Gold set for pullback or rebound?

- Home

- Market Analysis

- Gold set for pullback or rebound?

- Gold slipped more than 4% last Friday on Trump's remarks

- Precious metal secures nine consecutive weeks of gains, ↑ 60%+ YTD

- US-China trade talks, US political risk and CPI report = volatility

- Fed seen cutting interest rates 2 more times in 2025

- XAUUSD forecasted to move ↑ 0.9% or ↓ 0.4% post CPI

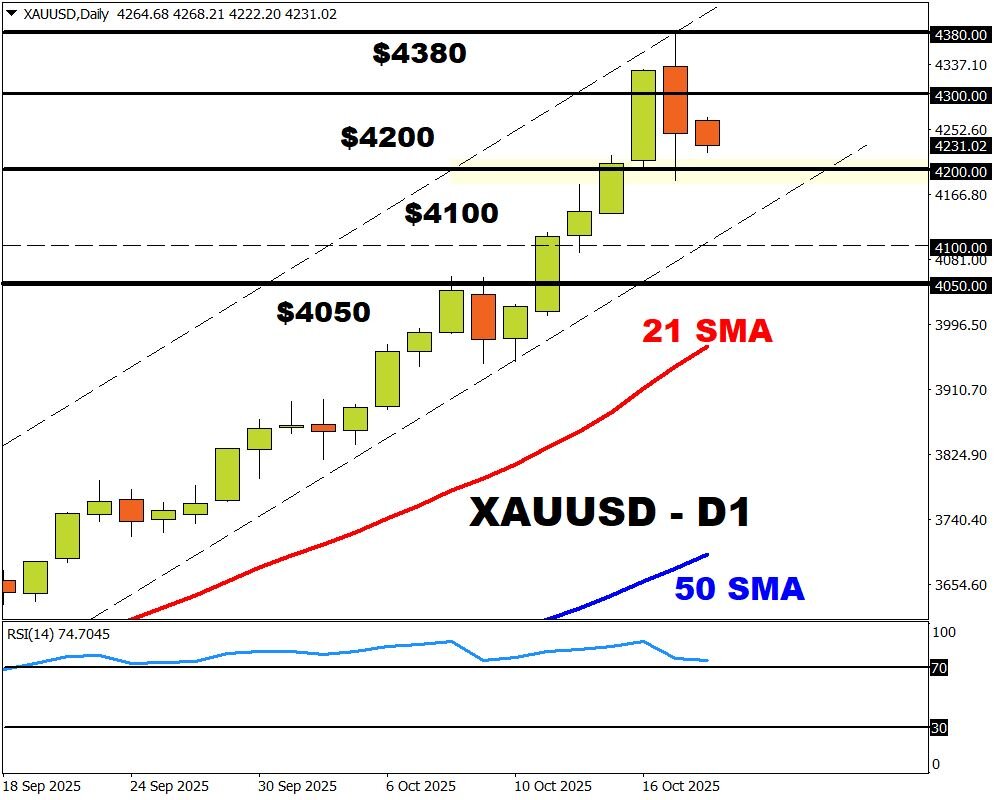

Gold prices tumbled more than 4% last Friday after hitting a record high at $4379.44.

Nevertheless, the precious metal still secured its ninth consecutive week of gains, taking this year’s rally to over 60%.

Note: The last time gold secured nine consecutive weeks of gains was from early June to early August 2020.

WHY DID GOLD RALLY, THEN TUMBLE?

-The precious metal was initially boosted by US credit fears as risky lending by two regional banks raised alarm bells and accelerated the flight to safety.

-US political risk and growing bets around the Fed moving ahead with a jumbo rate cut sometime in Q4 fuelled upside gains.

-Gold later tumbled after Trump stated that the much higher tariffs he had threatened to impose on China would not be sustainable.

-The next round of US-China trade talks is set for this week, with Treasury Secretary Scott Bessent and Vice Premier He Lifeng facing the task of negotiating.

WHAT COULD MOVE XAUUSD THIS WEEK?

US-China trade developments, the delayed US inflation report and speeches by Fed officials may rock gold prices.

Note: US government economic data releases may be delayed by shutdown that began on Oct. 1.

Thursday 23rd October

-Initial jobless claims – (12:30 PM GMT)

XAUUSD is forecasted to move 0.6% up or 0.6% down in a 6-hour window after the initial jobless claims.

Friday 24th October

-US September CPI report – (12:30 PM GMT)

CPI year-on-year (September 2025 vs. September 2024) to rise 3.1% from 2.9% in the prior month. Core CPI year-on-year to - unchanged at 3.1%.

Signs of still sticky inflation may shave bets around the Fed cutting interest rates.

XAUUSD is forecasted to move 0.9% up or 0.4% down in a 6-hour window after the CPI report.

-S&P Global PMI’s – (13:45 PM GMT)

XAUUSD is forecasted to move 0.4% up or 0.4% down in a 6-hour window after the S&P Global PMI reports

Note: Traders have fully priced in a Fed cut in October and December.

POTENTIAL SCENARIOS:

BULLISH – Should $4200 prove reliable support, prices may rebound back toward $4300, $4380 and $4422.61 - the upper limit of Bloomberg’s FX model.

BEARISH – Weakness below $4200 could see prices decline toward $4100 and $4067.27 the lower limit of Bloomberg’s FX model.