Noticias de forex y análisis de mercado diario

Markets rally on 90-day US-China trade truce

Risk-on returns on China-US trade truce

Both sides announce 115% reduction in tariffs for 90-days

Global equities, USDInd, Bitcoin and Oil rally

Gold tumbles almost 3%, JPY & CHF weaken

US500: US CPI sparked moves of ↑ 0.9% & ↓ 2.0% over past year

Investors sprinted toward riskier assets on Monday after China and the United States agreed to slash reciprocal tariffs for 90 days.

After positive talks over the weekends, both sides announced a massive 115% reduction in tariffs, representing a major step toward de-escalating a trade war.

China will lower tariffs on US goods to 10% from 125%.

The United States will cut tariffs on Chinese goods to 30% from 145%.

In response to the risk-on mood, Asian equities surged, European markets opened higher, while US futures flashed green.

FXTM’s USDInd jumped over 1%.

Bitcoin pushed beyond $105,000.

Crude oil rallied more than 2%.

Safe-haven assets took a beating as

Gold shed almost 3%.

The Yen and Swiss franc fell against all G10 currencies.

This breakthrough in the China and US talks has uplifted market sentiment and eased fears around a global recession.

Further signs of progress within this 90-day window could spell more gains for stock markets. However, if talks stall down the road or tensions return – risk assets will be in the firing line.

Beyond US-China trade developments, it’s a week packed with more key data and earnings from the largest Chinese companies.

The likes of JD.com, Tencent and Alibaba will publish their latest quarterly results which may influence FXTM’s CHINAH index.

On the data front, the CPI report is likely to impact Fed expectations, resulting in more volatility for US equities, USDInd and gold prices.

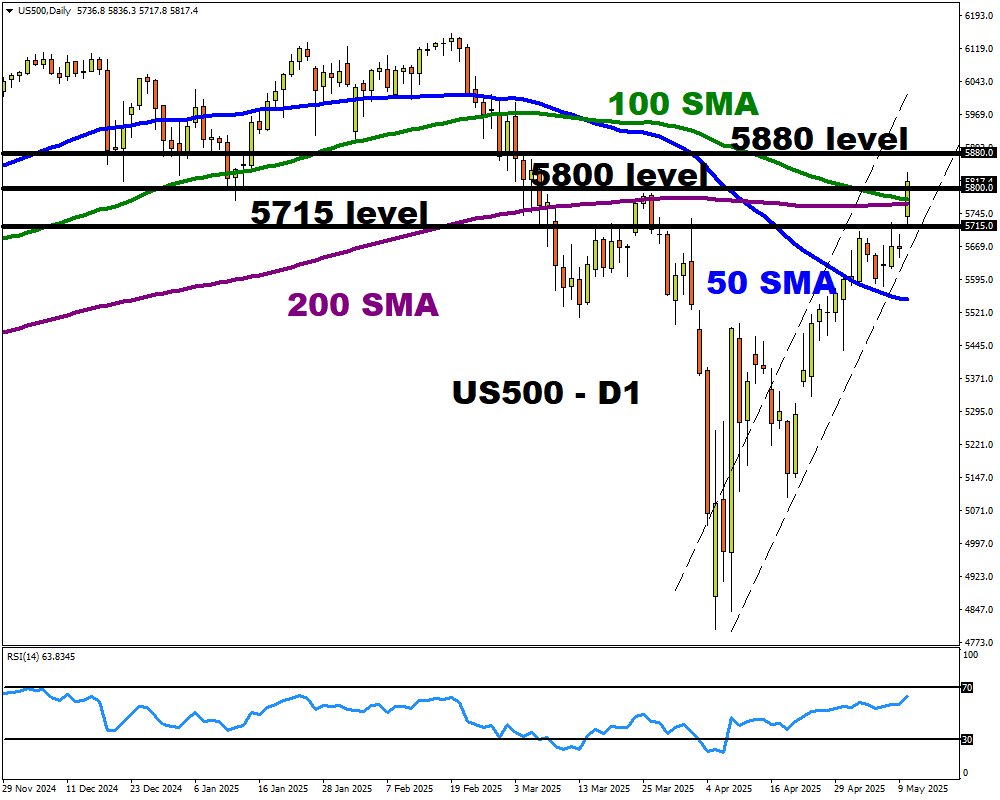

Speaking of equities, FXTM’s US500 has punched above key resistance at 5800.

The incoming CPI report and speech by Fed Chair Jerome Powell could determine whether this resistance is conquered.

Over the past 12 months, the US CPI has triggered upside moves of as much as 0.9% or declines of 2.0% in a 6-hour window post-release.

A solid breakout and daily close above 5800 may encourage an incline toward 5880.

Should prices remain below 5800, this may trigger a sell-off toward 5715.

¿Está listo para operar con dinero real?

Abra una cuentaElija su cuenta

Comience a operar con un bróker líder que le ofrece más.