Noticias de forex y análisis de mercado diario

Can Microsoft’s earnings narrow stock’s gap with record high?

- Microsoft still 15.7% below record high; down 6.5% so far in 2025

- US$2.93T tech titan set to unveil fiscal Q3 earnings after US markets close Wed, April 30th

- Investors eager for updates on AI demand via Microsoft’s data center capex, Azure growth

- Microsoft shares forecasted to move 4.3% up/down when US markets reopen Thursday

- Wall Street analysts still deem stock as strong buy with 24% potential 12-month upside

Microsoft is set to unveil its fiscal Q3 earnings after US markets close today (Wed, April 30th).

Leading up to its upcoming earnings, Microsoft shares remain some 15.7% below its highest-ever closing price posted on July 5th, 2024.

Still, the recent rebound in US tech stocks has lifted Microsoft 11% since its year-to-date low on April 8th.

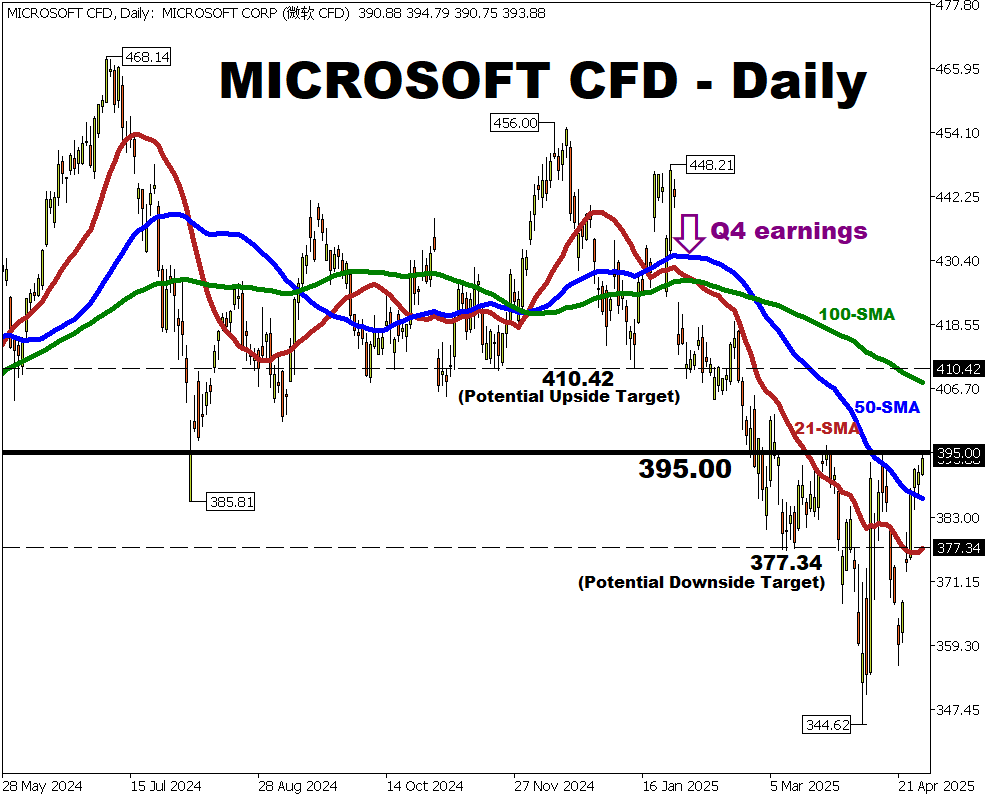

This stock’s bulls (those hoping prices will move higher) may find cheer from the fact that Microsoft is now trading back above its 50-day simple moving average (SMA) – a widely followed technical indicator – for the first time since late-January 2025.

However, its recent 11% rebound is now being tested by a familiar foe – the $395.00 resistance level which had thwarted 2 prior attempts to break higher since late-March 2025.

For proper context, Microsoft is holding up rather well versus other US Big Tech stocks.

