Daily Market Analysis and Forex News

Market round-up: Fed holds, Big Tech beats, Dollar rallies

Fed holds rates, 2 dovish dissenters but Powell hawkish

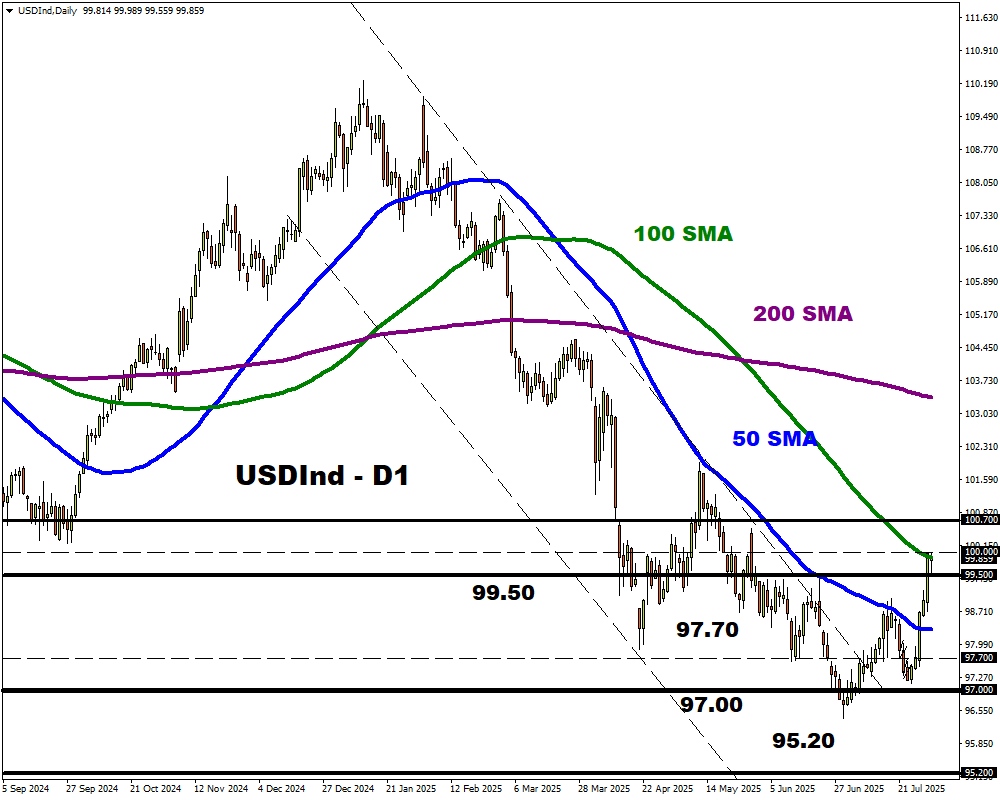

USDInd on track for first positive month of 2025

US equities rally as Microsoft & Meta delivers solid earnings

Core PCE for June YoY 2.8% vs 2.7% expected

Gold waits on Friday’s NFP & Trump’s tariff deadline

It’s been another volatile week defined by central bank decisions, big tech earnings, and tariff uncertainty.

Equity markets are buzzing with activity thanks to solid earnings from tech titans Microsoft and Meta. In the FX arena, the dollar is king this week thanks to strong US data and a hawkish Powell. Amidst all this, there is a sense of caution ahead of Trump’s tariff deadline on Friday 1st August.

Here is what you need to know:

Fed Chair Powell dampens cut hopes

The Federal Reserve left interest rates unchanged for a fifth consecutive time.

However, two dissenters voted in favour of a rate cut. But this was overshadowed by Powell’s hawkish remarks and caution regarding inflation risks. This dampened bets for a September rate cut with traders now pricing in a less than 45% probability.

In response, the dollar has rallied with the USDInd on track for its first positive month in 2025. These gains were supported by the hotter-than-expected US PCE report.

