Market round-up: Nvidia beats, mixed NFP, Gold rangebound

- Home

- Market Analysis

- Market round-up: Nvidia beats, mixed NFP, Gold rangebound

- Solid Nvidia results cool fears around AI bubble

- Mixed NFP fuels Fed cut bets for December

- Bitcoin slips below $90,000

- Gold rangebound despite heavy risk event week

Market chatter about an AI bubble and the resumption of US data dominated the headlines this week.

Sentiment shifted from anxiety to euphoria after Nvidia delivered blockbuster results, while the delayed September US jobs report painted a mixed picture. This was enough to support US equities and other risk assets. However, Bitcoin extended losses while gold offered a mixed response despite bets around a Fed cut in December jumping back to 40% from 25%.

Here is what you need to know:

Nvidia brushes off AI bubble concerns

Global markets cheered after Nvidia's quarterly results exceeded market expectations.

Stocks of the AI titan jumped 5% in after-hours trading after reporting solid Q3 earnings. Revenues for Q3 jumped 62% to $57 billion thanks to demand for chips used in AI data centers. These results alleviated concerns about an AI bubble, boosting sentiment across global financial markets.

US equities extended gains on Thursday with the NAS100 back above the 50-day SMA.

September’s NFP report mixed

US equity markets offered a positive response to the mixed September NFP report. The US economy created 119,000 jobs after declining in the prior month.

However, the unemployment rate rose to 4.4%. In response, bets around a Fed cut in December jumped back to around 40% from the 25% seen before the report was published. Should US economic data continue to disappoint, this may fuel bets around the Fed cutting rates by the end of 2025.

FXTM’s USDInd punched higher with prices almost touching 100.50. Bulls remain in control above the 200-day SMA.

What next for gold?

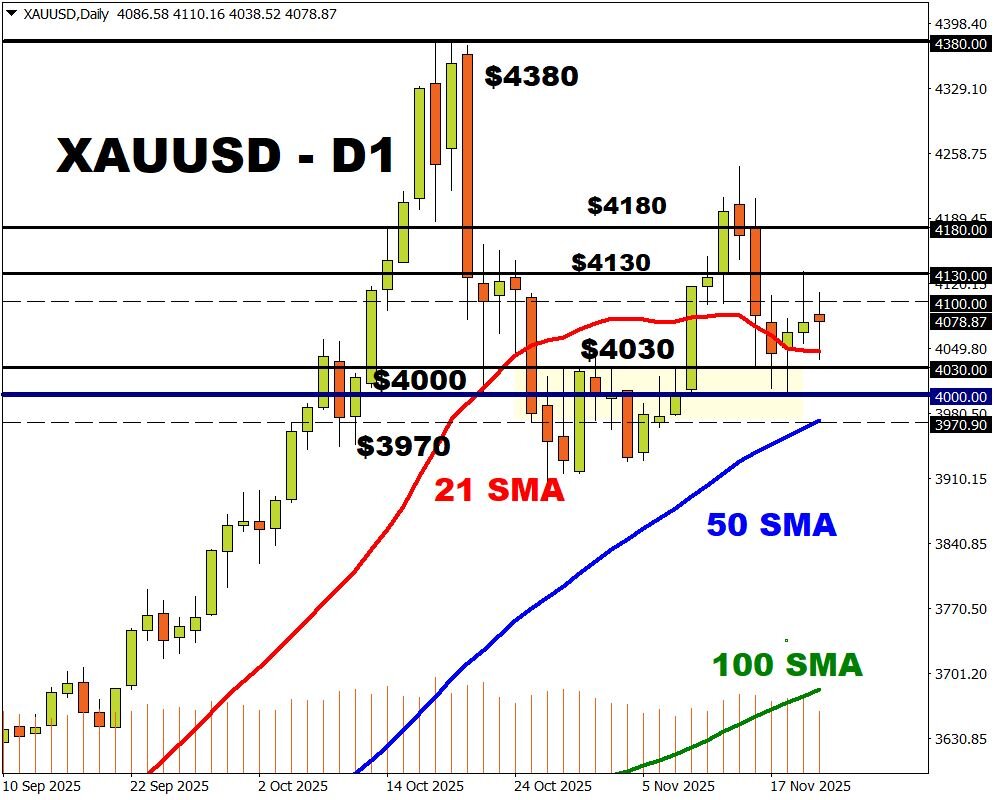

After rebounding from the psychological $4000 level earlier this week, gold has been trapped within a range.

The precious metal offered a mixed reaction to the jobs data, with prices trading below $4100 as of writing. Nevertheless, the outlook for gold will remain heavily influenced by Fed cut expectations.

- Should incoming US data support the case for lower rates, gold prices may push toward $4130 and $4200.

- However, more hawkish remarks by Fed speakers, coupled with stronger-than-expected data, could drag prices back toward $4030 and $4000.