Week Ahead: 3 assets primed for big moves – Brent, GBPUSD & USDInd

- Home

- Market Analysis

- Week Ahead: 3 assets primed for big moves – Brent, GBPUSD & USDInd

- Sunday, November 2nd: OPEC+ expected to raise oil supply

- Thursday, November 6th: BoE seen leaving rates unchanged

- BoE decision sparked moves ↑ 1.2% or ↓ 2.4% over past year

- US Government shutdown hits one-month mark

- USDInd: Technical levels – 200-day SMA, 100.00 & 99.00

If not for the ongoing US government shutdown, the NFP report would have been the main attraction for the week ahead…

Nevertheless, the OPEC+ meeting, Bank of England (BoE) rate decision and top-tier economic data could trigger fresh trading opportunities:

Sunday, 2nd November

- OIL: OPEC+ meeting on production levels

Monday, 3rd November

- CN50: China RatingDog manufacturing PMI

- EUR: Eurozone HCOB Manufacturing PMI

- GER40: Germany HCOB Manufacturing PMI

- UK100: UK S&P Global Manufacturing PMI

- USDInd: US ISM Manufacturing, San Francisco Fed President Mary Daly, Fed Governor Lisa Cook speech

Tuesday, 4th November

- AUD: RBA rate decision

- SPN35: Spain Unemployment Change

- EUR: ECB President Christine Lagarde keynote speech

Wednesday, 5th November

- CN50: China RatingDog services, composite and manufacturing PMIs

- NZD: New Zealand unemployment

- EU50: Eurozone S&P Global Eurozone Services PMI, PPI

- GER40: Germany factory orders

- SEK: Sweden rate decision

Thursday, 6th November

- EUR: Eurozone retail sales

- GER40: Germany industrial production

- TWN: Taiwan CPI

- GBP: BOE rate decision

- USDInd: St. Louis Fed President Alberto Musalem, Cleveland Fed chief Beth Hammack, Fed’s John Williams, Anna Paulson and Michael Barr speech

Friday, 7th November

- CNY: China trade, forex reserves

- CAD: Canada unemployment

- TWN: Taiwan trade

- USDInd: US University of Michigan consumer sentiment, New York Fed President John Williams speech

Here are 3 assets that could see significant price swings:

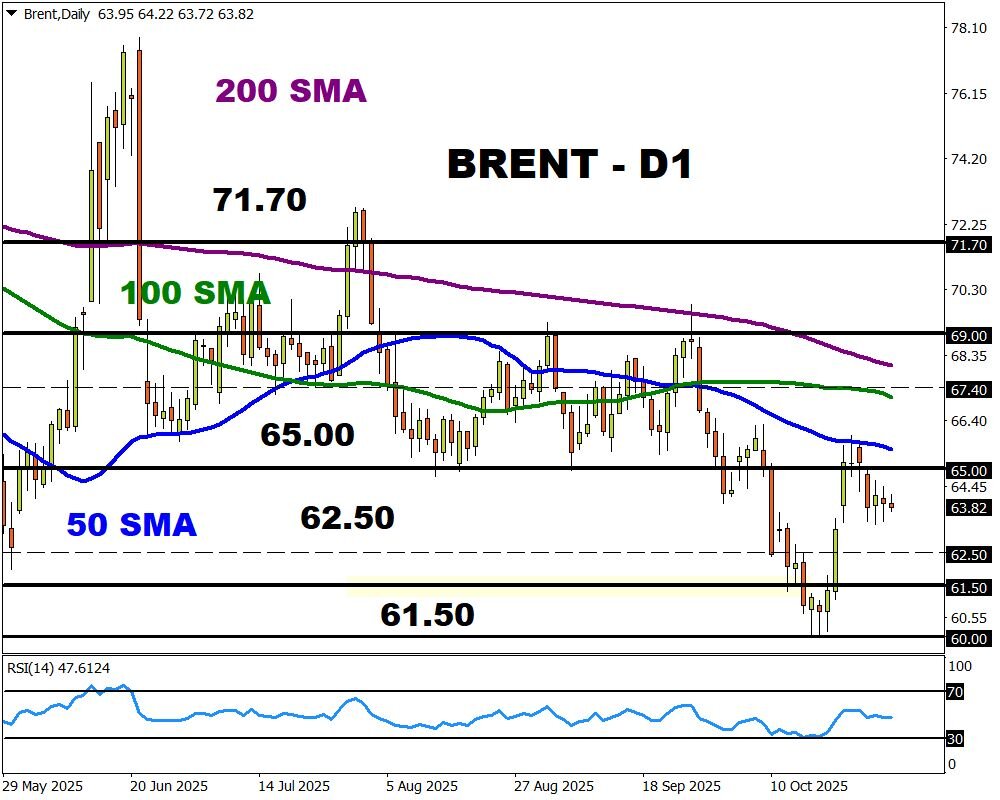

1) BRENT: OPEC+ meeting

On Sunday, 2nd November, OPEC+ will meet to discuss December production levels.

At their last meeting in October, the cartel announced plans to raise production by 137,000 barrels per day in November 2025 in a bid to regain more market share.

Markets are expecting the cartel to agree on another round of production increases by 137,000 barrels a day in December. Some delegates noted that the outcome to trade talks among the US, China and India may impact the final decision, especially when factoring sanctions on Russian energy exports.

Nevertheless, these production increases are coming at a time when oil markets are heading for a record supply glut of 4 million barrels per day – according to the International Energy Agency.

- Oil benchmarks are down roughly 15% this year YTD and may extend losses if OPEC+ continues its quest to reclaim more market share. Bearish targets can be found at $62.50, $61.50 and $60.00.

- Should the cartel pause production increases for December, this could support oil as oversupply fears cool. Bullish price targets for Brent are the 50-day SMA, $67.40 and $69.00.

2) USDInd: US government shutdown

The federal government shutdown has stretched into day 31, its second-longest in US history. Democrats and Republicans remain in a deadlock over passing a spending bill with many federal workers missing paychecks.

Note: The last shutdown started on December 22, 2018 till January 25, 2019 — 35 days, making it the longest government shutdown.

But things may get even worse on November 1st when several federal programs run out of money. If this becomes reality, tens of millions of people would lose federal food and nutrition benefits – a lifeline for low-income households.

- Growing US political risk and concerns over the outlook of the economy may weigh heavily on the dollar as the shutdown drags on.

- Should Democrats and Republicans secure a deal, the dollar may see a relief rally as sentiment improves.

3) GBPUSD: BoE rate decision

The Bank of England is expected to leave interest rates unchanged at 4% on November 6th.

Traders are currently pricing a 27% chance of a cut next week with the odds of another cut by December around 64%.

These expectations are based on growing unease ahead of the UK government’s autumn budget as fiscal concerns mount. The BoE is likely to remain cautious on future rate cuts until there is a clear downtrend in inflation, which is currently at 4.1% - twice the BoE’s target.

- Should the BoE strike a dovish note, this may drag the GBPUSD toward 1.3050 and 1.3000.

- Should the BoE express caution around future cuts, the GBPUSD may rebound toward 1.3200 and the 200-day SMA at 1.3250.