Mid-week outlook: Bitcoin tanks, government shutdown hits record & BoE in focus

- Home

- Market Analysis

- Mid-week outlook: Bitcoin tanks, government shutdown hits record & BoE in focus

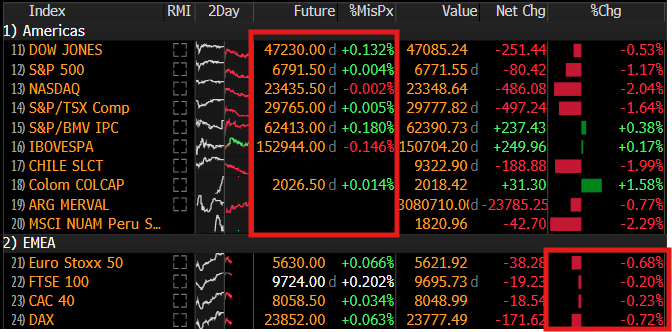

- US political risk & tech selloff hits equities

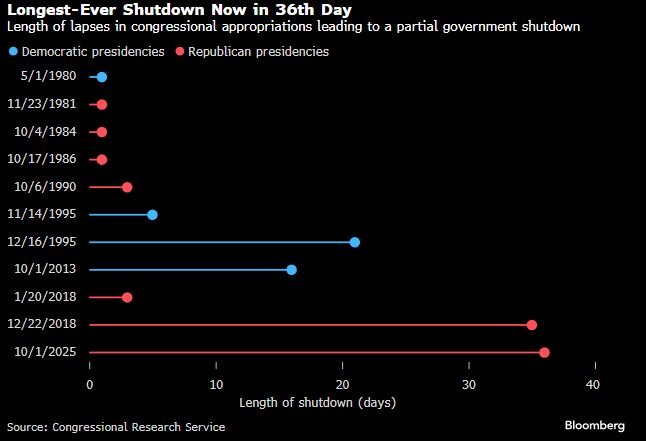

- Government shutdown extends to longest in history

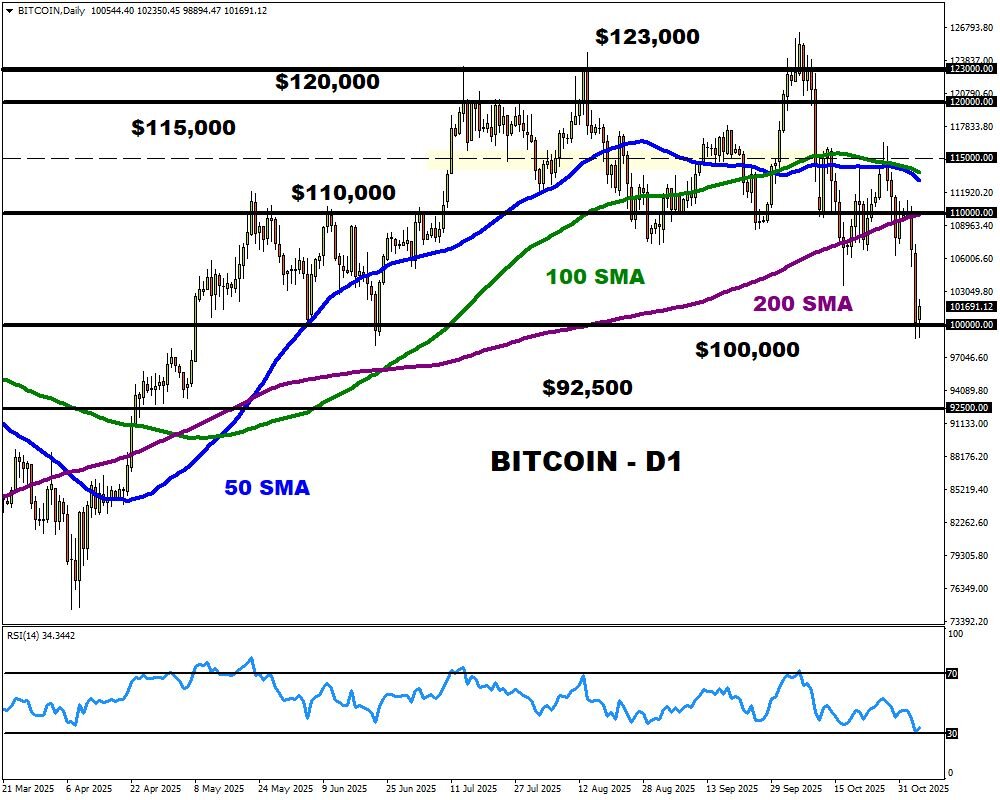

- Bitcoin dips below $100,000 on risk-off mood

- BoE expected to leave rates unchanged on Thursday

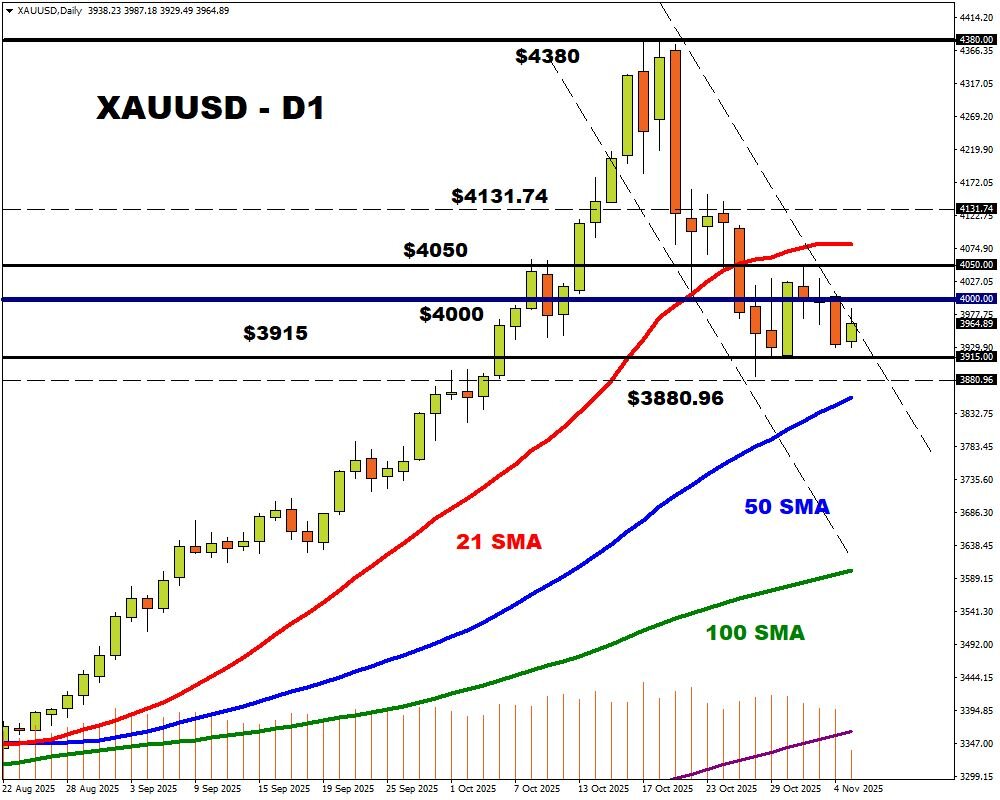

- Gold waits for fresh directional spark

Caution washed across markets on Wednesday with European equities mixed and US futures pointing to a negative open.

Growing concerns over sky-high tech valuations triggered a risk-off mood in the previous session, with mounting US political risk accelerating the flight to safety. The US government shutdown has dragged into its 36th day – the longest in history amid a stalemate between Republicans and Democrats over funding.

As the standoff continues, the economic pain is likely to worsen with everyone in the dark as the shutdown cuts off crucial data. This major source of uncertainty may trigger fresh pain for the USD as the US economic outlook darkens.

In the crypto space, Bitcoin collapsed like a house of cards on Tuesday – falling as much as 7.4% to dip below $100,000. The “OG” crypto was hammered by the risk-off mood, which has reduced its year-to-date gains to below 10%. A major contrast to the 120% gains of 2024 and the roughly 160% rally seen in 2023. Should $100,000 prove unreliable support, this may trigger another selloff that takes prices toward $92,500.

In the UK, the Bank of England is expected to leave interest rates unchanged at 4% on November 6th. Traders are currently pricing in a 28% chance of a cut this week, with the odds of another cut by December around 69%. These expectations may be driven by growing unease ahead of the UK government’s autumn budget amid mounting fiscal concerns.

Looking at commodities, gold is in bid this morning amid the risk-off sentiment and global equities selloff. However, the precious metal still needs a potent fundamental spark to determine its next major move.

On one side of the equation, the US-China trade truce, the Fed’s hawkish stance on rates, and a stabilizing dollar have enforced downside pressures. However, mounting US political risk and overall market caution could keep bulls in the game. Key technical levels can be found at $4000, $3960, and $3915.