Noticias de forex y análisis de mercado diario

Week Ahead: Dollar braces for massive week of risk events

FXTM’s USDInd ↓ 1% MTD

Geopolitical risk + Fed decision = fresh volatility?

Over past year Fed decision triggered moves of ↑ 0.4% & ↓ 0.8%

GBP + JPY + CHF + SEK = 33% of USDInd weight

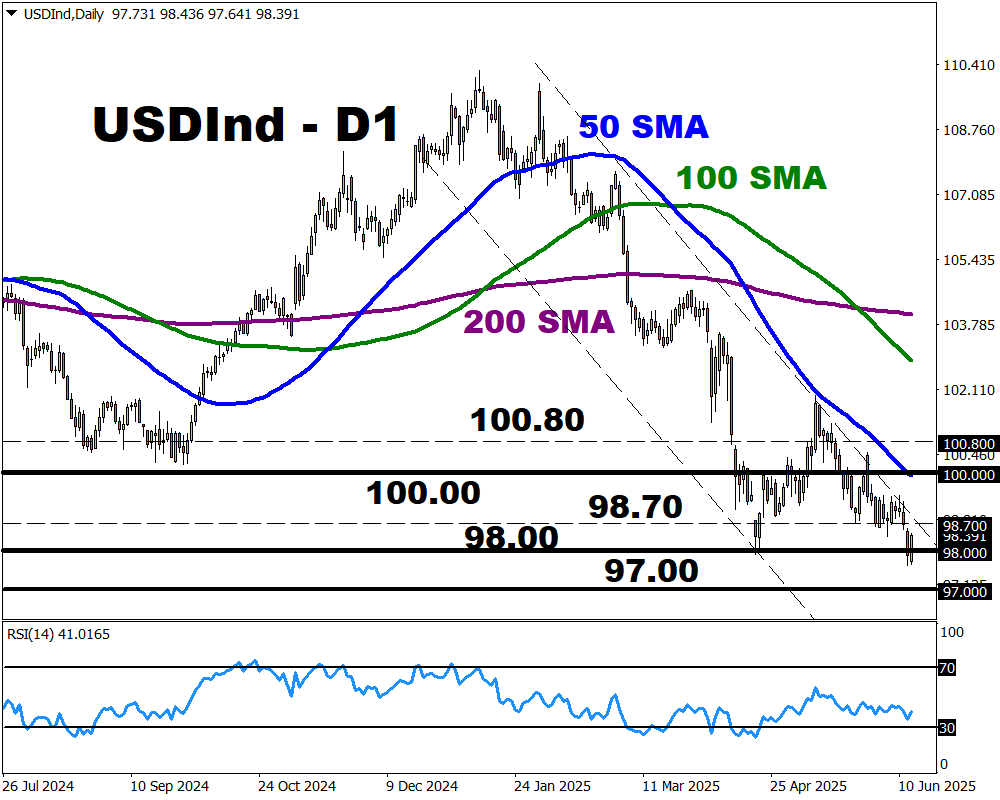

Technical levels: 98.00, 98.70 and 50-day SMA

Escalating tensions in the Middle East have put financial markets in a chokehold, with investors steering clear of riskier assets.

Israel attacked Iran’s nuclear program sites early Friday morning. In response, Iran has launched over 100 drones.

Mounting geopolitical risk, major central bank decisions and top-tier data could provide fresh trading opportunities in the week ahead:

Sunday, 15th June

- G7 Leaders’s Summit

Monday, 16th June

- CN50: China retail sales, industrial production

- USDInd: US Empire Manufacturing

Tuesday, 17th June

- GER40: Germany ZEW survey expectations

- JPY: BoJ rate decision

- NZD: New Zealand food prices

- US500: US retail sales, business inventories, industrial production

Wednesday, 18th June

- EUR: Eurozone CPI

- JP225: Japan machinery orders, trade

- ZAR: South Africa retail sales, CPI

- SEK: Sweden rate decision

- UK100: UK CPI

- US500: Fed decision, initial jobless claims

Thursday, 19th June

- AUD: Australia unemployment

- NZD: New Zealand GDP

- CHF: Switzerland rate decision

- TWN: Taiwan rate decision

- GBP: BoE rate decision

- Juneteenth federal holiday in US – equity markets closed

Friday, 20th June

- CN50: China loan prime rates

- CAD: Canada retail sales, materials prices

- EU50: Eurozone consumer confidence

- JPY: Japan CPI

- UK100: UK retail sales

- RUS2000: US Conf. Board leading index, Philadelphia Fed services

The spotlight shines on FXTM’s USDInd, which is attempting to rebound from a 3-year low.

Note: FXTM’s USDInd measures how the dollar performs against a basket of six different G10 currencies, including the Euro, British Pound, Japanese Yen, and Canadian dollar, Swedish krona & Swiss franc.

Here is how they are weighted:

Euro: 57.6%

JPY: 13.6%

GBP: 11.9%

CAD: 9.1%

SEK: 4.2%

CHF: 3.6%

Geopolitical tensions and central bank decisions could spell fresh volatility for the USDInd.

Here are 4 reasons why:

1) Israel-Iran conflict

A major escalation of tensions in the Middle East has sparked a risk-off mood, with uncertainty fuelling appetite for safe-haven assets.

Should the situation worsen and risk spilling over into a wider conflict, investors may rush toward safe-haven destinations like the US dollar.

Signs of easing tensions may lift the market mood, weakening the dollar as appetite for safe-haven assets cools.

2) Fed rate decision

The Federal Reserve is widely expected to leave interest rates unchanged in June, but the updated dot plot and Jerome Powell’s press conference may shape the dollar’s outlook.

Note: The latest US CPI report increased less than expected in May with traders currently pricing in 2 Fed cuts for 2025. To add, the Fed is not expected to cut rates until September 2025.

The USDInd could jump if the updated “dot plot” signals only one rate cut in 2025 and Powell strikes a hawkish note.

Should Powell strike a dovish note and signal lower rates down the line, the dollar may weaken.

Over the past 12 months, the Fed decision has triggered upside moves on the USDInd of as much as 0.4% or declines of 0.8% in a 6-hour window post-release.

Note: The US Empire Manufacturing report on Monday, US retail sales report on Tuesday, initial jobless claims on Wednesday and US Conf. Board leading index published Friday may influence the dollar’s performance.

3) BoE, BoJ, SNB & Riksbank decisions

The Bank of England, Bank of Japan, Swedish National Bank and Riksbank all have their policy decisions. Markets expect the BoE and BoJ to leave rates unchanged, but both the SNB and Riksbank are expected to cut rates.

It is worth noting that the GBP, JPY, SEK and CHF make up roughly 33% of the USDInd weighting.

So, these central bank decisions could translate to additional volatility for the USDInd.

4) Technical forces

FXTM’s USDInd is respecting a bearish channel on the daily charts. However, the Relative Strength Index is close to 30 - signalling that prices are nearly oversold.

A solid breakout and daily close above 98.70 could signal a move back toward the 50-day SMA at 100.00 and 100.80.

Sustained weakness below 98.00 could see prices decline back toward 97.65, 97.00 and 96.00 – a level not seen since February 2022.

¿Está listo para operar con dinero real?

Abra una cuentaElija su cuenta

Comience a operar con un bróker líder que le ofrece más.