Noticias de forex y análisis de mercado diario

Mid-week review: Mideast Truce, Powell & PCE

Risk-on mood returns on fragile Israel-Iran truce

Oil prices tank almost 15% as supply fears ease, gold dims, dollar sinks

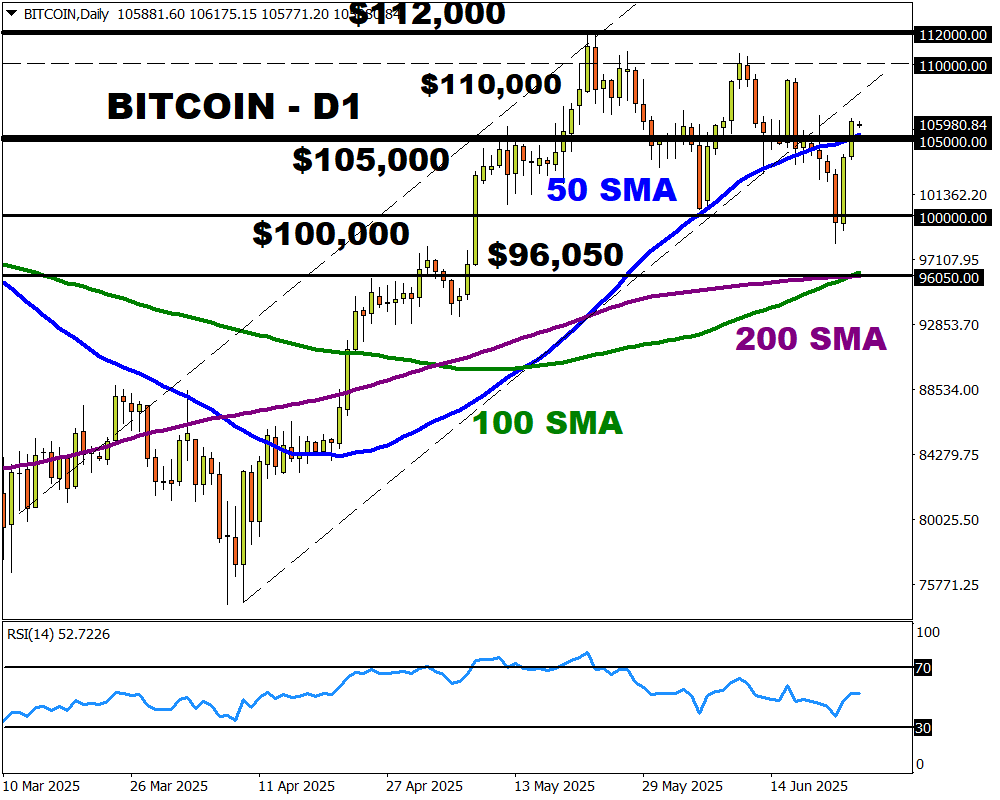

Equities stage sharp rebound, Bitcoin closes above $105,000

Fed Chair Powell says Fed in no rush to cut rates during testimony

US PCE report on Friday could spark fresh market volatility

Global stocks surged on Tuesday after a ceasefire between Iran and Israel appeared to hold despite initially faltering.

President Donald Trump rebuked both sides for early breaches, which appeared to keep everyone back in line.

Equities across the globe may extend gains after Wall Street ended sharply higher, with the Nasdaq 100 hitting a fresh all-time high.

This extraordinary development comes after two weeks of constant conflict and uncertainty in the region. While the truce is a welcome relief to investors, financial markets will remain highly sensitive to headlines surrounding this development.

