Gold conquers $4000 ahead of Fed minutes

- Home

- Market Analysis

- Gold conquers $4000 ahead of Fed minutes

- Gold hits fresh all-time high, ↑ over 50% YTD

- On track for best annual performance since 1970

- Fed minutes and speeches in focus

- Bloomberg FX model – 71.7% - ($3944.40 - $4142.53)

- Key technical levels: $4000

Gold blasted past $4000 for the first time as US political risk boosted appetite for safe-haven assets.

The precious metal is up nearly 5% this month, pushing 2025 gains close to 55%!

Beyond concerns over the US government shutdown, gold has been boosted by central bank buying, geopolitical risk, and prospects around lower interest rates.

This bullish cocktail has positioned gold for its best annual performance since 1970.

Although the path of least resistance points north, speeches by Fed officials and the Fed minutes may dictate near-term price action.

Note: With US government data releases on hold, there will be a stronger focus on the Fed minutes for fresh policy signals.

When will the minutes be released?

- Wed, Oct 8 at 6pm GMT

Market Expectation:

- No policy change (neutral) – markets don’t expect fresh rate moves to be announced in the minutes.

- Tilt toward dovish language – narrative support for easing later in the year.

- Watch for “disagreement language” (some members pushing back) to gauge stickiness.

Potential Market Impact:

- Dovish-leaning minutes may boost gold prices as the Fed cut bets jump.

- Reluctance to cut may weaken gold as the dollar rebounds.

- Ambiguous tone may result in a range-bound price action with heightened intraday volatility

Technical outlook:

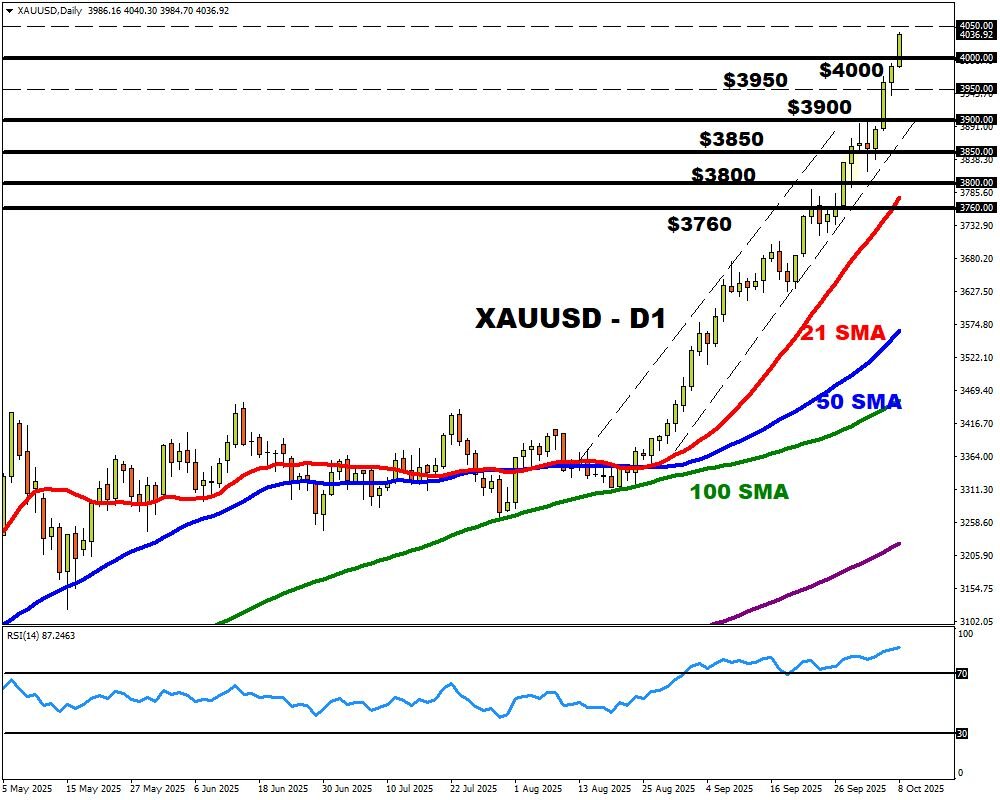

Gold prices are firmly bullish on the daily charts, with prices trading above the 50, 100, and 200-day SMA.

- Should $4000 prove reliable support, prices may venture toward $4050.

- Weakness below $4000 could see a decline back toward $3950 and $3900.

Bloomberg’s FX model forecasts a 71.7% chance that XAUUSD trades between $3944.40 - $4142.53 over the next one-week period.

XAUUSD