Week Ahead: 3 opportunities to watch out for

- Home

- Market Analysis

- Week Ahead: 3 opportunities to watch out for

- CHINAH ↑ 25 % year-to-date

- Alibaba accounts for almost 10% of CHINAH weight

- UK Autumn budget on Wednesday could rock GBPUSD

- US retail sales + PPI = USDInd volatility?

- USDInd: Technical levels – 101.30, 100.00 & 99.0

November could end with a bang due to a string of high-risk events!

From big tech China earnings to the UK’s pivotal Autumn budget and US economic reports, here’s what you need to know:

Saturday, 22nd November

- EUR: ECB President Lagarde speech

- CHF: SNB President Schlegel speech

- USDInd: Boston Fed President Collins speech

- G20 summit in Johannesburg through November 23rd

Monday, 24th November

- GER40: Germany IFO business climate

- TWN: Taiwan unemployment

- EUR: ECB President Lagarde speech

- Japanese markets closed for Labor Thanksgiving Day

Tuesday, 25th November

- CHINAH: Alibaba earnings

- GER40: Germany GDP

- TWN: Taiwan industrial production

- USDInd: US retail sales, PPI, Conference Board consumer confidence

Wednesday, 26th November

- AUD: Australia CPI

- NZD: New Zealand rate decision

- USDInd: US durable goods, initial jobless claims, Fed Beige book

- GBP: UK Autumn budget

Thursday, 27th November

- CN50: China industrial production

- EUR: Eurozone consumer confidence, ECB meeting minutes

- US markets closed for Thanksgiving holiday

Friday, 28th November

- CAD: Canada GDP

- EUR: 1-year, 3-year CPI expectations

- GER40: Germany CPI, unemployment

- JPY: Japan Tokyo CPI, unemployment, industrial production, retail sales

- TWN: Taiwan GDP

Here are 3 assets primed for significant price swings:

CHINAH: ALIBABA EARNINGS

Chinese e-commerce giant Alibaba is set to release its Q2 FY26 results on Tuesday, 25th November.

As one of China’s tech giants and the biggest player in the CHINAH Index, Alibaba’s results will be closely watched for updates on cloud services and AI investment amid lingering fears around a bubble.

Its stock prices are down over 10% year-to-date, weighed by reports claiming the company provides technology support to the Chinese military.

Alibaba’s Market estimates

- The average 12M target price is 201.77 (~36% increase in stock price).

- The stock’s 1-day implied move (up/down) is 6.78%

- Estimated EPS (Q1’25): $.89 per share

Scenarios

- Strong earnings and optimistic guidance could boost the CHINAH index, pushing prices toward 9070 and the 100-day SMA.

- Disappointing figures or a cautious tone may weigh on the CHINAH Index, sending prices toward the 200-day SMA and 8680.

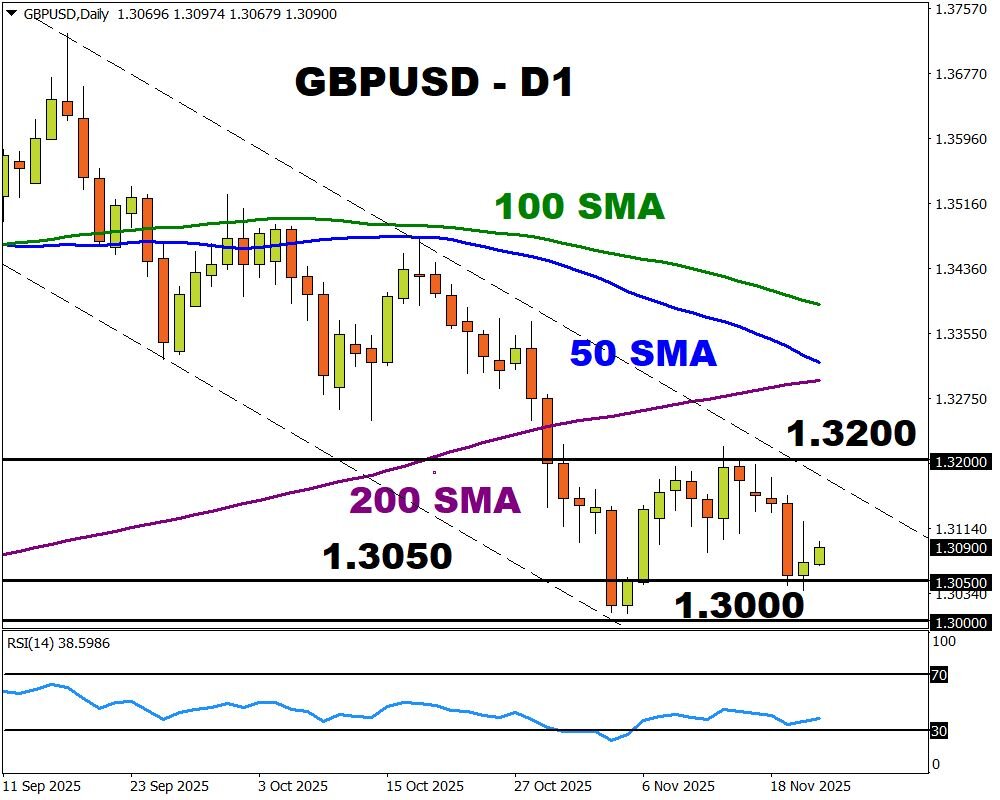

GBPUSD: UK autumn budget

GBPUSD could be set for a week of mayhem due to the high-stakes Autumn budget on Wednesday, 26th November.

With the UK fiscal hole as much as £35 billion, Rachel Reeves is considering possible tax increases, including an exit charge for wealthy Britons leaving the country. Other options include reforming council tax and introducing new taxes on online gambling, among other potential hikes. Ultimately, this may lead to more pain for consumers with a drop in disposable incoming hitting growth.

- Sterling is likely to sink if the Autumn budget dents optimism over the UK economy and fuels bets around lower UK interest rates.

- Should the Autumn budget somehow soothe investor fears over the UK’s outlook, the pound may rise.

USDInd: US retail sales, PPI

FXTM’s USDInd could be in for a wild ride as investors try to figure out whether the Fed will cut rates in December or not.

September’s NFP report was a mixed bag with the US economy creating 119,000 jobs after decline in the prior month. However, the unemployment rate rose to 4.4%. This boosted the odds of a December Fed cut to around 30% from 25%.

The incoming US retail sales and PPI may provide more insight into the health of the US economy. Should US economic data continue to disappoint, this may fuel bets around the Fed cutting rates by the end of 2025.

FXTM’s USDInd is turning bullish on the daily charts with prices above the 200-day SMA.

- A strong breakout above 100.50 could signal a move toward 101.30.

- Weakness below 100.00 may open the doors back toward 99.00.