Market round-up: BoE holds, equities flash red, bitcoin wobbles above $100k

- Home

- Market Analysis

- Market round-up: BoE holds, equities flash red, bitcoin wobbles above $100k

- US government shutdown becomes longest in history

- BoE leaves rates unchanged, cut expected in December

- Bitcoin dips below $100,000 for first time since June

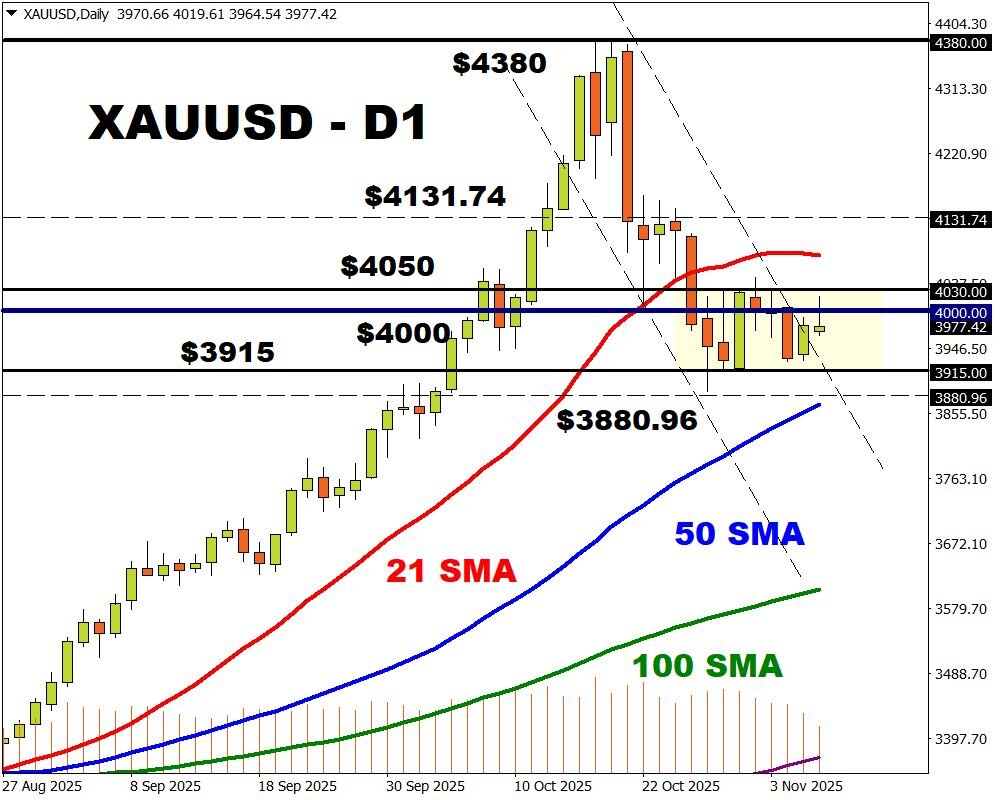

- Gold trapped within range on daily charts

It was another week defined by US political risk as the government shutdown extended to its longest in history.

Caution lingered across markets as investors questioned the tech rally, while strong evidence of a cooling US labour force weighed on US equities.

In the commodity space, gold struggled for direction while Bitcoin tumbled below $100,000 for the first time since June.

Here is what you need to know…

BoE leaves rates unchanged

In a widely expected move, the BoE held interest rates unchanged at 4% on Thursday.

This was certainly a tight vote with five members voting to leave policy unchanged and four calling for a cut to 3.75%.

With inflation “likely to have peaked” this reinforced bets around the BoE cutting interest rates in December. However, the upcoming Autumn budget remained an element of uncertainty amid the darkening fiscal outlook for the UK.

Traders are pricing in a 71% probability that the BoE cuts rates in December, with the odds of another cut by March 2026 around 42%.

