Daily Market Analysis and Forex News

Global stocks rally on Fed easing hopes

US500 & NAS100 hit fresh all-time highs

In-line US inflation boosts Fed cut bets, September cut priced in

USDInd tumbles below 98.00, USD down against all G10

GBPUSD trades higher ahead of upcoming UK GDP data

Equities across the globe extended gains on Wednesday as mounting Fed cut bets stimulated appetite for risk assets.

The US annual inflation rate held steady at 2.7% in July, defying expectations of a tariff-induced rise to 2.8%. This essentially sealed the deal for the Fed to cut rates in September and boosted the odds of another cut by October to 60%.

Markets are buzzing with activity:

- The S&P500 and Nasdaq100 surged to fresh all-time highs.

- FXTM’s USDInd tumbled below 98.00 for the first time since late July.

- Bitcoin rebounded back toward $120,000.

- Gold prices stabilized above the 50-day SMA.

The risk-on rally has also been supported by:

- President Donald Trump extending a trade truce with Beijing until 10 November.

- Optimism over Trump-Putin talks leading to an end to Russia’s war in Ukraine.

USDInd set to extend losses?

The USD has depreciated against every single G10 currency this week, with the USDInd dipping below 98.00.

Prices are bearish with more soft data fuelling the downside. Much attention will be on the incoming US PPI, initial jobless claims, and speeches by Fed officials, which may provide further insight into Fed cuts.

Looking at the charts, the negative momentum may drag prices toward 97.00.

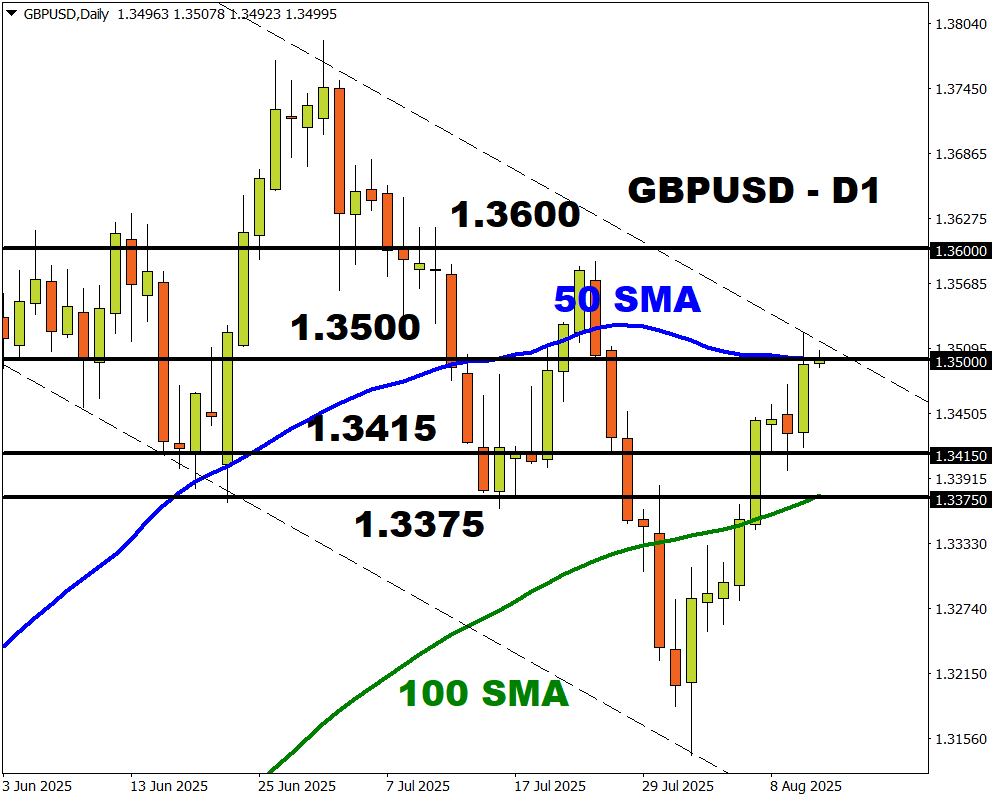

GBPUSD higher ahead of GDP

GBPUSD jumped as much as 100 pips yesterday after in-line US inflation readings weakened the dollar and boosted bets around the Fed cutting rates in September.

Sterling was already supported by the BoE’s hawkish rate cut last week and may see more volatility due to the incoming Q2 GDP report on Thursday.

A stronger-than-expected figure may boost confidence in the UK economy. If this reduces bets around the BoE cutting rates, the pound could rally.

A weaker-than-expected figure is likely to support the argument for lower UK interest rates, weakening the pound as a result.

- Bullish: A solid breakout above the 50-day SMA may encourage a move toward 1.3600.

- Bearish: Weakness below the 50-day SMA may trigger a decline toward 1.3415.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.