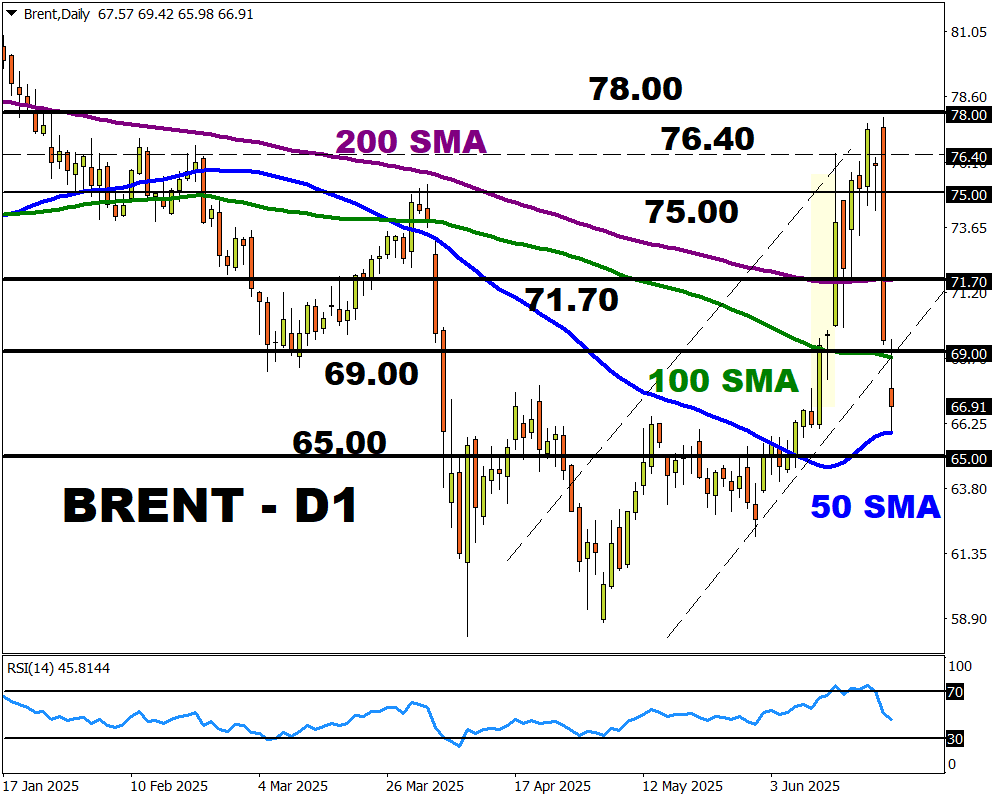

Oil nosedives on Mideast truce

Oil prices have displayed monstrous levels of volatility over the past two days. After initially jumping almost 6% on Sunday’s open amid fears about supply disruptions, prices have crashed amid reports of the ceasefire.

One of the major drivers initially powering oil prices was potential disruptions through the vital Strait of Hormuz channel. Oil benchmarks have shed almost 15% this week with Brent eyeing support at $65.00.

In the FX markets, the dollar has tumbled across the board this week amid the risk-on.

A return in risk appetite has sent investors rushing back toward Bitcoin, currently trading above $105,000.

Powell says Fed is no rush to act…

Beyond the geopolitical drama, Federal Reserve Chair Jerome Powell reiterated that the Fed was in no rush to cut interest rates during his testimony. A counter to recent statements from other policymakers signaled that they would be open to lowering interest rates as soon as July.

US PCE report could trigger fresh volatility

On the data front, all eyes will be on the US PCE report on Friday.

The Fed’s preferred inflation gauge – the Core PCE could influence expectations about when the central bank will cut rates in the second half of 2025. Ultimately, more signs of rising price pressure may shave bets around lower US interest rates. The same can be said vice versa.

Traders are currently pricing in a 19% probability of a Fed rate cut by July, with a move essentially priced in by September. Any major shifts to these bets may impact the dollar, US equities, and gold.

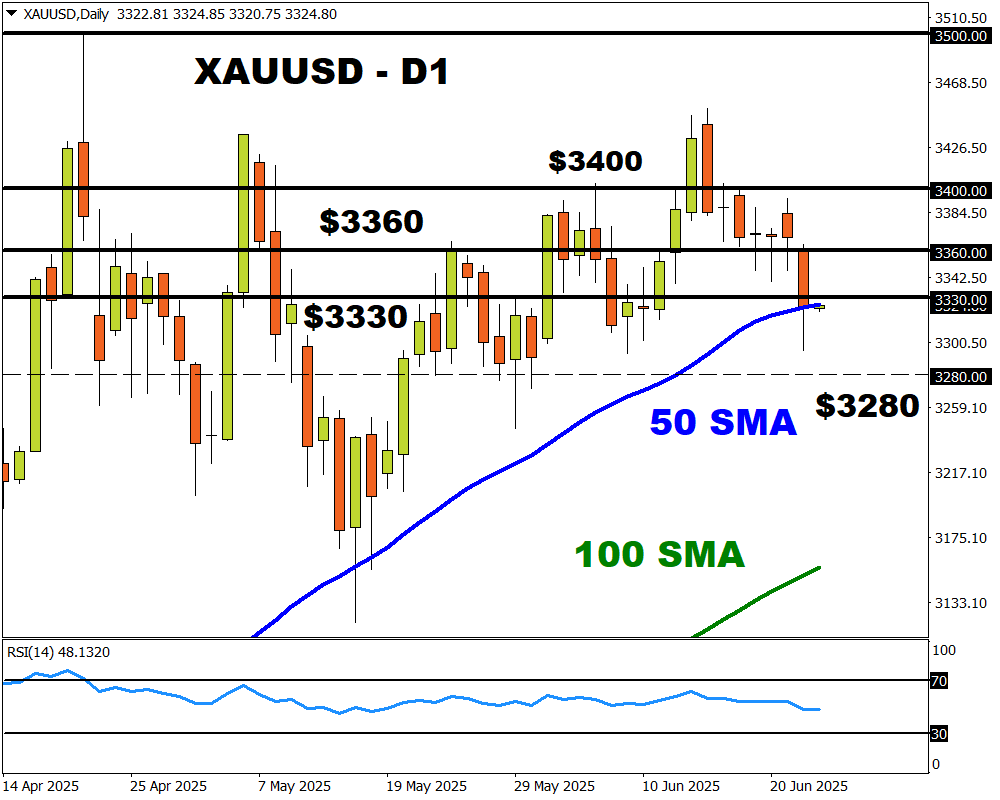

Commodity spotlight – Gold

Speaking of gold, it shed as much as 2.2% on Tuesday – its biggest intraday loss since mid-May. This brings the precious metal’s weekly losses to over 1%.

- Further signs of easing geopolitical tensions could spell more pain for gold, opening the doors back toward $3300 and $3280.

- Should the fragile Israel-Iran ceasefire fall apart, gold could rebound back toward $3360 and $3400.

¿Está listo para operar con dinero real?

Abra una cuentaElija su cuenta

Comience a operar con un bróker líder que le ofrece más.