Week Ahead: 3 hot assets to track – Brent, NZDUSD & USDInd

- Home

- Market Analysis

- Week Ahead: 3 hot assets to track – Brent, NZDUSD & USDInd

- Sunday, October 5th: OPEC+ expected to raise oil supply

- Wednesday, October 8th: RBNZ seen cutting rates

- Fed minutes + speeches = USD volatility?

- Ongoing government shutdown to add to overall volatility

- USDInd: Technical levels – 99.00, 98.00 and 97.15.

October commenced with the US government experiencing a shutdown for the first time in almost seven years.

This major political development will remain a key theme as investors prepare for another week packed with high-impact events.

The OPEC+ meeting, Fed’s minutes and Reserve Bank of New Zealand Rate decision could spark fresh trading opportunities:

Sunday, 5th October

- OIL: OPEC+ meeting on production levels

Monday, 6th October

- AUD: Australia Westpac Consumer Confidence Change

- EUR: Eurozone retail sales, ECB President Lagarde testimony

- GBP: UK S&P Global Construction PMI, BOE Governor Bailey keynote speech

- JPY: Japan Household Spending

Tuesday, 7th October

- AUD: Australia consumer confidence

- GER40: Germany factory orders

- USDInd: Fed Governor Stephen Miran, Atlanta Fed President Raphael Bostic speech

- WTI: US API Crude Oil Stock Change

Wednesday, 8th October

- GER40: Germany industrial production

- NZD: New Zealand rate decision

- CHF: Sweden CPI

- USDInd: US FOMC minutes

Thursday, 9th October

- EU50: Germany Balance of Trade

- MXN: Mexico Inflation Rate

- USD: US Initial Jobless Claims; Fed Chair Jerome Powell & Fed Governor Bowman Speeches

- NZD: New Zealand Business NZ PMI

Friday, 10th October

- CAD: Canada unemployment

- JPY: Japan PPI

- NZD: New Zealand BusinessNZ Manufacturing PMI

- USDInd: US University of Michigan consumer sentiment, Chicago Fed President Austan Goolsbee speech

Here are 3 assets that could see significant price swings:

