Markets gripped by political risk, Fed minutes in focus

- Home

- Market Analysis

- Markets gripped by political risk, Fed minutes in focus

- Worries over US government shutdown dent sentiment

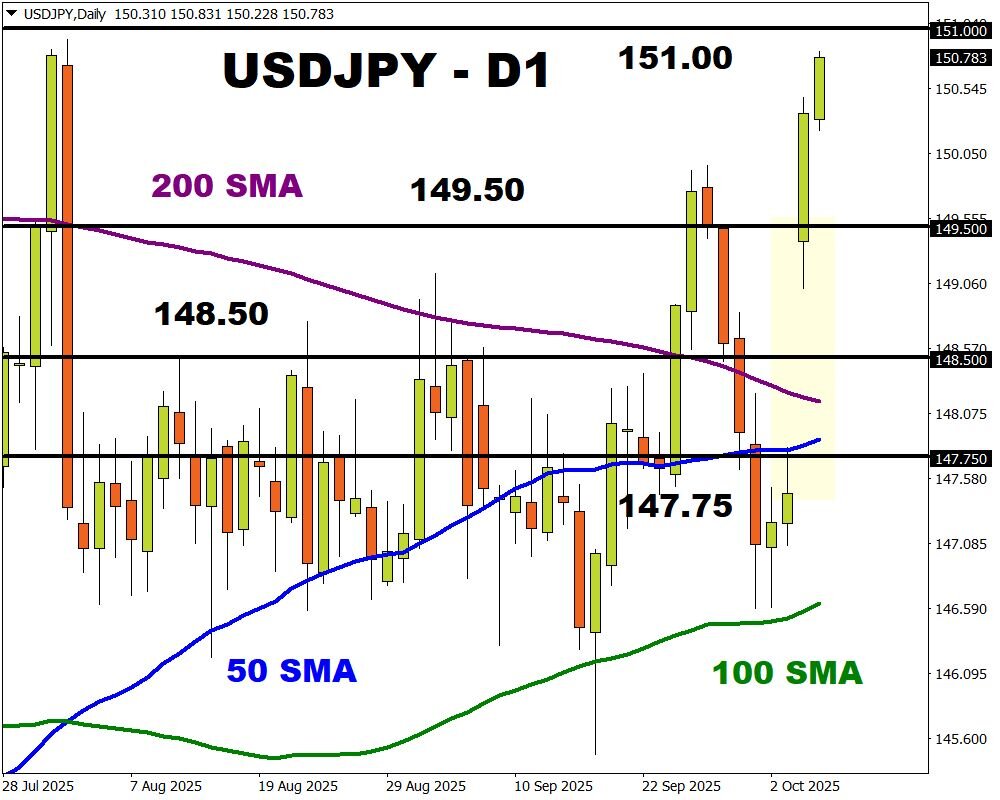

- Yen worst performing G10 currency vs USD week-to-date

- RBNZ expected to cut rates by 25bp or 50bp on Wednesday

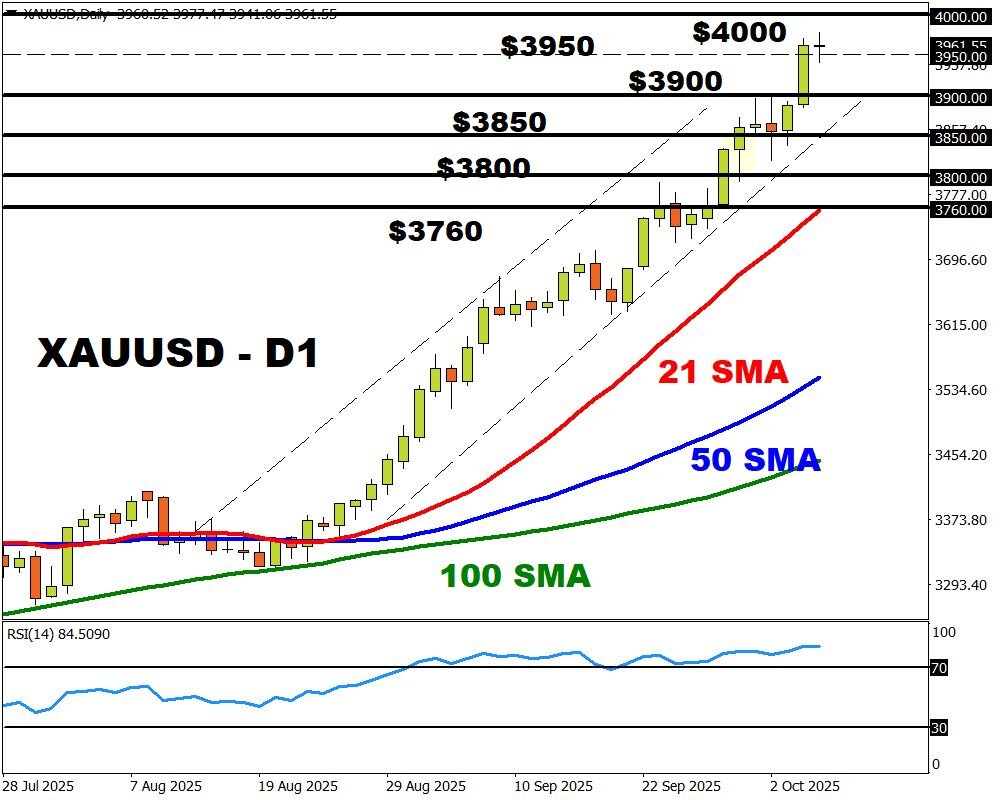

- Gold retreats after coming close to $4000

- Fed speeches and FOMC minutes in sharp focus

European shares and US equity futures struggled to find direction on Tuesday, despite the positive momentum in Asia during early trade.

It seems that ongoing political risk has left investors anxious, despite the tech-fueled rally on Monday.

Caution may remain the name of the game as the US shutdown drags with investors relying on private reports for greater clarity on the US economy. An extended shutdown could result in a wave of dollar weakness as concerns mount over slowing economic growth.

Given how US government economic data releases may be delayed by the shutdown, much focus will be on speeches by a host of Fed officials, including Jerome Powell. FOMC minutes may provide some insight into the Fed’s monetary policy path.

In the FX space, the Yen is the worst-performing G10 currency week-to-date after pro-stimulus lawmaker Sanae Takaichi secured a victory in the ruling party leadership race. Her victory lifted growth expectations and reduced bets around the BoJ hiking interest rates in October. Before her victory, traders were pricing in a 57% chance of a BoJ rate hike this month; the odds have now dropped to 21%.

The USDJPY is firmly bullish with the next key point of interest at 151.00.

The Reserve Bank of New Zealand (RBNZ) is expected to cut interest rates on Wednesday, 8th October but the question is by how much? Traders are currently pricing in a 44% chance that the central bank moves ahead with a jumbo 50 basis point cut.

Gold slipped on Tuesday as the dollar stabilized, but US political risk may limit downside losses. The precious metal continues to be supported by various fundamental forces, ranging from central bank buying, geopolitical risk, and prospects around lower US interest rates. A host of Fed speeches this week may influence whether gold maintains gains or experiences a technical correction.

Looking at the charts, weakness below $3950 may open a path toward $3900. Should $3950 prove reliable support, gold may rebound back toward the milestone $4000 level.