Daily Market Analysis and Forex News

ECB meeting preview: Rate pause amid tariff uncertainty

ECB expected to leave rates unchanged

Trump tariff threat could influence ECB rate outlook

Dovish messaging may drag the EURUSD lower

EURUSD forecasted to move ↑ 0.5% or ↓ 0.2% post ECB

Technical levels: 1.1820, 1.1700 & 1.1570

The European Central Bank is expected to leave rates unchanged on Thursday after eight consecutive cuts.

But it would be unwise to label this as a non-event given the ongoing uncertainty surrounding Trump’s tariffs.

The lowdown…

Over the past few months, the ECB adopted an aggressive approach to rate cuts compared to other major central banks like the Fed and BoE.

This seems to have paid off with inflation in the eurozone stable around the 2% target while economic growth has bounced back.

With the deposit rate currently at 2%, ECB policymakers have stated they are in a comfortable place.

Trump’s tariffs remain major threat

US President Donald Trump has threatened to impose tariffs of 30% on the EU from August 1st. EU officials are set to meet this week to create a plan to respond to a possible no-deal outcome with Trump.

If such a move becomes reality, this could signify a significant escalation in trade tensions that could weigh heavily on the European economy. This may boost bets around more ECB rate cuts to stimulate economic growth.

What are the current odds for ECB rate cuts…

Traders are pricing in less than a 50% probability of a Fed rate cut by September, with this jumping to over 60% by October.

These odds could rise or fall depending on what tone the central bank adopts.

Technical outlook

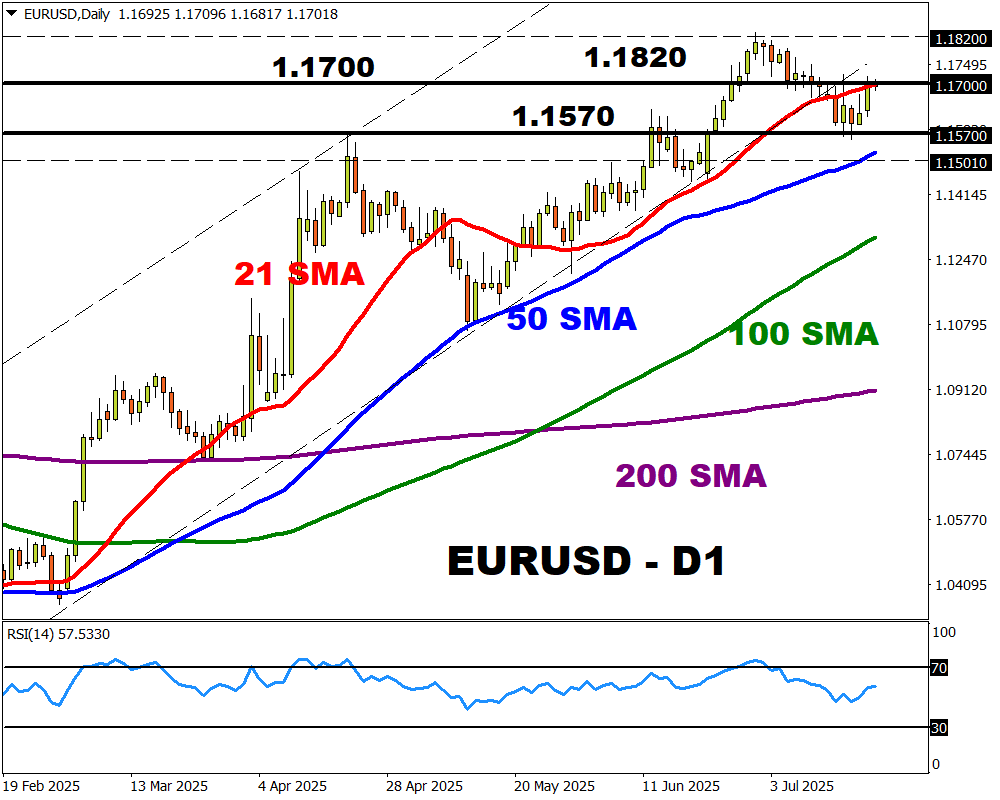

The EURUSD is bullish on the daily timeframe with prices trading above the 50, 100 and 200-day SMA.

BULLISH – A breakout above the 1.1700 resistance may trigger a move toward 1.1820.

BEARISH – Sustained weakness below 1.1570 may spark a selloff toward the 50-day SMA.

Bloomberg forecast model: 76.3% chance EURUSD trades between 1.1579 – 1.1836 over the next one-week period.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.