Daily Market Analysis and Forex News

FXTM’s JP225 soars on US-Japan trade deal

FXTM’s JP225 ↑ over 4% on trade deal, hits 12 month high

US to impose 15% tariffs on Japanese imports, lower than threatened 25%

Yen gains capped by political risk, despite trade ‘massive’ deal.

Japan PM Ishiba denies reports of stepping down

New FXTM JPC crosses tumble as JP225 surges

Japanese shares surged on Wednesday after President Donald Trump announced a ‘massive’ trade deal with Japan after eight rounds of negotiations!

FXTM’s JP225 which tracks the underlying Nikkei 225 index jumped more than 4% - hitting its highest level since July 2024.

More gains could be on the cards given how this removes uncertainty around trade and boosts sentiment toward the Japanese economy.

What are the details on the ‘massive’ deal?

US to impose 15% tariffs on all Japanese imports, including automobiles - lower than threatened 25% rate set to take effect August 1st.

Japan to also create US$550 billion fund for US-bound investments.

Japan to buy 100 Boeing aircrafts, increase rice purchases by 75%, buy US$8 billion of agricultural products.

Japan to spend US$17 billion per year on American defense firms - up from $ 8 billion annually.

Japan to be guaranteed lowest US tariffs on semiconductors and pharmaceuticals.

How did the Japanese Yen react?

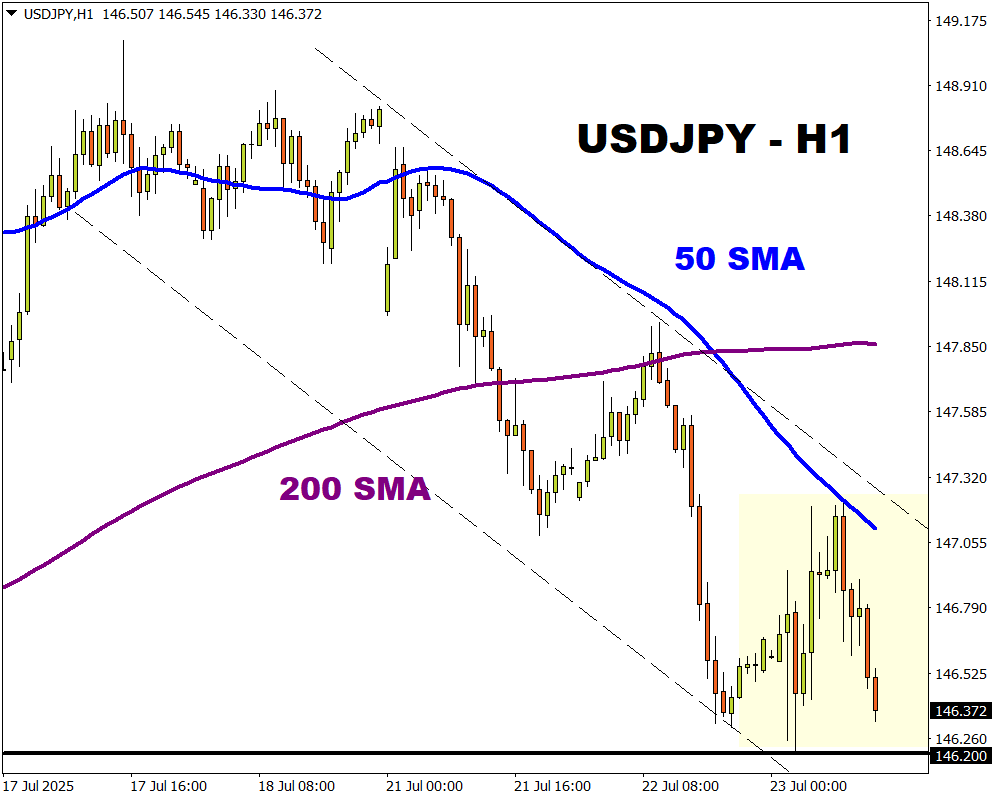

The USDJPY dipped to its lowest level since July 11th on the positive trade news, as it raised the odds of a potential BoJ hike in 2025.

However, gains were surrendered following reports that Japanese Prime Minister Shigeru Ishiba intended to step down next month. Ishiba later denied these reports, which offered some support to the Yen.

Traders are currently pricing an 80% probability of a BoJ rate hike by the end of 2025.

Watch out for political risk…

Last Sunday, Japan’s ruling coalition failed to gain a majority in the upper house elections as widely expected. It is worth noting that nine months ago, the coalition lost a majority in the more powerful lower chamber of parliament.

This will be the first time that the governing LDP has lost a majority in both chambers since its inception in 1955.

Such a development may pressure Prime Minister Shigeru Ishiba to step down, resulting in fresh political uncertainty.

By the way… FXTM has launched 4 new JPC crosses!

And they are buzzing with activity following Trump’s ‘massive’ trade deal.

The rally on the JP225 (Nikkei 225) has dragged these JPC crosses lower today:

CHCJPC (CN50 vs JP225): ↓3.8%

DJCJPC (US30 vs JP225): ↓4.2%

NACJPC (NAS100 vs JP225): ↓3.7%

SPCJPC (US500 vs JP225): ↓3.7%

JPC crosses could experience steeper declines if the JP225 continues to surge on trade optimism.

However, political risk down the road may limit the downside and spark a potential rebound.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.