(albeit after a relatively sluggish performance in 2024, when Microsoft "merely" climbed 12%, versus the Nasdaq 100's 24.9% surge last year)

More recently, here’s how Microsoft is faring versus its “Magnificent 7” peers - in terms of how far each stock remains below their respective record highs (closing prices):

- Microsoft: 15.7% lower (down 6.5% year-to-date)

- Apple: 18.5% lower (down 15.7% year-to-date)

- Alphabet: 22% lower (down about 15% year-to-date)

- Amazon: 22.6% lower (down 14.6% year-to-date)

- Meta: 24.7% lower (down 5.3% year-to-date)

- Nvidia: 27% lower (down 18.8% year-to-date)

- Tesla: 39.1% lower (down 27.7% year-to-date)

Compared to other Big Tech stocks …

Microsoft has the smallest gap to make up from its record high and also one of the smallest year-to-date declines (second only to Meta).

Microsoft’s fiscal Q3 (ending March 2025) earnings: What to look out for?

1) Azure growth

Microsoft's cloud business is a key barometer of AI demand.

Here are some key figures pertaining to this crucial business segment:

- Microsoft Cloud’s total revenue is estimated at US$42.2 billion

- 31% expected revenue growth for Azure and other cloud services

- Microsoft’s “Intelligent Cloud” segment (including Azure) revenue estimated at US$26 billion

Overall, Microsoft’s “Intelligent Cloud” segment is set to account for 39.1% of the company’s total revenue for the quarter – its highest share since fiscal Q4 (ending June) 2022 – underscoring its importance to Microsoft as a whole.

2) Capital expenditures (capex)

Microsoft’s capex for the fiscal year ending June 2025, including leasing costs, is about US$ 88 billion.

Looking ahead to the next fiscal year, total capex is expected to be about US$ 100 billion.

The latest updates surrounding Microsoft’s capex plans will be a key consideration for markets in assessing the sustainability of AI demand.

Earlier this month, Bloomberg reported that Microsoft may be having cold feet on intended data center projects in Indonesia, Australia, the UK, and the US (Illinois, Wisconsin, and North Dakota).

- If Microsoft’s incoming statements suggest that such delays are a mere hiccup in its longer-term AI ambitions, that could reinvigorate the AI-mania and drive Microsoft (and other tech stocks) higher.

- However, if Microsoft signals that AI demand may not be as robust as previously envisioned, especially in light of DeepSeek’s apparently more cost-efficient threats, that could unwind the recent rebound in US tech stocks.

3) Tariff threats?

And of course, an ever-present theme in this earnings season, US President Donald Trump’s tariff rollout is bound to be yet another major talking point.

To be clear, the tariffs are set to have minimal impact on Microsoft’s quarterly earnings for the first 3 months of 2025, given that the rollout only picked up steam this month (April 2025).

Still, a slowing global economy may weigh on Microsoft’s PC and Office sales further down the line.

Beyond the main themes listed above, here are some headline figures to look out for:

- Revenue: forecasted at US$ 68.5 billion

- Operating income: forecasted at US$ 30.31 billion

- Adjusted earnings per share (EPS): forecasted at US$ 3.21

Potential Post-Earnings Scenarios

Note that markets currently predict that Microsoft shares could move 4.3% up or down when US markets reopen on Thursday, May 1st – the day after its fiscal Q3 earnings announcement.

- BULLISH: Should Microsoft’s latest quarterly financials and forward guidance help restore risk-on sentiment surrounding this stock, that could help pare its year-to-date declines.

Using Tuesday’s closing price of $393.88 as a reference point, a 4.3% climb would see this stock breaking above its 100-day simple moving average (SMA) and reaching around $410.42 – closing in on the $420.97 price where it ended 2024.

- BEARISH: Should Microsoft announce lower-than-expected fiscal Q3 results, while citing greater concern about its Azure earnings outlook and capex plans, a 4.3% move downwards from Tuesday’s closing price should see this stock testing support at its 21-day SMA around $377.34.

Over the next 12 months …

Wall Street analysts are still bullish on this stock, with:

- 65 “Buy” calls

- 7 “Holds”

- 0 “Sells”

By this time next year, this stock is forecasted to have an upside potential of 24%, eventually breaching US$ 488.

Depending on what Microsoft conveys to the world overnight, it could trigger a big move for its share price, and broader US stock markets as well.

Such moves could in turn present not-to-be-missed opportunities for short-term trading or even longer-term investing.

¿Está listo para operar con dinero real?

Abra una cuentaElija su cuenta

Comience a operar con un bróker líder que le ofrece más.