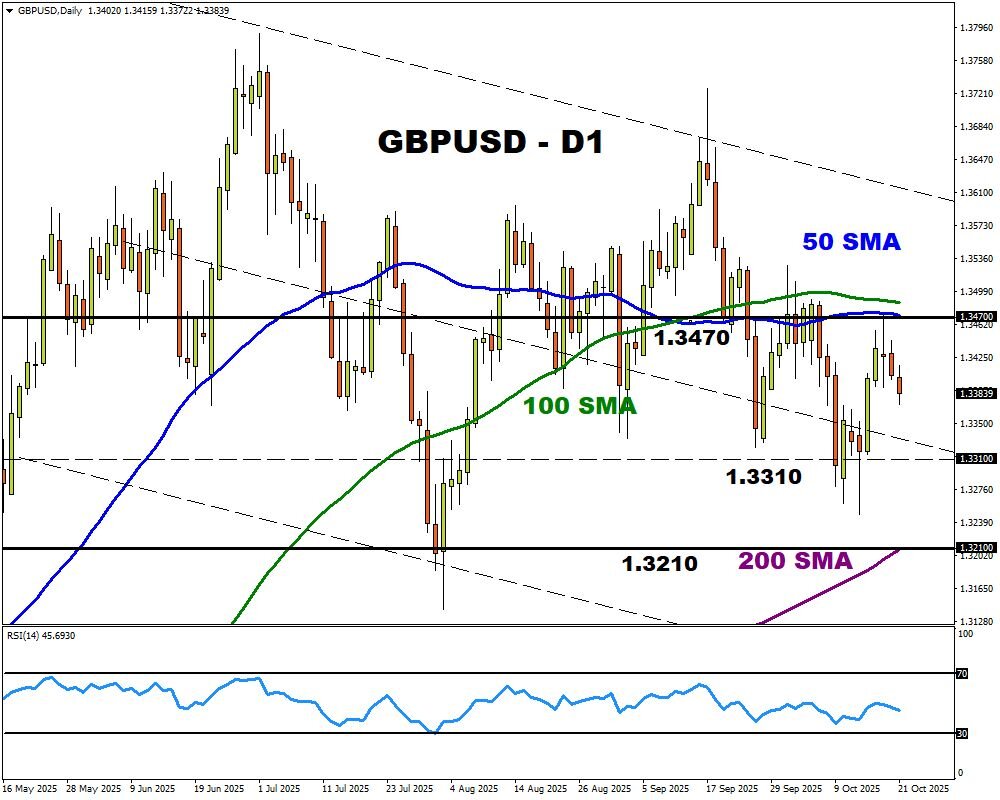

- Technical levels: 1.3470, 1.3310 and 1.3210

The incoming UK inflation report may play a key role in determining whether the GBPUSD extends losses this week.

Note: The September UK CPI report will be released on Wednesday, 22nd October at 06:00 AM GMT.

An appreciating dollar has dragged the major currency pair lower, with prices approaching support at 1.3350.

Throughout this year, UK inflation has remained persistently above the Bank of England’s (BoE) 2% target.

After dipping to a low of around 2.6% in March, the Consumer Price Index (CPI) year-on-year rate climbed steadily, reaching 3.8% by August - the highest level since early 2024.

This has reduced expectations around the BoE cutting interest rates with traders only pricing in a 40% chance of a cut by December.

Market Expectation

Analysts expect UK CPI to remain above the 2% target throughout 2025, averaging around 3.2 – 3.65 for the year with a peak of up to 4.0% in September before a gradual decline later in the year.

Potential Market Impact:

- Higher than expected: BOE delays rate cuts, and the Pound sterling strengthens

- Inline with expectations: The pound sterling may appreciate mildly.

- Lower than expected: This will boost rate cut bets, consequently leading to a weak pound sterling.

GBPUSD is forecasted to move 0.1% up or 0.3% down in a 6-hour window after the CPI data release.

POTENTIAL SCENARIOS:

BULLISH – A CPI reading in line or above expectations, may see GBPUSD rally to test its 50-day SMA at 1.3710.

BEARISH – A softer CPI print may see GBPUSD decline toward 1.3310 and the 200-day SMA at 1.3210.