Gold to resume bullish trend?

- Home

- Market Analysis

- Gold to resume bullish trend?

- Gold ↑ 2% on Monday amid risk-off tone

- US senators pass deal on Sunday, which needs to be passed by the House

- Political risk and growth fears fuelling gold’s upside

- Fed speeches may add to overall volatility

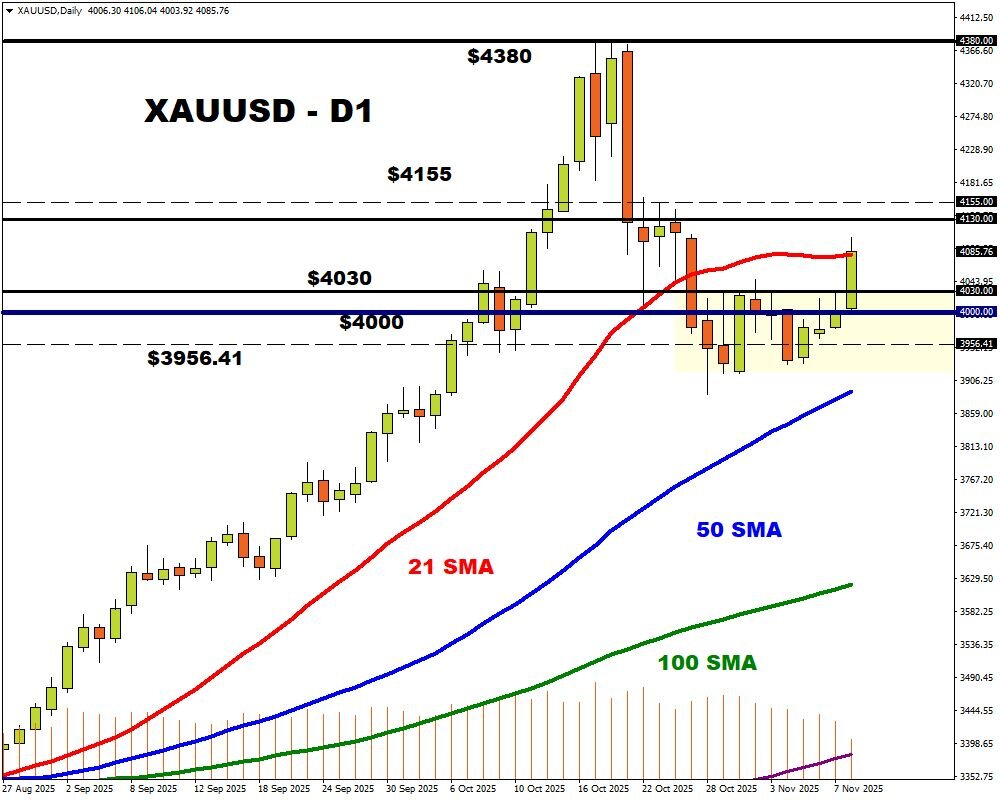

- Key levels of interest $4155, $4130 and 21-day SMA

DID YOU KNOW…

Gold jumped over 2% on Monday amid US political risk, expectations of another Fed cut in December and growth fears…

WHAT COULD MOVE XAUUSD THIS WEEK?

Mounting political drama in the United States as the government shutdown hits 40 days.

US senators have passed a deal that could end the longest government shutdown in history, but it still needs to be passed by the House and by Democrats in the Senate.

The negative effects compound as the shutdown drags on - costing the US economy roughly $15 billion a week. If this sparks fresh jitters, safe-haven assets like gold could receive a boost.

Fed speeches and private data may also add to the potential volatility.

Note: US government economic data releases may be delayed by shutdown that began on Oct. 1.

Monday 10th November

- Fed’s Daly speech – (13:30 PM GMT)

- Fed’s Musalem speech – (14:45 PM GMT)

Tuesday 12th November

- Fed’s Barr speech – (03:25 AM GMT)

- Fed’s Williams speech – (14:20 PM GMT)

- Fed’s Waller speech – (15:20 PM GMT)

- Fed’s Bostic speech – (17:15 PM GMT)

Wednesday 13th November

- Fed’s Musalem speech – (17:15 PM GMT)

- Thursday 14th November

- Fed’s Bostic speech - (14:20 PM GMT)

POTENTIAL SCENARIOS:

- BULLISH – A solid breakout above $4030 may open a path toward the 21-day SMA, $4130 and $4155.00 - the upper limit of Bloomberg’s FX model.

- BEARISH – Weakness below $4000 could see prices decline toward $3956.41 the lower limit of Bloomberg’s FX model.