Daily Market Analysis and Forex News

Bitcoin waits for fresh directional spark

Bitcoin ↓ 1.6% month-to-date

Fresh catalyst needed to break out of range

Trump’s tariff & US data could spark volatility

Technical levels: $120k, $115k, $112k

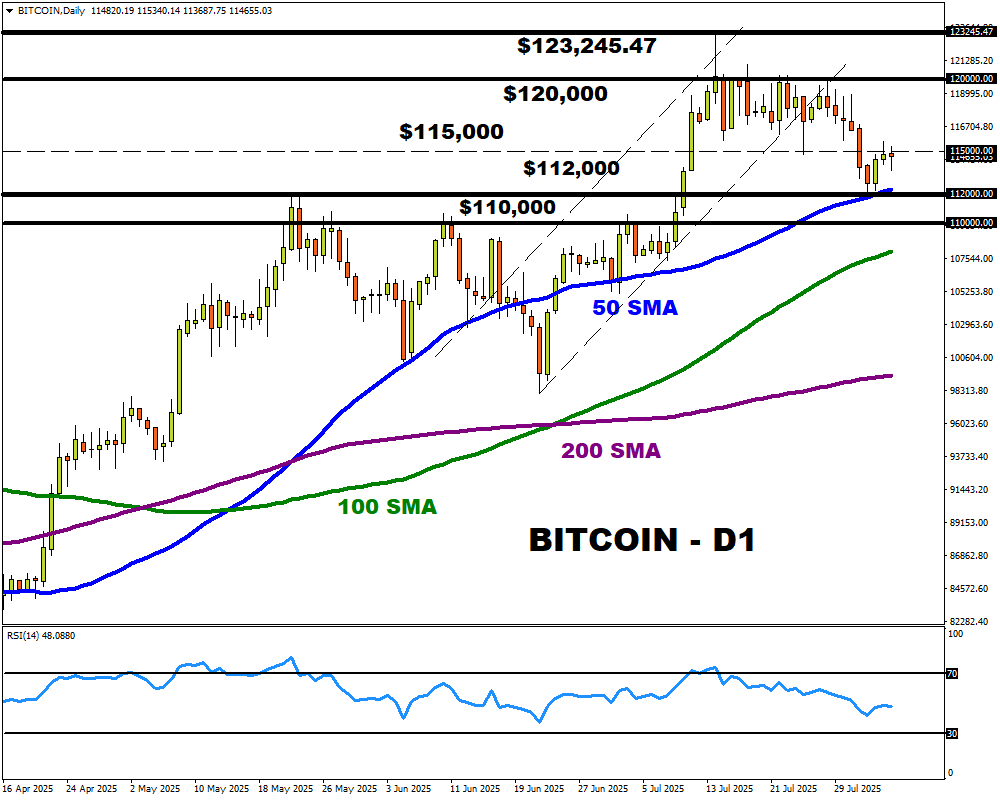

Bitcoin remains in standby mode with prices lingering around $115k in the absence of a fresh directional catalyst.

Despite the action witnessed last Friday, the “OG” crypto remains trapped within a range with support identified at the 50-day SMA.

This period of calm could come to an end amid Trump’s tariff drama and market bets around the Fed cutting interest rates.

As of now, the massive ETF outflow of $812 million last Friday suggests that bears could strike. This was the biggest single-day outflow seen since late February 2025, when Bitcoin ended the month 17% lower.

Considering how Trump’s updated tariffs come into effect on Thursday, 7th August, risk assets, including Bitcoin could be exposed to downside risks.

Beyond the tariff drama, Bitcoin could also be influenced by US economic data and Fed cut expectations. Should US data support the argument around lower interest rates, this may support Bitcoin. The same can be said vice versa.

Potential scenarios:

Bullish Scenario: A clean breakout above $115k could push prices toward $120k and $123k.

Bearish Scenario: Weakness below $115k may trigger a decline back toward $112k and $110k.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.