Daily Market Analysis and Forex News

Market round-up: ECB cuts rates, US-China stalemate, Silver hits 13 year high

Note: An hour after this report was published, there was breaking news that Trump and China's Xi Jinping had a 'positive' phone call on trade.

US-China stalemate leaves markets on edge

ECB cuts rates for eighth consecutive time

Silver hits levels not seen since 2012, ↑ 24% YTD

USDInd on standby ahead of NFP report

A sense of caution enveloped global markets this week as trade uncertainty left investors on edge ahead of Friday’s US jobs report.

US equities were trapped within a range, Bitcoin struggled for direction, while gold glittered as a string of negative developments fuelled risk aversion.

On Tuesday, the OECD cut its 2025 global growth projection to 2.9%, citing the impacts of tariffs by US President Donald Trump.

Mid-week, Trump lashed out at Federal Reserve Chair Jerome Powell to cut rates after the ADP figures for May showed the smallest gains since March 2023.

Trump on Wednesday said that it was “extremely hard” to make a deal with his Chinese counterpart Xi Jinping, further fuelling concerns that trade US-China talks have stalled.

ECB cuts rate as widely expected

As widely expected, the European Central Bank lowered interest rates by 25 basis points on Thursday.

This was the eighth consecutive cut since last June as global trade tensions fuelled fears over the region’s economic outlook. Officials stated that future rate cuts will be data-dependent and expressed concerns over trade policy uncertainty.

Regarding the new forecasts, the ECB sees 2026 inflation at 1.6%, down from the prior 1.9%. Regarding growth, 2025 forecasts were left unchanged, but 2026 and 2027 figures were downgraded.

Traders are currently pricing in one more ECB cut this year, with the probability of a second cut by December at 57%.

Dollar waits on US jobs report

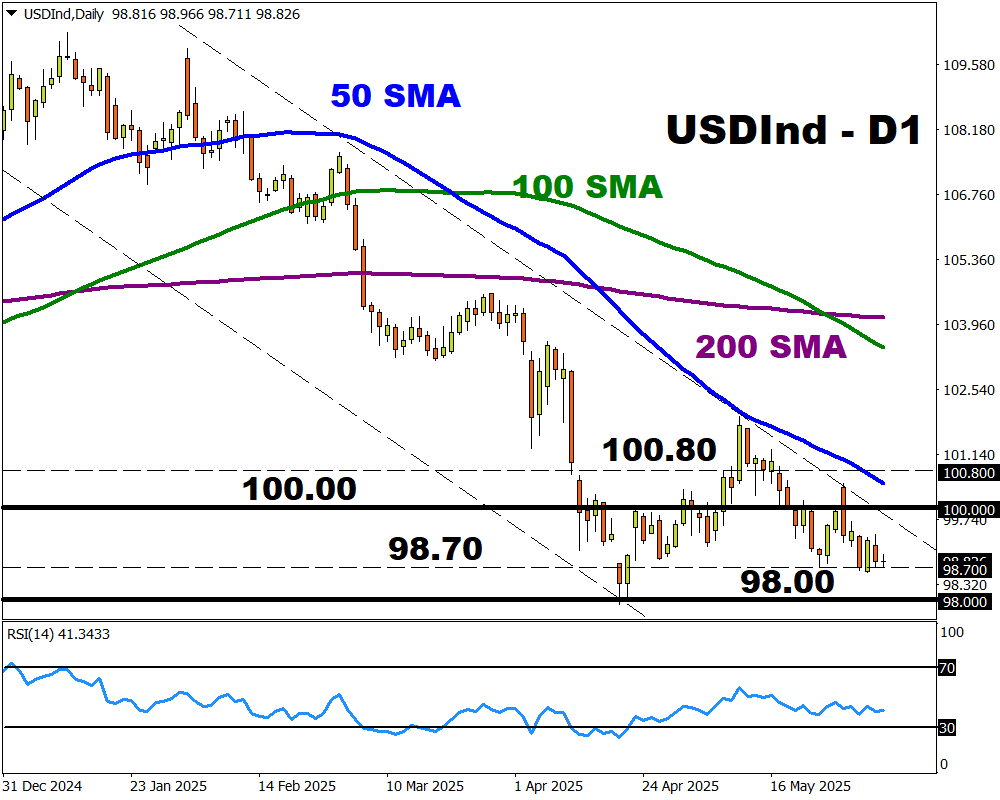

It’s been a flat week for the USDInd with prices hovering above the 98.70 level as of writing.

Bulls and bears are likely waiting for the incoming US Jobs report, which may influence Fed cut expectations.

Market forecasts point to a gain of 127,000 US jobs, which would be below April’s total of 177,000. But most importantly, it will also be the first full month of employment data with Trump’s tariffs in effect. So, investors will be looking for clues on how these extra costs have impacted businesses.

Over the past 12 months, the US NFP report has triggered upside moves on the USDInd of as much as 0.8% or declines of 0.8% in a 6-hour window post-release.

- A breakout above 100.00 may trigger a move toward the 50-day SMA at 100.80 and 101.85.

- Sustained weakness below 100.00, may trigger a decline toward 98.70 and 98.00.

Silver hits its highest since 2012

Silver prices surged over 4% on Thursday, fuelled by a technical breakout and demand for precious metals beyond gold.

Prices are trading at levels not seen since February 2012 with the path of least resistance pointing north. Another factor powering the upside is the significant inflows into silver-backed ETFs and reports that the market is headed for a fifth year of deficit according to the Silver Institute.

The metal has gained almost 9% this month, pushing year-to-date gains to almost 25%.

- Looking at the charts, prices could be primed for further upside with the next key level found at $37.50.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.