USDInd holds below 100 as markets brace for data-heavy week

- Home

- Market Analysis

- USDInd holds below 100 as markets brace for data-heavy week

USDInd holds below 100 as markets brace for data-heavy week

- USDInd consolidates near 98.05 after recent rebound from August lows

- High-stakes week with ISM Manufacturing, JOLTs, and NFP in focus

- Technical upside hurdles: 98.26, 98.80, 99.05

- Downside risks: 97.90 floor, deeper slide toward 97.05

A cocktail of major U.S. economic events may stir fresh volatility for the dollar in the week ahead.

Attention will be firmly fixed on U.S. activity and labor data releases, all of which could determine whether the US Dollar Index (USDInd) extends its rebound or faces renewed pressure.

Key Upcoming Events:

Monday, 1st September

- US Labor Day: US Markets Are Closed

- CNY: China Caixin Manufacturing PMI

- SPN35: Spain HCOB Manufacturing PMI

- CHF: Swiss Manufacturing PMI (procure.ch)

- GBP: BoE Consumer Credit; Mortgage Approvals; Mortgage Lending

- EUR: EU Unemployment rate

Tuesday, 2nd September

- CHF: Swiss Retail Sales

- EUR: Eurozone Inflation Rate

- CAD: Canada S&P Global Manufacturing PMI

- USD: US ISM Manufacturing PMI

Wednesday, 3rd September

- AUD: Australia GDP

- CNY: China Caixin Services PMI

- SPN35: Spain HCOB Services PMI

- US500: US JOLTs Job Openings

- WTI: US API Crude Oil Stock Change

Thursday, 4th September

- AUD: Australia Balance of Trade

- CHF: Swiss Inflation Rate; Unemployment Rate

- EZ: Eurozone Retail Sales

- CAD: Canada Balance of Trade

- NAS100: US ISM Services PMI; Initial Jobless Claims

- JPY: Japan Household Spending

Friday, 5th September

- GER40: Germany Factory orders

- UK100: UK Retail Sales; Halifax House Price Index

- CHF: Swiss Consumer Confidence

- CAD: Canada Unemployment Rate; Ivey PMI s.a

- USD: US Non-Farm Payrolls; Unemployment Rate; Average Hourly Earnings

3 Factors That May Rock the Dollar:

1) ISM Manufacturing PMI

Tuesday’s ISM Manufacturing report kicks off the week. Resilient factory activity and sticky prices paid could underpin expectations of persistent inflation, strengthening the case for higher yields and supporting the dollar. Conversely, a weaker print may feed fears of a cooling economy, denting USDInd momentum.

2) JOLTs Job Openings

The Wednesday JOLTS release will offer a fresh snapshot of labor demand. Elevated openings would confirm ongoing tightness, reinforcing hawkish Fed bets. A sharper drop, however, may flag cracks in the labor market, weighing on the greenback ahead of Friday’s NFP report.

3) Nonfarm Payrolls (NFP)

Friday’s marquee event holds the power to dictate the dollar’s near-term direction.

- Hot print: USDInd could surge to/beyond 99.06

- Soft print: USDInd risks slipping towards/below 97.06, with traders pivoting into riskier assets (e.g. equities).

- Mixed outcome: Expect choppy, intraday swings as markets balance headline data

Technical Picture:

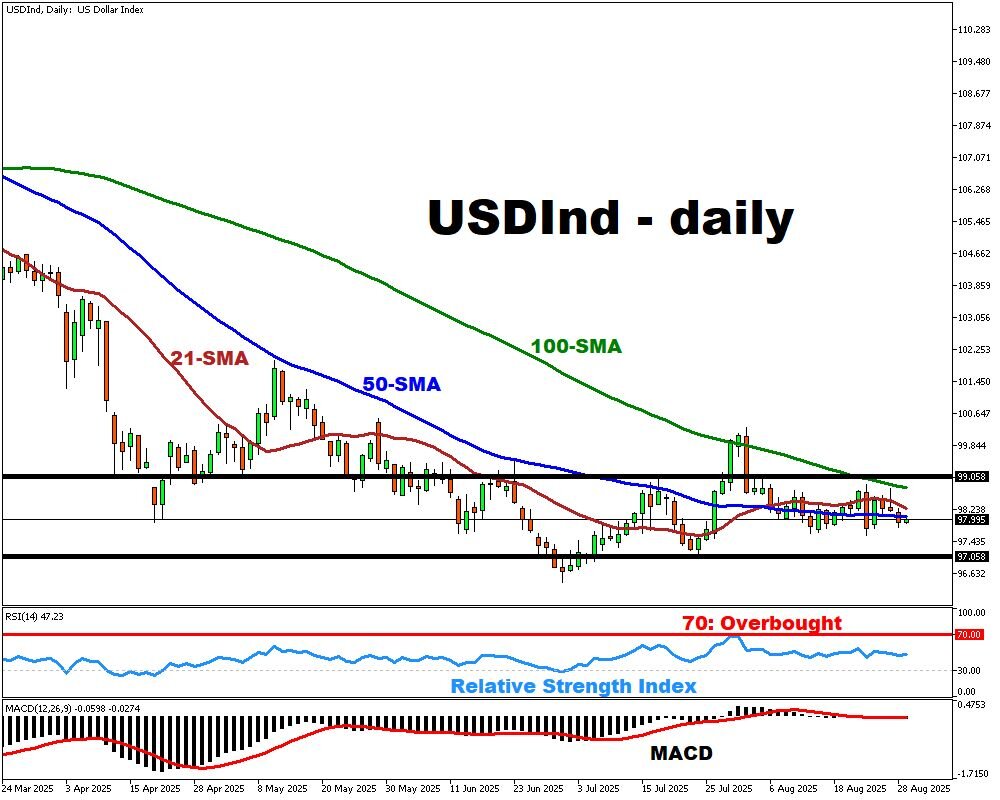

At the time of writing, the USDInd is trading at 97.99 after testing resistance near 98.07 intraday. Price action remains below all key moving averages (21-, 50- and 100-day MAs), reflecting a cautious tone.

- Upside targets: A sustained rebound above 98.05 (50-day MA) would open the door toward 98.26 (21-day MA). Beyond that, a push above 98.78 (100-day MA) could strengthen recovery potential

- Downside risks: A daily close below the 97.63 floor risks renewed bearish pressure

- Momentum watch: The RSI at 47.23 sits in neutral territory, lacking a clear directional bias. Meanwhile, the MACD remains negative (-0.0598 vs. signal -0.0274), suggesting bearish momentum still lingers unless a bullish crossover emerges