Markets hold breath as US shutdown nears end

- Home

- Market Analysis

- Markets hold breath as US shutdown nears end

- Senate passes deal that could end government shutdown

- Tech concerns and US political risk fuel caution

- Weak UK data boosts BoE cut bets, near 90% chance of December cut

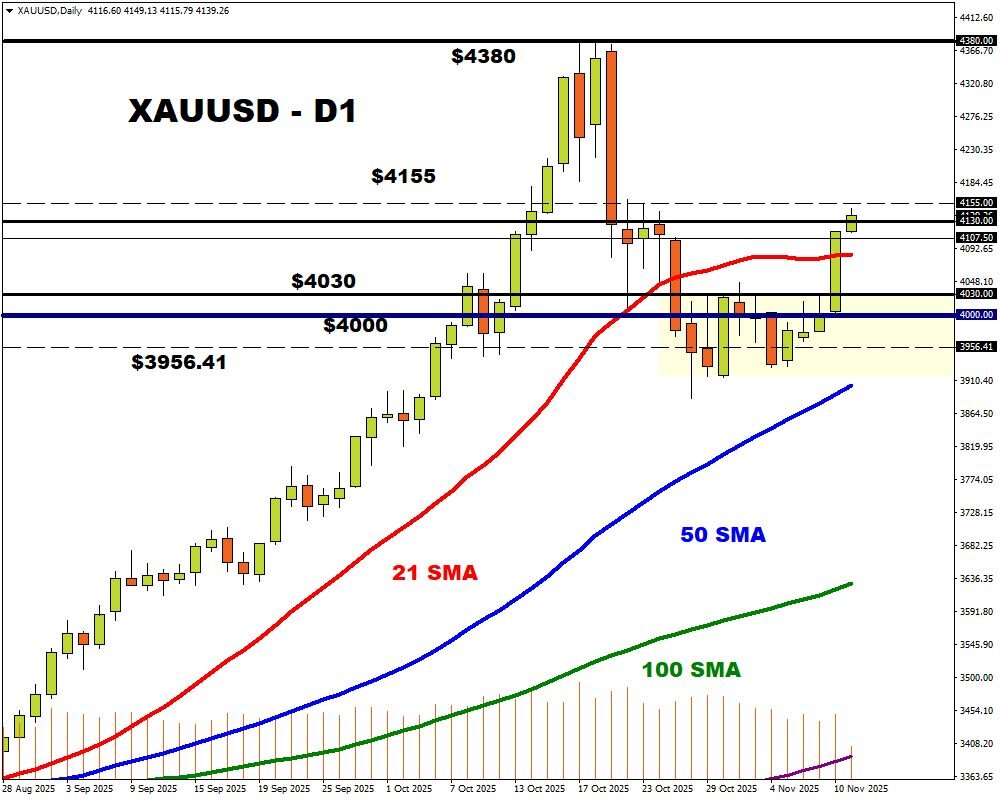

- Gold up almost 4% since Monday

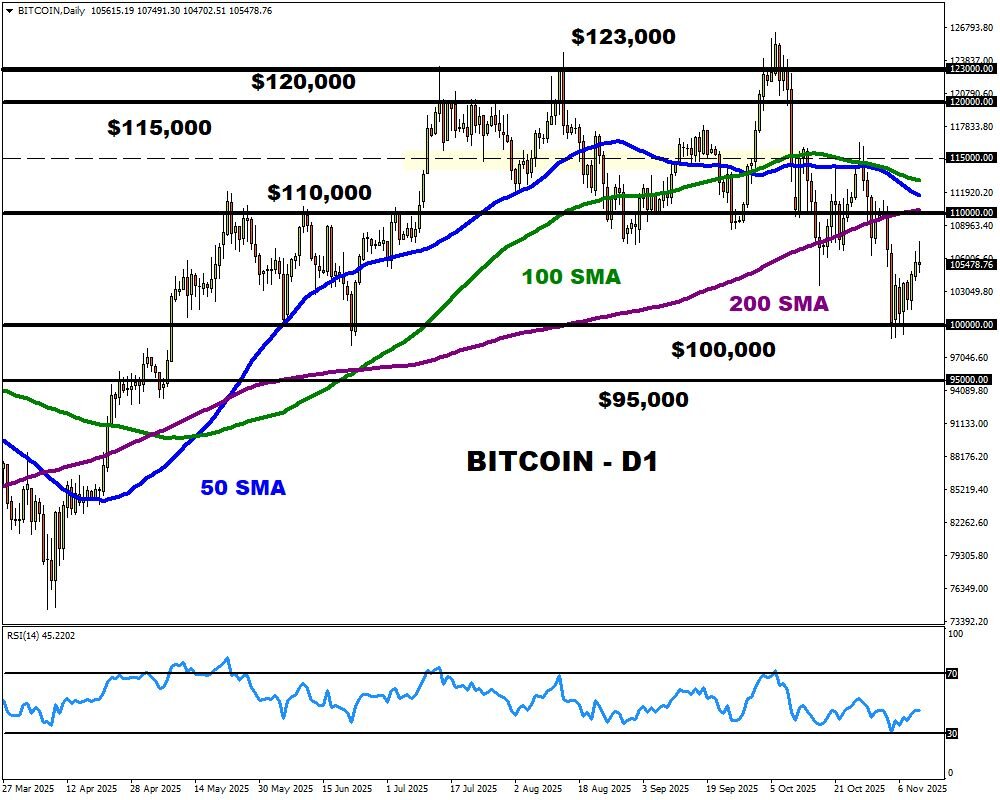

- Bitcoin rebounds from $100,000 support level

A sense of caution enveloped global markets on Tuesday as investors questioned the AI rally with US political risk weighing on sentiment.

It’s another week packed with corporate earnings and key data from across the globe.

But all eyes remain on the political drama in the US as the government shutdown hits 41 days. US senators have passed a deal that could end the longest government shutdown in history, but it still needs to be passed by the House.

Any further delays may compound the negative impacts, which have cost the US economy $15 billion a week. So, caution may remain the name of the game ahead of the House vote which could come as early as Wednesday.

In the United Kingdom, unemployment rose to 5% in the three months through September – the highest since early 2021. This jobs report is the first of a string of key data that may heavily influence monetary policy expectations for December.

Traders are currently pricing in an 86% of a BoE cut by the end of the year.

FXTM’s UK100 touched a fresh all-time high on Tuesday, punching above 9900. A solid daily close above this point may open a path toward 10,000.

Much is happening in the world's second-largest economy, Chinese tech heavyweights Tencent Holdings and JD.com are set to report earnings on Thursday, 13th November, Alibaba follows on Friday. A data dump at the end of the week may offer insight into how the US-China trade drama has impacted growth.

In the commodity space, gold extended gains on Tuesday after recording its biggest daily jump since May. The precious metal remains supported by Fed cut bets and economic risks in the US amid plans to pay a so-called tariff dividend which may lead to higher inflation. Prices remain firmly bullish on the daily charts with a breakout above $4150 opening a path toward $4200.

Regarding Bitcoin, it is trading close to $105,000 as hopes of a resolution to the US government shutdown lifted risk sentiment. The key question is whether $100,000 will prove a solid support or a weak floor for bears to conquer.