Trump-Xi talks, Central Banks & Big Tech in focus

- Home

- Market Analysis

- Trump-Xi talks, Central Banks & Big Tech in focus

- Global stocks rally on Monday amid trade optimism

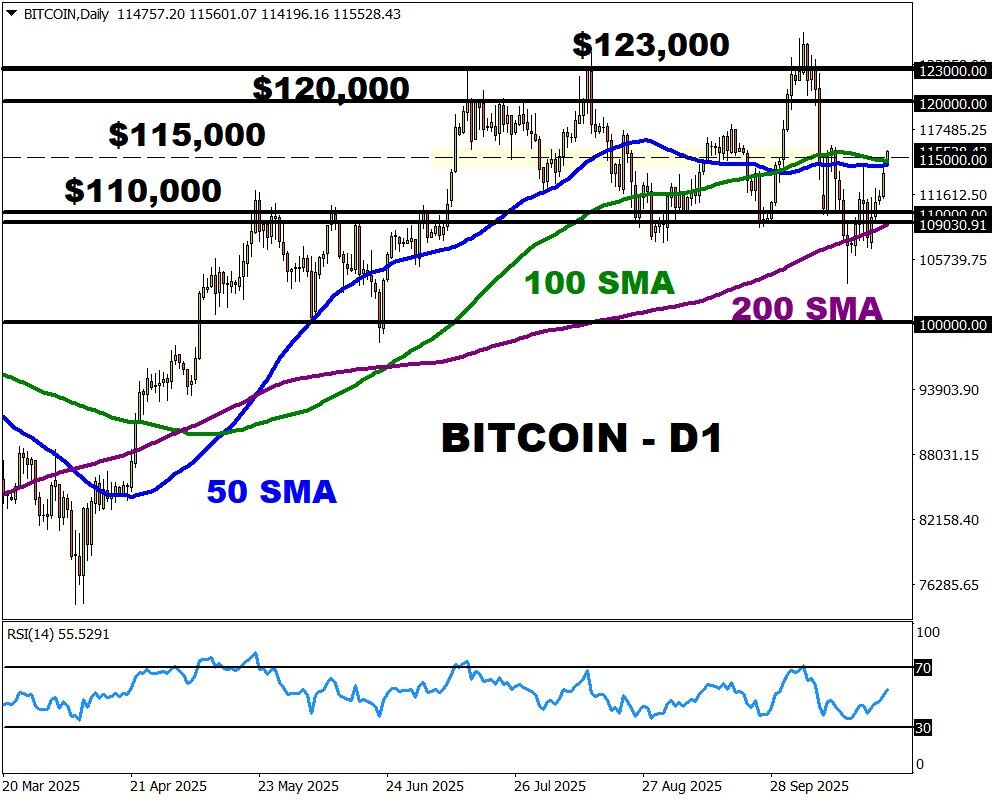

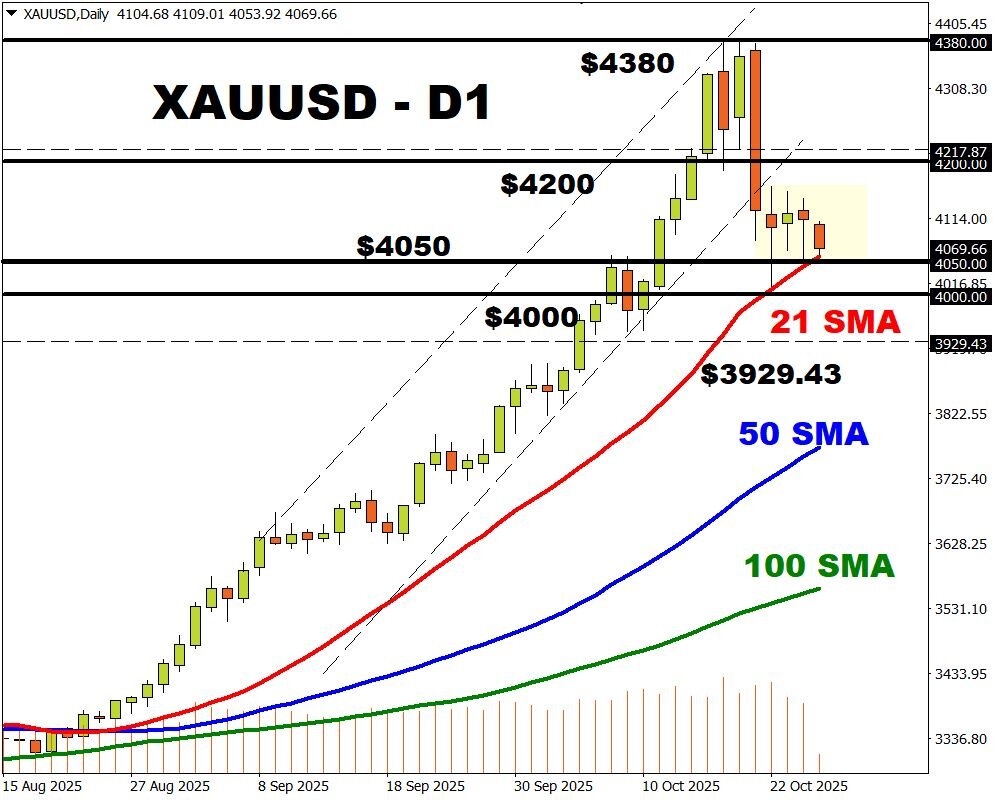

- Gold sinks more than 1%, Bitcoin jumps above $115,000

- Trillion-dollar titans set to report earnings

- Fed seen cutting rates, BoJ & ECB to hold

- Trump-Xi talks on Thursday may shape global sentiment

Global equity bulls roared back to life on Monday amid mounting optimism over the US and China closing in on a trade deal.

Asian shares closed higher, European markets flashed green while US equity futures pointed to a record open.

Over the weekend, top trade negotiators were able to find a middle ground on trade, with Scott Bessent stating Trump’s threat of 100% tariffs “is effectively off the table”.

This has set the stage for US President Trump and Xi Jinping to sign things off when they meet on Thursday.

The positive market mood has pushed Bitcoin above $115,000 while gold is down over 1% to below $4050.

On the data front, the US government shutdown has entered its 5th week – meaning more delays in key US data.

But there are plenty of other risk events that could trigger outsized moves across markets.

Five of the so-called “Magnificent” 7 tech giants with a combined market capitalization of almost $15 trillion are set to publish their results this week.

Quarterly results from Meta, Alphabet, Microsoft, Amazon and Apple will be heavily scrutinized as investors await proof that massive AI investments are driving growth.

Mid-week, the Fed is expected to cut interest rates for the second time this year, with traders pricing in a 95% probability of another cut by December.

On Thursday, both the Bank of Japan and the European Central Bank are expected to leave monetary policy unchanged. However, any clues offered about future moves may spark volatility across FX markets.

Looking at commodities, gold has lost some of its luster as progress on a US-China trade deal boosted global sentiment.

Still, US political risk and prospects of lower US rates may limit downside losses.

- Should $4050 prove reliable support, prices may rebound back toward $4150 and $4200.

- Weakness below $4050 could see prices decline toward $4000 and $3930.