Market round-up: Trade war rebooted, gold hits ATH, dollar slips

- Home

- Market Analysis

- Market round-up: Trade war rebooted, gold hits ATH, dollar slips

- Trump declares that US locked in trade war with China

- Equities supported by big bank earnings and tech rally

- Gold hits fresh all-time high above $4200

- Dollar weakens against most G10 currencies amid Fed cut bets

- Bitcoin headed toward $100,000?

It was a week defined by renewed US-China trade tensions and ongoing US political risk.

Global stocks held firm against the uncertainty, while the dollar weakened amid recession fears. Big US banks reported strong earnings while gold and silver both surged to record highs. Looking at cryptos, Bitcoin struggled to nurse deep wounds inflicted by the brutal weekend selloff.

US-China trade war restarted

Markets have been rocked by comments from President Donald Trump stating that the US was locked in a trade war with China. This has sparked volatility across the board, with trade fears leaving investors jittery. Equity, commodity and FX markets are likely to remain highly sensitive to trade developments ahead of the November 1st deadline.

US government shutdown drags on

It’s been over 15 days since the US government shutdown with investors left in the dark as government data is delayed. This represents a major element of uncertainty to the US economy and may fuel expectations around lower rates as recession fears mount. Due to the government shutdown, the September US jobs report is still on hold and the US CPI report has been delayed till next week.

Dollar weakens on Fed cut bets

The dollar has weakened against almost every single G10 currency this week amid US political risk and Fed cut bets.

Traders have practically priced in a Fed rate cut in October and December.

These odds could be influenced by US political risk and what the delayed NFP and CPI report reveal when the government shutdown comes to an end.

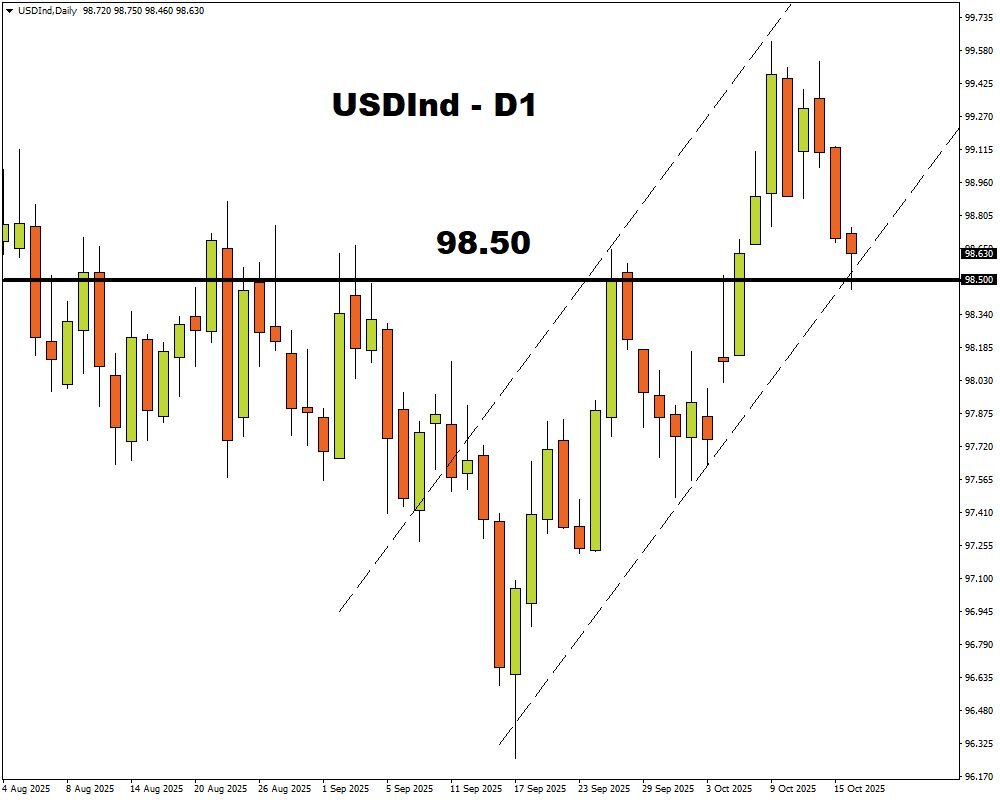

FXTM’s USDInd is under pressure on the daily charts with prices trading around 98.50. A solid break below this support could signal a selloff toward 98.10 and 97.60.

Gold surges to all-time high

Gold continues to glitter amid mounting trade tensions and bets around lower interest rates, as US political risk fuels recession fears. The precious metal reached a new all-time high at $4,242.13 this morning, pushing 2025 gains to over 60%. With the dollar also on the backfoot, this may support further upside with the next key psychological level at $4250.

Alternatively, weakness below $4200 could be early signs of a potential correction in the short term before the rally resumes.

Bitcoin to slip toward $100,000?

A horrible cocktail of trade tensions, political risk, and recession fears has somewhat soured appetite for risk assets. This is being reflected in Bitcoin, which is approaching the $110,000 level. Prices are under pressure on the daily charts with weakness below $110,000, opening a path toward $107,500 and potentially lower.