Trump tariff tantrum triggers trillion-dollar selloff

- Home

- Market Analysis

- Trump tariff tantrum triggers trillion-dollar selloff

- Trump threatens to impose additional 100% tariffs on China

- US markets shed $2 trillion in market cap last Friday

- Gold hits new all-time high above $4070 on Monday

- US-China trade uncertainty back in focus

- Powell, big bank earnings and government shutdown in focus

A post by Trump on Truth Social was enough to erase almost $2 trillion from US markets last Friday.

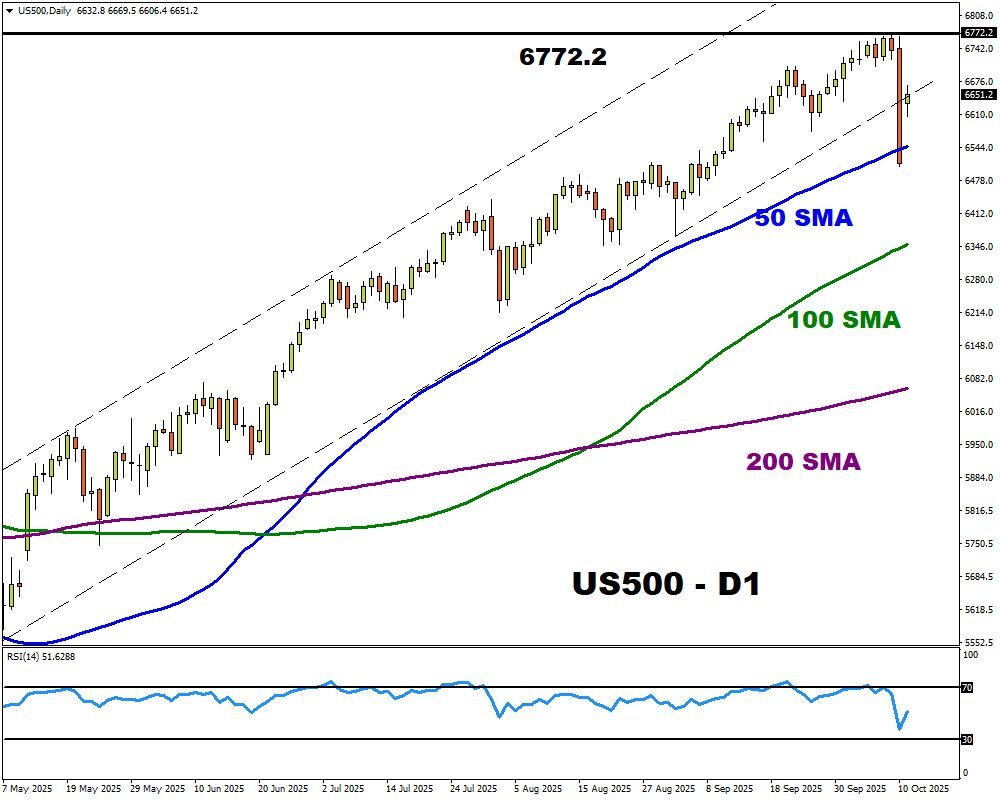

Risk aversion engulfed global markets after Trump threatened to impose an additional 100% tariff on Chinese goods starting from 1st November. US equity bulls were slaughtered as the S&P 500 tumbled 2.7% - its worst session since April.

