Daily Market Analysis and Forex News

Gold eases lower on risk-on mode

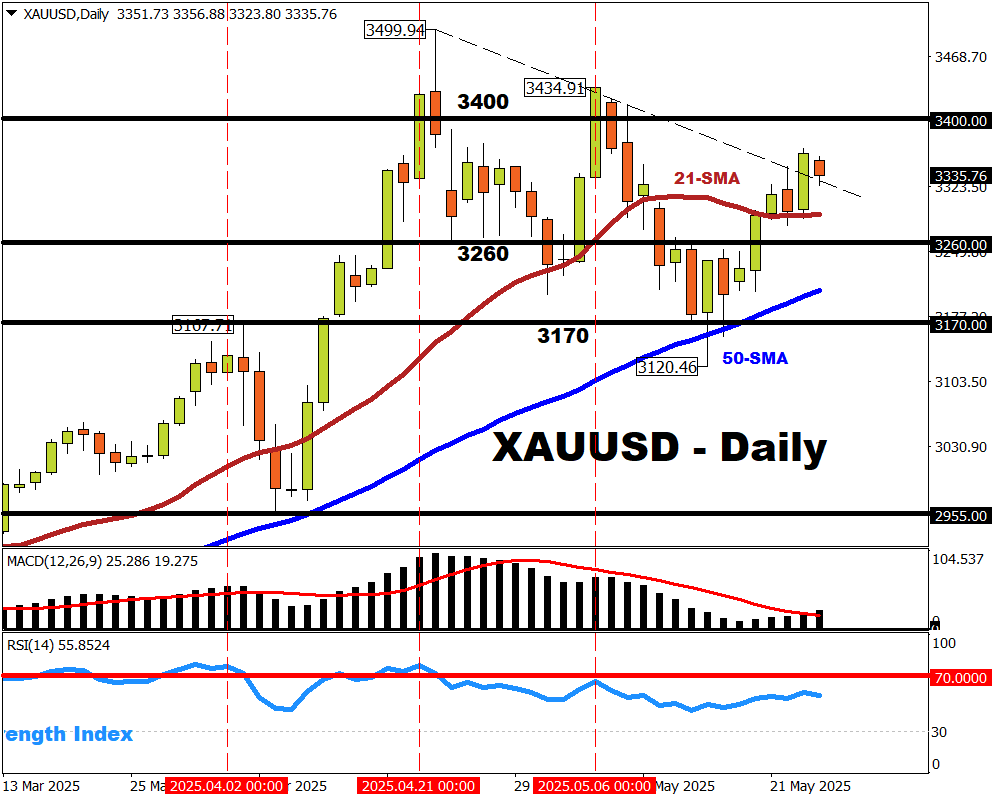

- Spot gold now testing immediate support and downward trendline from record high

- XAUUSD now about $166 below all-time high; still up 27% so far in 2025

- Key Events: Fed Speak, FOMC minutes, US April PCE data

- Bloomberg model: 72% chance gold trades between $3249.00 - $3432.60 this week

Gold is easing slightly amid the risk-on mood in markets today.

This comes after President Trump announced a delay to July 9th on the 50% tariff threat against EU goods.

Gold testing key support levels

Looking at the chart above, XAUUSD has in recent sessions respected the 21-day simple moving average (SMA) we had been watching in recent weeks.

The 21-day SMA went from resistance to support mode last week.

Now, the downward-sloping, upper trendline from the all-time intraday high (near-$3500 on April 22nd) is acting as immediate support

What could move spot gold this week?

Spot gold is bound to move if any of the events listed below prompt markets to adjust expectations for the timing of the next Fed rate cut.

Note that markets currently "only" predict a 72% chance of a September Fed rate cut, significantly later than the 70% chance accorded a month ago to a June rate cut.

Besides Trump's social media posts ...

- Tue-Thur, May 27-29: Speeches by 7 different Fed officials

- Wed, May 28: FOMC meeting minutes

- Fri, May 30: US April PCE - Fed's preferred way of measuring inflation

Also note that US markets are closed today (Monday, May 26th), hence no movements on US Treasury yields.

It'll also be important to see how Treasury yields fare, especially those on the 30-year, once Treasury markets resume after the extended Memorial Day weekend.

Potential Scenarios

Currently, Bloomberg's model predicts 71.5% chance that XAUUSD will trade between $3249.00 - $3432.60 this week.

- BEARISH: A break below that downward-slopping upper trendline immediate support may once again call the 21-day SMA into action as key support.

Stronger support may arrive around $3260 and 50-day SMA.

- BULLISH: Greater risk-off sentiment (traders/investors become even more uncertain/fearful about the future) could see gold reclaiming the psychological $3400 mark.

Stronger resistance may arrive around $3434.91 (early-May cycle high), which lies close to the upper bound of Bloomberg's forecast model for this week.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.