Noticias de forex y análisis de mercado diario

Market round-up: Fragile ceasefire, Dollar crumbles, Risk assets rally

Trump set to resume nuclear talks with Iran next week

Dollar hits lowest since March 2022 on rising Fed cut bets

Global equities rally amid risk-on mood, NAS100 hits all-time high

Gold waits for key US PCE report on Friday

This week was dominated by geopolitical drama, volatile commodity prices, and rising equity markets.

Monday initially kicked off on a risk-off note after the United States attacked nuclear sites in Iran on Sunday. However, the mood brightened on Tuesday after Trump secured a fragile ceasefire deal between Iran and Israel. Since then, investors have rushed to risk assets with the Nasdaq 100 hitting an all-time high.

In the FX space, reports that Trump would name Powell’s replacement sooner than expected dragged the dollar to levels not seen since March 2022. Oil benchmarks remain under pressure despite cooling geopolitical tensions, while gold remains under pressure ahead of Friday’s PCE report.

Here is what you need to know:

Israel-Iran ceasefire…

The United States brokered a ceasefire deal between Iran and Israel on Tuesday.

Trump initially lashed out at both sides for breaking the deal, but it has since been honored, with Trump scheduled to hold nuclear talks next week.

- Further signs of cooling tensions may elevate global sentiment, boosting appetite for global equities and other risk assets.

- However, risk aversion could return with a vengeance if the ceasefire falls apart.

Trump attacks Powell (again)

President Donald Trump slammed Federal Reserve Jerome Powell on Wednesday, calling the Fed head “terrible”.

There were reports around Trump announcing Powell’s replacement as soon as September. Given how this reinforced bets around a more dovish-leaning Fed, the dollar tumbled to levels not seen since March 2022.

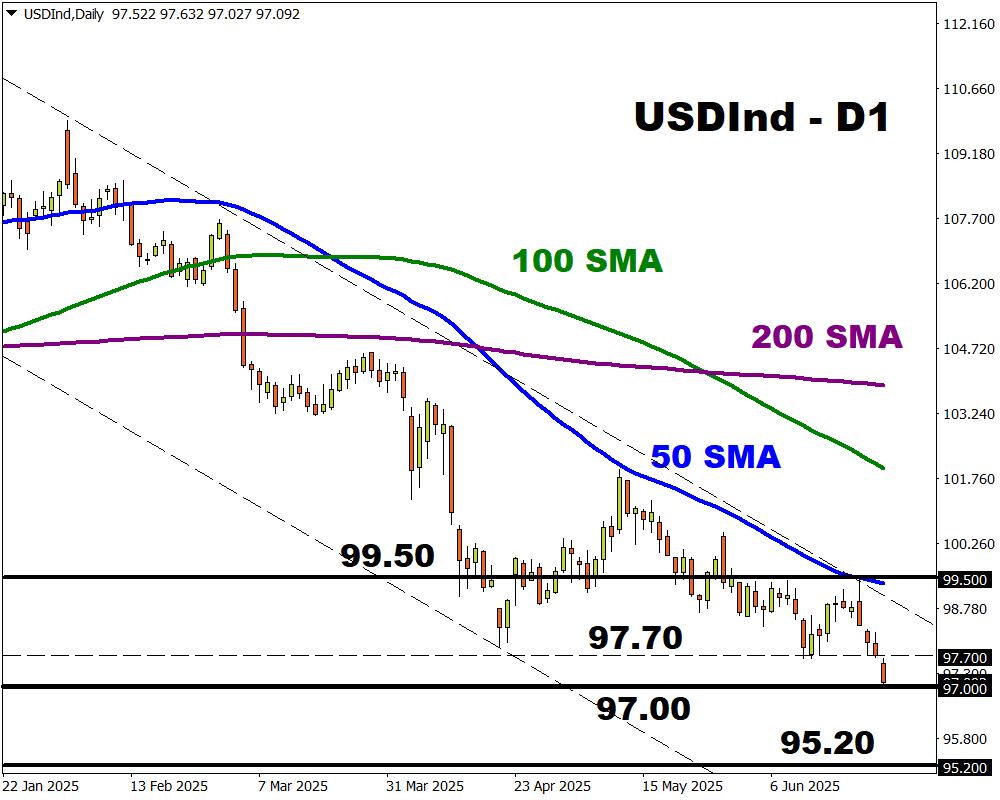

Prices are firmly bearish with USDInd likely to be influenced by Friday’s US PCE report.

The Index has lost over 2% this month, dragging year-to-date gains to more than 10%.

- A breakdown below 97.00 could signal a decline toward 96.70 and 95.20.

Gold waits on PCE report

It’s been a rough week for gold thanks to the improving market mood. However, a weaker dollar is limiting downside losses. The precious metal is waiting for the key PCE report on Friday to make its next major move.

All eyes remain on the key $3330 level, which could determine whether bulls or bears win this current tug of war.

¿Está listo para operar con dinero real?

Abra una cuentaElija su cuenta

Comience a operar con un bróker líder que le ofrece más.