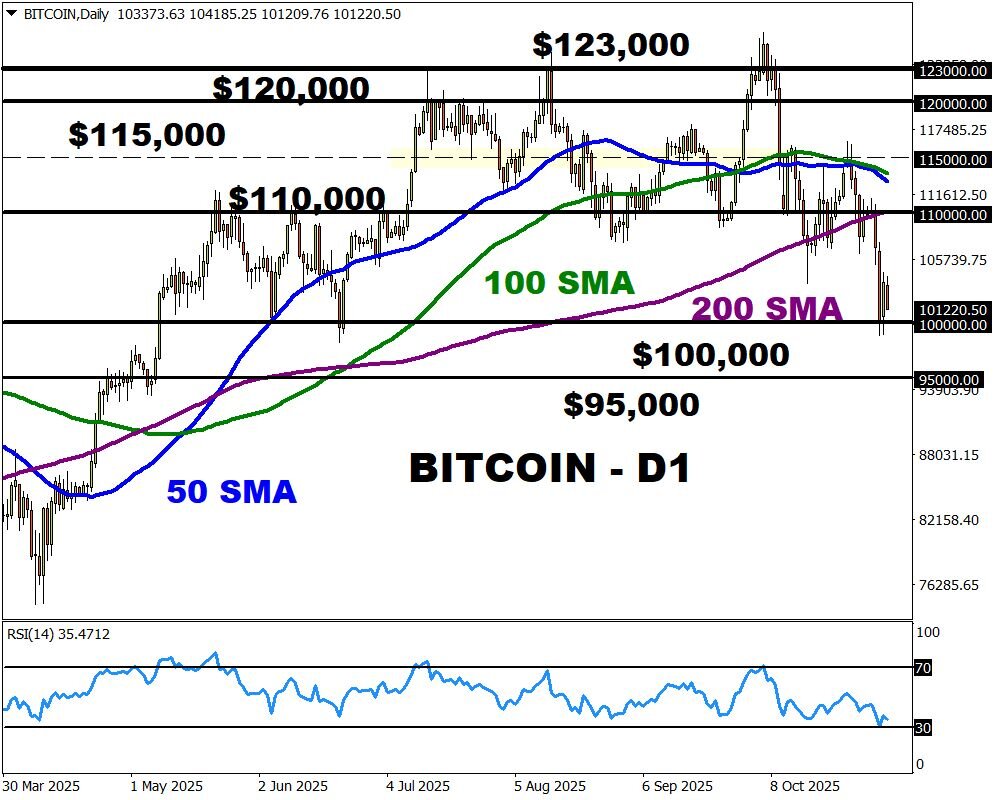

Bitcoin wobbles above key $100,000 support

The past few weeks have been rough and rocky for Bitcoin.

After the brutal wave of bullish liquidations on October 10, sellers have struck at any given opportunity.

The recent risk-off mood triggered a $45 billion sell-off by long-term holders while growing negativity across the board fuelled downside pressures.

Given how US spot Bitcoin ETFs recorded over $1 billion in cumulative outflows since October 29th, it certainly feels like sentiment is shifting in favour of bears.

On the technical side, Bitcoin has shed almost 20% from its all-time high, ending October roughly 5% lower. Considering prices are up only 10% year-to-date, a solid move below $95,000 could mean Bitcoin's first negative year since 2022.

Despite the negative outlook in the short to medium term, Bitcoin is no stranger to massive selloffs only to recover down the road. A return of risk appetite, helped by easing trade tensions and Fed cut bets, may bring bulls back into the game.

In addition, the Fear and Greed index has hit 20 for the first time since the tariff-fuelled selloff in April that sent Bitcoin sliding toward $75,000 before staging a rebound. Should history repeat itself and $100,000 prove to be reliable support, Bitcoin may be gearing up for a rebound.

However, sustained weakness below $100,000 may open the door to $95,000 and potentially lower.

Gold waits for a catalyst…

Gold remains trapped within a range on the daily charts with support at $3915 and resistance $4030. Despite the key themes revolving around US political risk, global trade developments and Fed cut expectations, gold needs something fresh.

- A move above $4030 may signal a resumption of the bullish trend.

- Weakness below $3915 may open a path toward $3900 and $3880.