Market round-up: Israel-Gaza ceasefire, gold tanks, US shutdown drags on

- Home

- Market Analysis

- Market round-up: Israel-Gaza ceasefire, gold tanks, US shutdown drags on

- Israel-Gaza ceasefire may reduce geopolitical risk

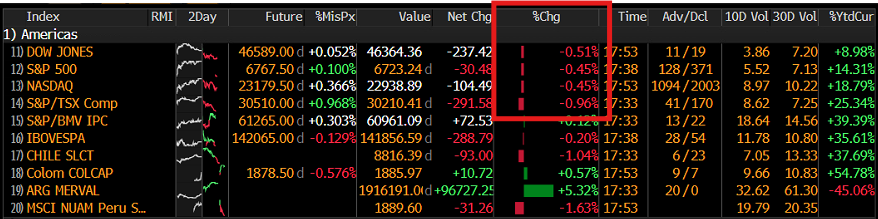

- US equities gripped by political uncertainty, US500 drops 0.5%

- US Government shutdown drags on amid funding dead-lock

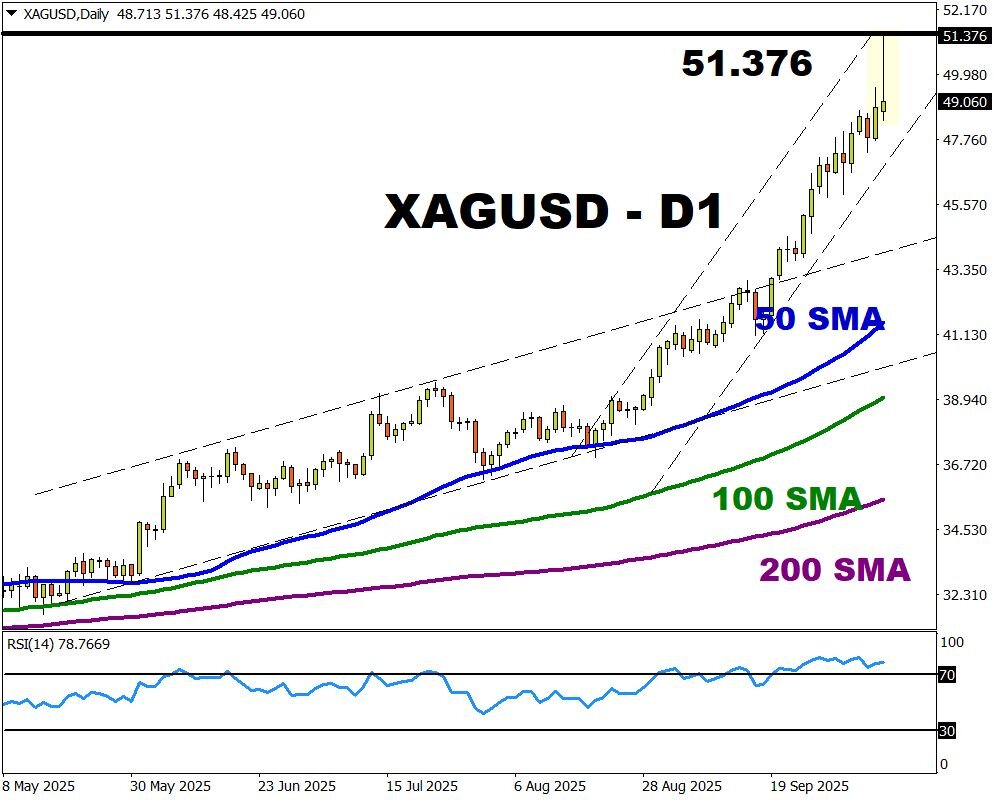

- Silver tumbles over 5% amid profit-taking and dollar strength

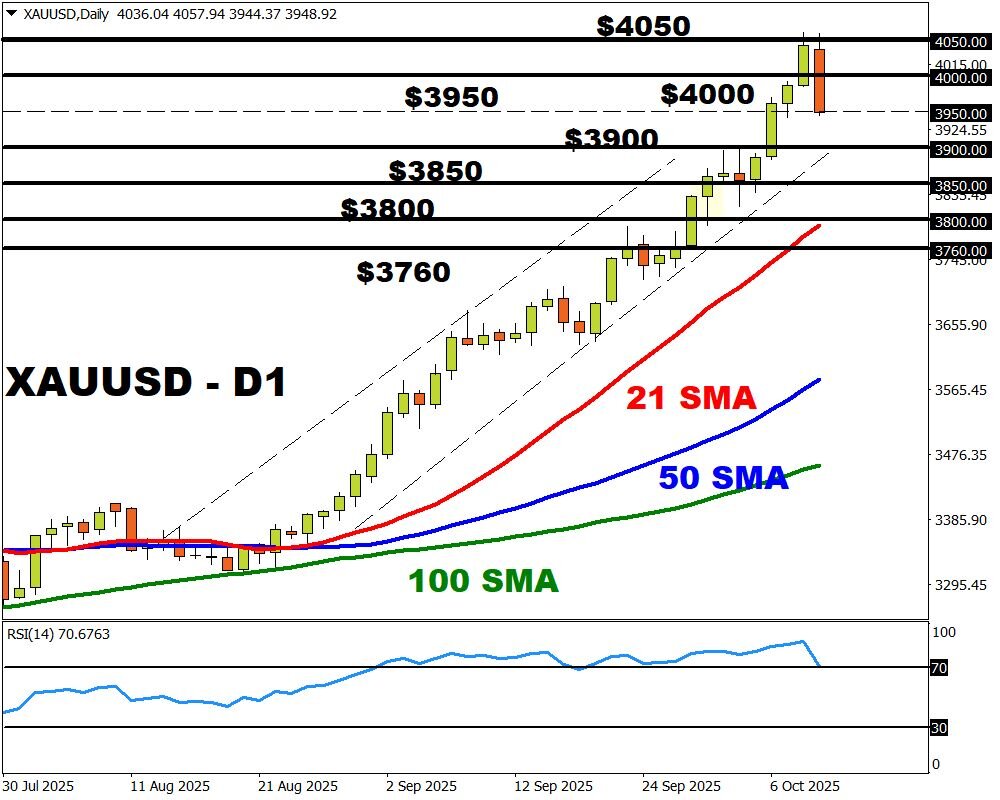

- Gold drops over $100 in a matter of hours to test $3950

US equity markets were a sea of red on Thursday amid US political risk and questions about the bull run overheating.

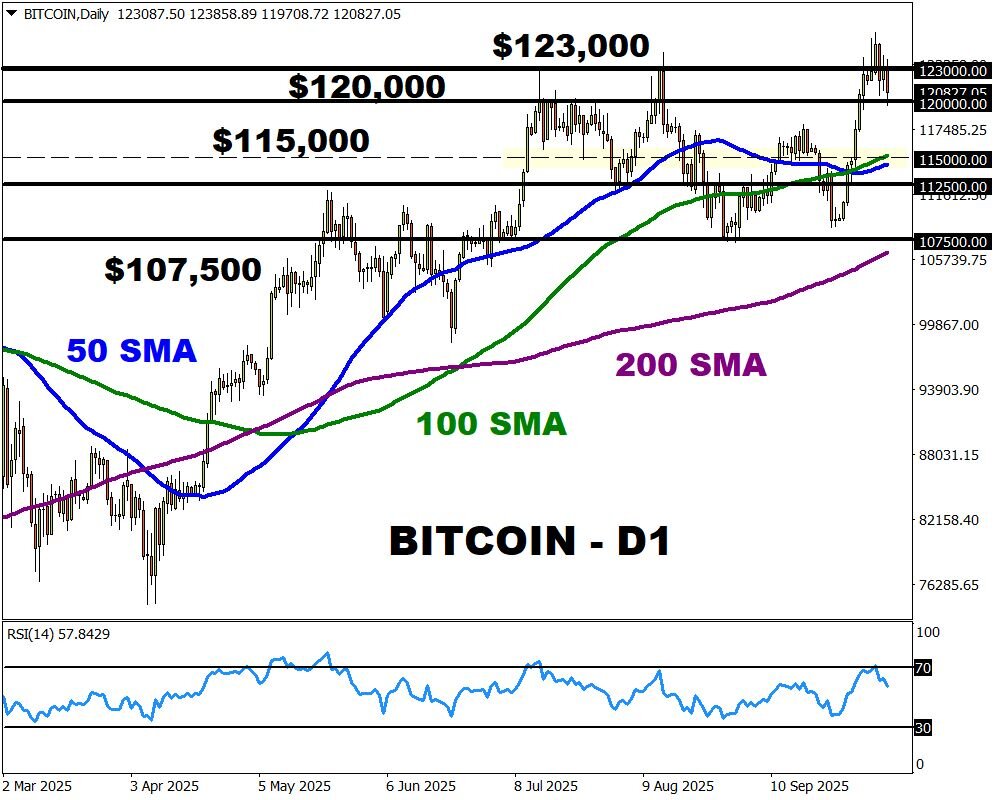

In the commodity space, gold price tumbled over 2% as risk sentiment jumped on the Israel-Gaza ceasefire. Regarding FX, the dollar staged a sharp rebound, punishing all G10 currencies while Bitcoin slipped back toward $120,000.

US political risks mount

It’s been over a week since the US government shut down, with Congress still deadlocked on a funding plan.

Note: There have been 11 shutdowns since 1980 with the longest shutdown occurring during Trump's first term in November 2018.

Shutdowns represent a major element of uncertainty to the US economy and are quite damaging. Investors are basically in the dark regarding the economic outlook amid the pause in government data.

September’s US jobs report, which was scheduled for release last Friday, has been put on hold until the shutdown finishes.

Gaza ceasefire deal

Israel has started implementing a ceasefire deal in Gaza, its first diplomatic breakthrough after months of failed attempts.

This major development could ease geopolitical tensions in the region, lending support to risk assets like equities and Bitcoin. Nevertheless, it’s still early days with any signs of renewed tensions sparking risk aversion.

Silver tops $50…then crashes

Spot silver surged over 2% past $50 an ounce - its highest since the 1980s Hunt brothers squeeze, as safe-haven demand met tight supply.

However, prices later tumbled over 5% amid profit-taking and an appreciating US dollar. Still, the precious metal is up roughly 70% this year, outpacing gold amid concerns over US fiscal risk and prospects over lower US rates.

Gold also saw an aggressive sell-off that sent prices back toward $3950, essentially a $100 drop from $4050 in a matter of hours.

Although the fundamental forces favour bulls, the technicals are starting to veer in favour of bears. Weakness below $3950 may open a path toward $3900 and lower.