Daily Market Analysis and Forex News

Market round-up: Big tech beats, Tariff hopes, Gold's luster dims

Strong tech earnings empower US equities

USDInd tests key resistance at 100.20 ahead of NFP

Tariff hopes send gold to 2-week low

XAUUSD: NFP sparked moves of ↑ 1.0% & ↓ 2.3% over past year

Optimism swept across markets on Thursday as investors cheered strong tech earnings and cooling trade tensions.

US equities kicked off the new trading month on a solid note, extending gains from the previous session after Microsoft and Meta posted solid results.

Note: Microsoft saw total revenue in the fiscal third quarter increase by 13% to $70.1 billion while Meta reported $42.3 billion in Q1 sales – beating analyst forecast.

FXTM’s US500 and NAS100 jumped over 1%, the dollar regained some of its mojo, Bitcoin surged above $97,000, while gold prices tumbled toward $3200.

Data on Wednesday revealed that the US economy contracted for the first time since 2022. However, growth was dragged lower by rising imports as companies responded to Trump’s tariffs. When factoring how consumer spending remained resilient, investors were somewhat hopeful – especially with trade tensions easing.

Still, the outlook for US equities and the dollar may be influenced by Friday’s US jobs report.

Over the past 12 months, the US NFP report has triggered upside moves on the USDInd of as much as 1.1% or declines of 0.8% in a 6-hour window post-release.

Speaking of the USDInd, prices are testing resistance at 100.20.

- A breakout and daily close above 100.20 could open the doors toward 101.00 and 101.80.

- Should 100.20 prove reliable resistance, this may trigger a decline back toward 98.90 and 98.00.

On the global trade front, there are reports that the US has approached China seeking trade talks. If this paves the way for proper negotiations, this could support overall sentiment as trade fears ease.

This could put more pressure on gold, which has tumbled to a two-week low.

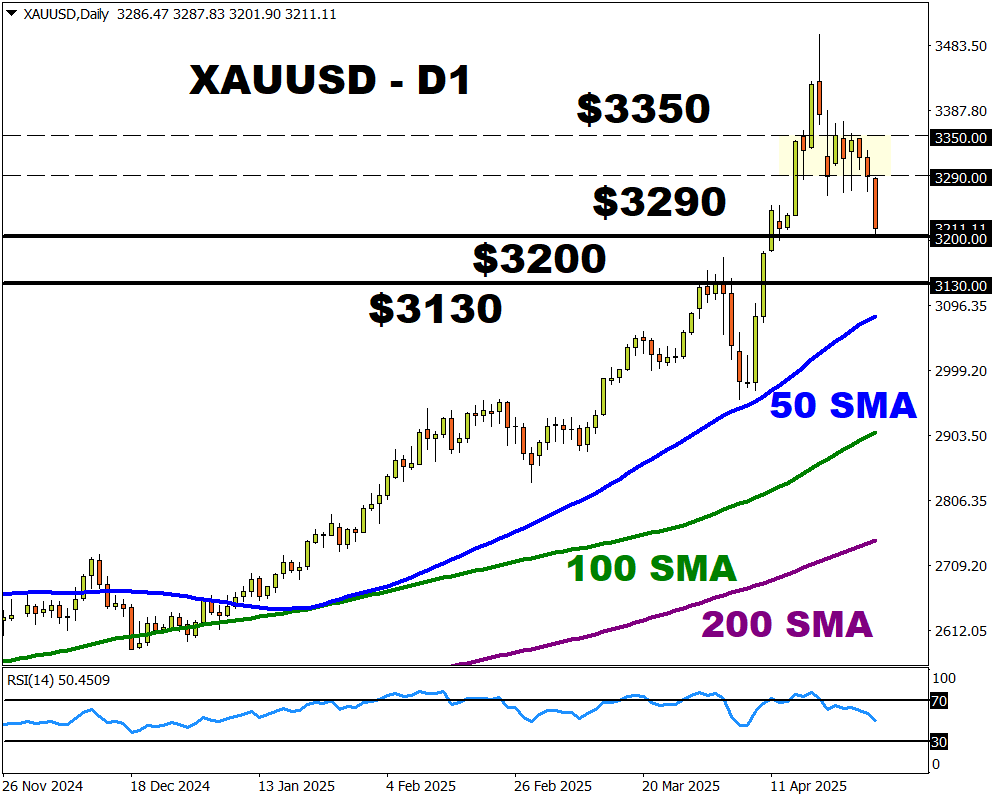

The precious metal is down over 2% with bears eyeing support at $3200. The incoming US jobs report may determine whether prices end the week above or below this key level.

Over the past 12 months, the US NFP report has triggered upside moves on XAUUSD of as much as 1.0% or declines of 2.3% in a 6-hour window post-release.

Talking technicals, weakness below $3200 may trigger a selloff toward $3130. Should $3200 prove reliable support, prices may rebound back toward $3290.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.