Week Ahead: US500 braces for explosive risk cocktail

- Home

- Market Analysis

- Week Ahead: US500 braces for explosive risk cocktail

- US500 ↑ 15% since the start of 2025; near ATH

- Meta, Alphabet, Microsoft, Apple & Amazon almost 25% of US500 weight

- Trump-Xi meeting on October 30th = fresh volatility?

- Fed decision sparked moves ↑ 0.3% or ↓ 1.3% over past year

- Technical levels: 6775, 6650 & 6530

*Note: This report was written before the delayed US September CPI report*

Financial markets could end October on a volatile note thanks to key risk events.

Major central bank decisions, earnings from trillion-dollar titans and US-China trade developments will dominate the week ahead:

Monday, Oct 27th

- CN50: China industrial profits

- EUR: Germany Ifo Business Climate

- TWN: Taiwan jobless rate

- USD: US Durable Goods Orders; Dallas Fed Manufacturing Index

Tuesday, Oct 28th

- GER40: Germany GfK Consumer Confidence

- UK100: HSBC earnings

- FRA30: France Unemployment Rate

- WTI: US API Crude Oil Stock Change

- US400: US consumer confidence, Richmond Fed manufacturing

Wednesday, Oct 29th

- AUD: Australia Inflation Rate

- USD: Fed Interest Rate Decision

- CAD: BoC Interest Rate Decision

- WTI: US EIA Crude Oil Stocks Change

- US500: Meta, Alphabet, Microsoft earnings

Thursday, Oct 30th

- JPY: BoJ Interest Rate Decision

- EUR: ECB Interest Rate Decision; Eurozone GDP; Germany GDP; Germany Inflation Rate

- USD: US GDP (Q3); Initial Jobless Claims

- US500: Apple, Amazon earnings

- President Donald Trump meets Chinese counterpart Xi Jinping

Friday, Oct 31st

- CN50: China manufacturing PMI, non-manufacturing PMI

- EUR: Eurozone Inflation Rate

- JPY: Japan Tokyo CPI, unemployment, industrial production, retail sales

- TWN: Taiwan GDP

- US30: Chevron earnings

The spotlight swings on FXTM’s US500, which has gained almost 15% year-to-date.

Note: FXTM's US500 tracks the underlying S&P 500 index

Recently, US equities have risen on easing trade tensions, strong earnings results, and bets that the Fed will cut interest rates.

Prices are trading close to the all-time high at 6772.2 ahead of the US CPI report this afternoon.

Here are 4 factors that could trigger significant price swings:

1) Fed rate decision – October 29th

The Federal Reserve is widely expected to cut interest rates by 25 basis points when it meets next week.

Fed Chair Jerome Powell may justify the move as insurance against risks to employment in the face of the ongoing government shutdown. Investors will also be seeking clues on what the Fed plans to do beyond October with traders still pricing in a 90% probability of another cut by December.

- Should the Fed signal that a rate cut in December is still on the table, this may boost the US500.

- Any hawkish hints or hesitation in cutting rates beyond October may weigh on the US500.

2) Big tech earnings

Five of the so-called “Magnificent” 7 tech giants with a combined market cap of almost $15 trillion are set to publish their results in the week ahead.

Quarterly results from Meta, Alphabet, Microsoft, Amazon and Apple will be heavily scrutinized as investors await proof that massive AI investments are driving growth.

Considering that the combined weight of Meta, Alphabet, Microsoft, Amazon and Apple makes up nearly 25% of the US500, the incoming earnings could spark significant price swings.

- A solid set of results and optimistic forward guidance from tech titans may boost the US500 higher.

- Should results disappoint and concerns be expressed about the earnings outlook, the US500 could fall.

3) Trump-Xi meeting – October 30th

President Donald Trump is expected to meet with his Chinese counterpart, Xi Jinping on Thursday 30th October.

This critical meeting comes at a time when tensions between the US and China have escalated in recent weeks after Trump threatened 100% tariffs on Chinese exports.

Note: These tariffs are due to take effect on the 1st November, while the 90-day trade truce is set to expire on 10th November.

- The U500 may rally if the meeting ends on a positive note with Trump backing down on 100% tariffs and extending the trade truce.

- Should the meeting end on a sour note, this could weigh on US500 as renewed trade uncertainty sparks risk aversion.

4) Technical forces

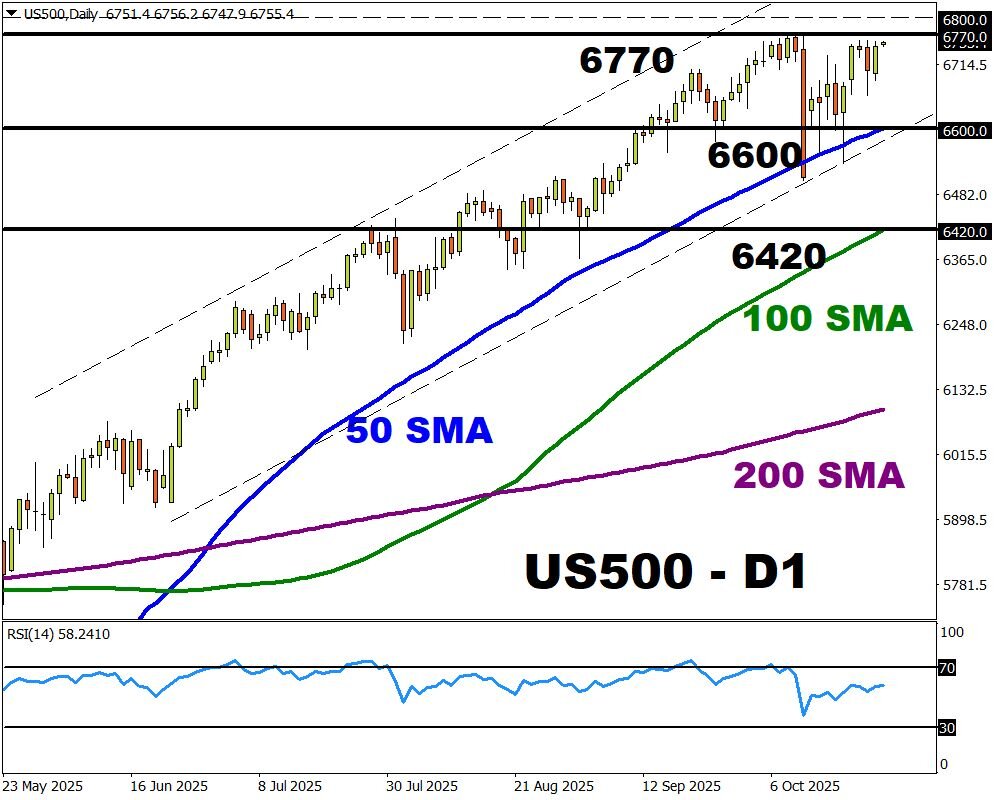

The US500 is testing key resistance at 6770 with prices trading above the 50, 100 and 20-day SMA.

- A solid breakout and daily close above 6770 may inspire a move toward 6800 and 6900.

- Sustained weakness below 6770 may drag prices back toward the 50-day SMA at 6600 and 100-day SMA at 6420.

*Note: This chart was created before the delayed US September CPI report on Friday afternoon*