Looking at the charts, the USDInd is firmly bullish on the daily charts. A breakout above 100.00 could open a path toward 100.70.

Big tech delivers big gains

Microsoft shares jumped almost 10% in pre-market trade on Wednesday after reporting better-than-expected earnings and revenues for the fiscal fourth quarter. Shares in Meta also surged after posting a solid set of financial results for Q2 and positive forward guidance.

These results have reinforced optimism around the A.I. boom ahead of earnings from Amazon and Apple after US markets close on Thursday.

Note: Markets are pricing in potential one-day moves of ±5.3% for Amazon and ±4.1% for Apple post earnings.

FXTM’s US500 and NAS100 have both touched fresh all-time highs and could extend gains amid the positive sentiment.

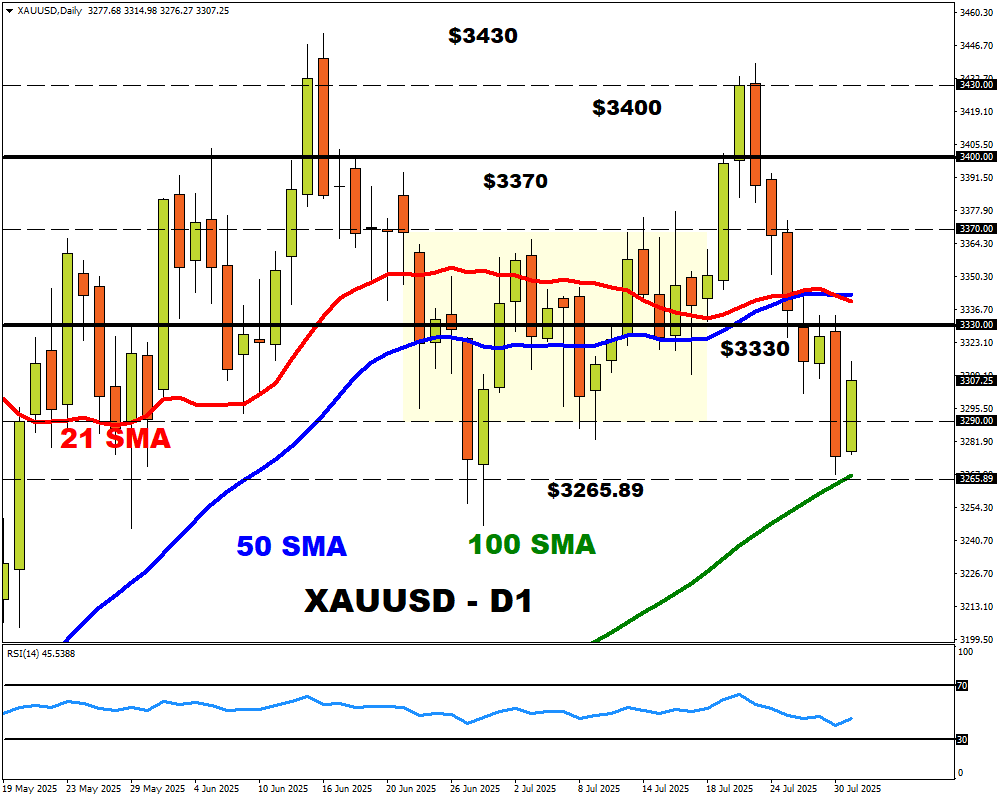

Gold set for weekly loss?

Gold is up almost 1% today, clawing back some losses from a sharp 2% selloff in the previous session as traders slashed bets around Fed rate cuts.

While gold remains vulnerable to an appreciating dollar in the face of slower Fed cuts, Trump’s looming tariff deadline could cushion downside losses.

The precious metal is likely to remain volatile due to the incoming NFP report on Friday.

Looking at the charts, prices remain bearish below the $3330 resistance.

Sustained weakness below $3330 may encourage a decline toward $3290 and the 100-day.

Should prices push back above $3318, this could trigger a move toward $3330 and the 50-day SMA.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.