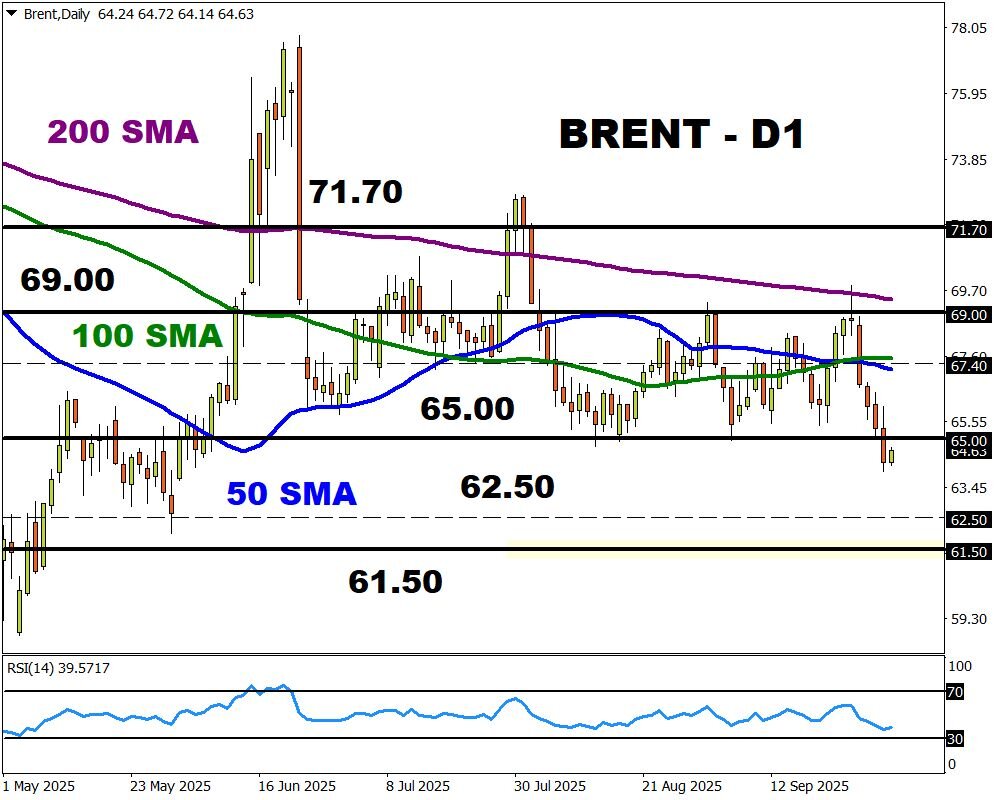

1) BRENT: OPEC+ meeting

On Sunday, 5th October, OPEC+ will meet to discuss November production levels.

At their last meeting in September, the cartel announced plans to raise production by 137,000 barrels per day in October 2025 in a bid to regain market share.

There are reports that the cartel could agree on another round of production increases by 500,000 barrels a day in November - triple the increase made for October. However, OPEC has rejected such reports.

Nevertheless, these production increases are coming at a time when oil markets are heading for a record supply-demand surplus in 2026 – according to the International Energy Agency.

- Oil benchmarks are down over 10% this year and may extend losses if OPEC+ moves forward with further increases in production. Bearish targets can be found at $62.50 and $61.50.

- Should the cartel pause production increases for November, this could support oil as oversupply fears cool. Bullish price targets for Brent are the 50-day SMA, $67.40 and $69.00.

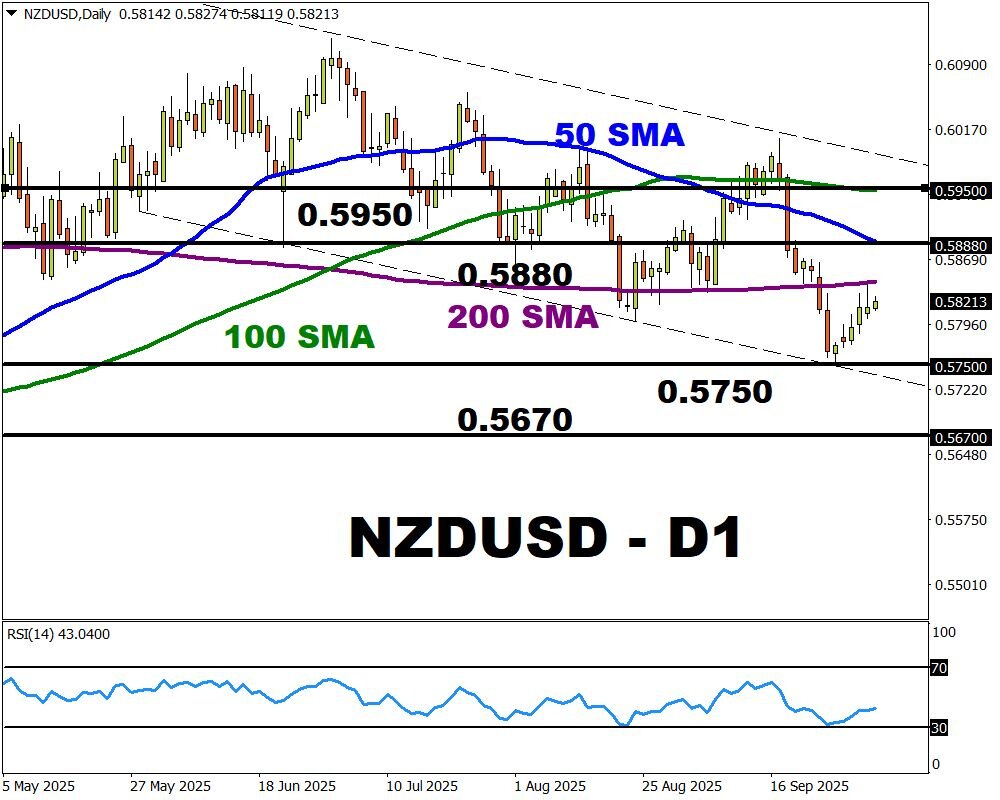

2) NZDUSD: RBNZ rate decision

The Reserve Bank of New Zealand (RBNZ) is expected to cut interest rates on Wednesday, 8th October. The question is how much?