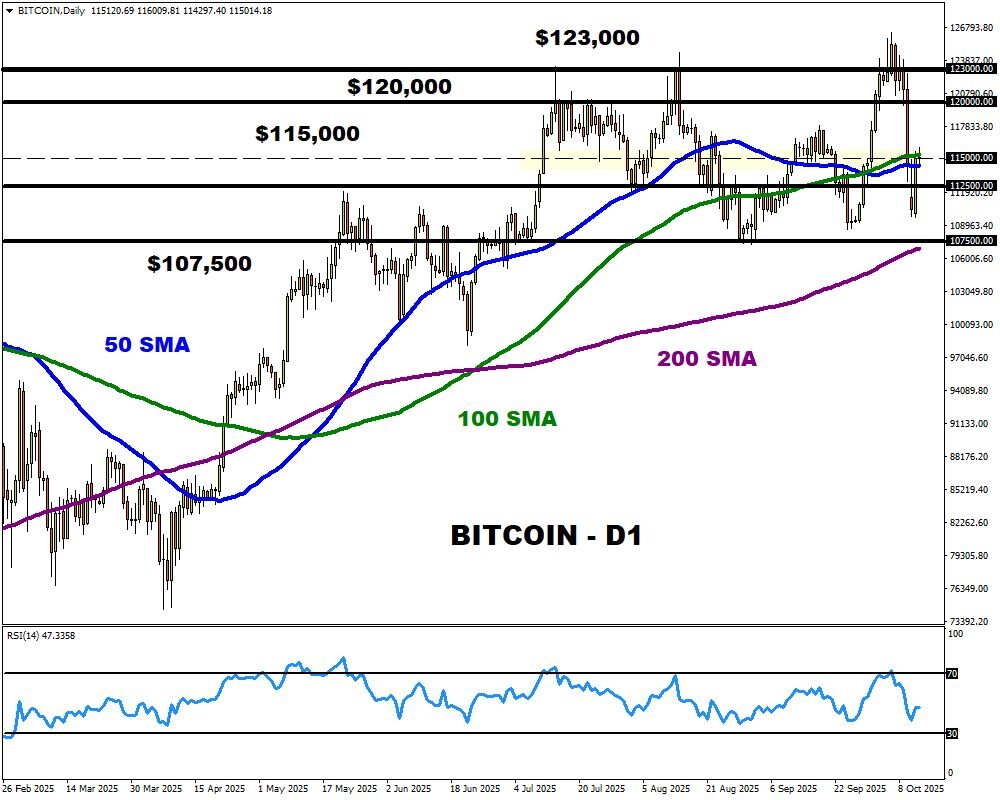

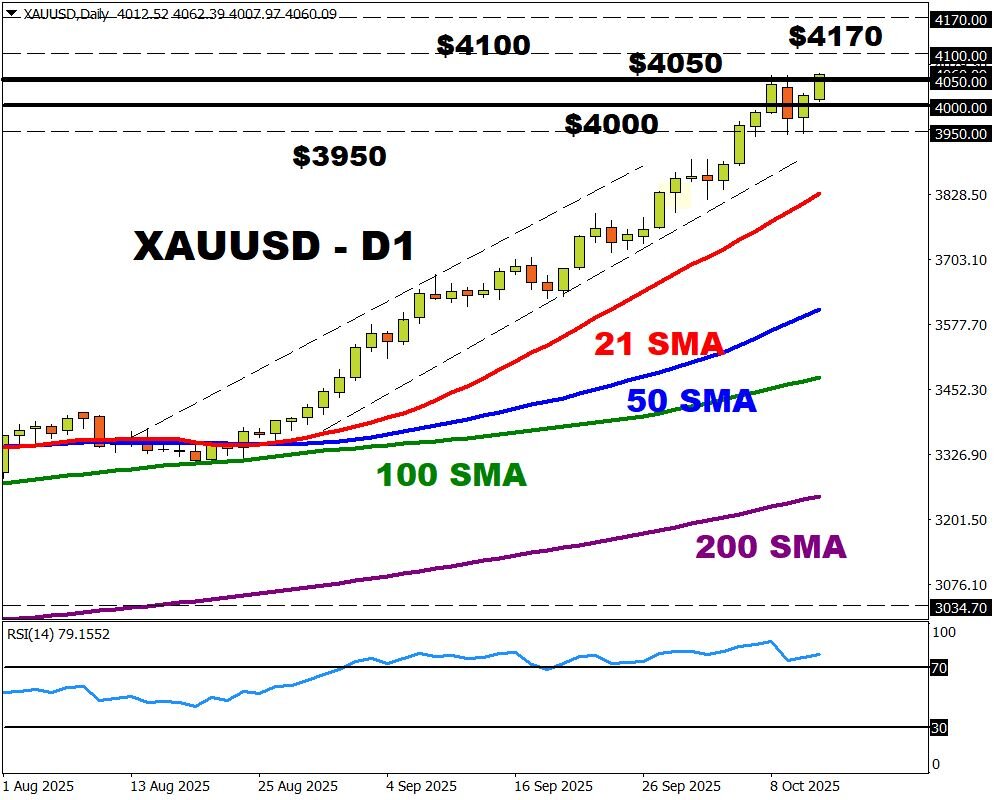

The pain spread beyond equities with Bitcoin collapsing like a house of cards while safe-haven gold glittered through the chaos.

Over the weekend, the Trump administration signalled an openness to talk with China, which has slightly eased concerns. Regardless, the damage has already been done with US-China trade uncertainty coming at a time when investors are already jittery over the US government shutdown, which started on 1st October.

Trade developments will certainly add more flavour to a week already packed with key reports, Fed speeches, geopolitics in the Middle East, and earnings from big US banks.

US banks are expected to report strong Q3 earnings thanks to a rebound in investment banking. Easing regulations and expectations for lower US interest rates have boosted mergers and acquisition deals.

Fed Chair Jerome Powell will be back under the spotlight on Tuesday as he speaks at the NABE Annual meeting. Should Powell offer any clues on future policy moves, this may trigger outsized reactions in the absence of US government economic data.

In the commodity space, gold touched a fresh all-time high above $4070 on Monday amid US-China trade tensions. The precious metal has secured eight consecutive weeks of gains and is up almost 55% year-to-date. Given the fresh wave of risk aversion, the powerful bull run could extend towards $4100 and higher if $4050 proves to be reliable support.