Traders are currently pricing in a 30% chance that the central bank moves ahead with a jumbo 50 basis point cut!

These expectations are based on disappointing economic growth in the second quarter.

- Should the RBNZ cut interest rates and strike a dovish note, this may drag the NZDUSD toward 0.5750 and 0.5670.

- Should the RBNZ move ahead with a hawkish rate cut, the NZDUSD may rebound toward 0.5888 and 0.5950.

Bloomberg’s FX model forecasts a 73.5% chance that NZDUSD will trade within the 0.5744 – 0.5897 range, using current levels as a base, over the next one-week period.

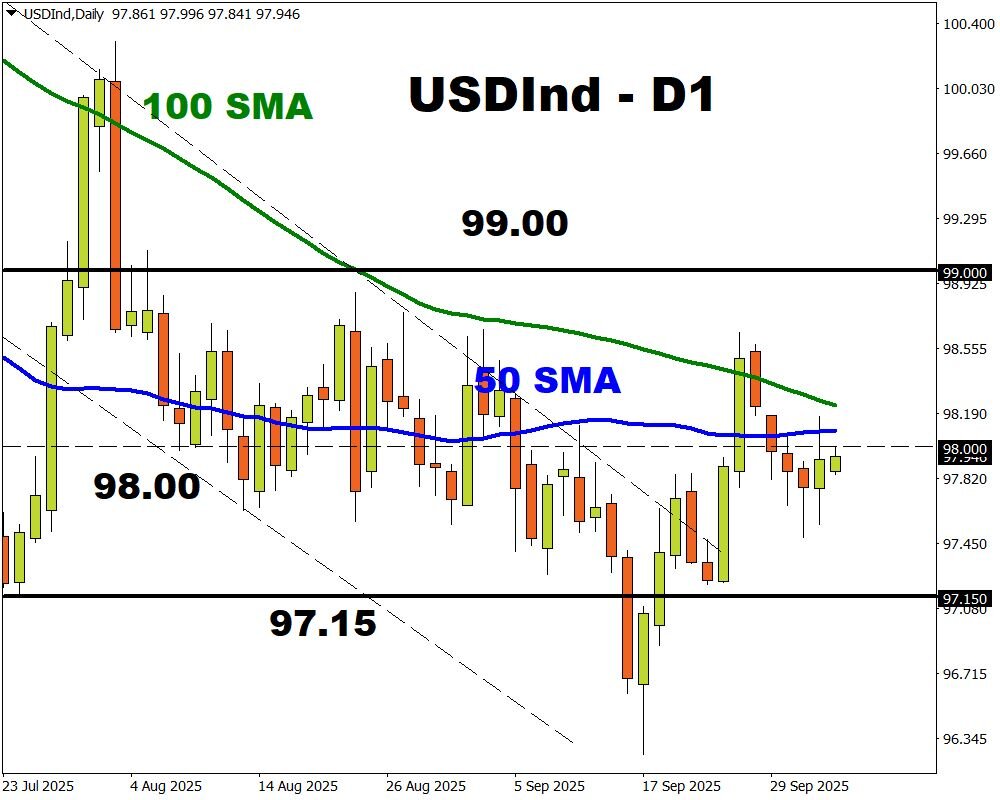

3) USDInd: Fed minutes & Powell speech

The week ahead could be rocky for the USD due to the government shutdown and speeches by Fed officials.

Note: US government economic data releases may be delayed by shutdown that began on Oct. 1.

An extended shutdown could result in a wave of weakness for the US Dollar as concerns over slowing growth boost bets around further Fed cuts. However, an end to the shutdown could trigger a relief rally on the dollar as growth fears subside.

So, all eyes will be on the Fed minutes and speeches by various Fed officials including Fed Chair Jerome Powell.

Traders are currently pricing a 98% chance that the Fed cuts rates in October with the odds of another cut by December at 87%. Any major shifts to these bets could rock FXTM’s USDInd.