Daily Market Analysis and Forex News

Market round-up: Record highs, Fed cut bets, Dollar doldrums

US500, NAS100, Bitcoin hit fresh all-time highs

Fed September cut fully priced in, 65% chance of a cut in October

USD weakens against most G10 currencies, USDInd ↓ 2% MTD

Gold wobbles above 50-day SMA

US data + Trump/Putin talks = fresh volatility?

It was a week defined by record highs as Fed cut bets boosted market sentiment.

Investors rushed toward risk assets as in-line US inflation figures solidified expectations for a September US rate cut. Market optimism was also lifted by easing trade tensions after Trump extended the US-China trade truce by 90 days.

With traders fully pricing in a rate cut in September, this injected equity bulls with fresh confidence. The risk-on mood also propelled Bitcoin to a fresh all-time high, while the dollar weakened against every single G10 currency.

Interestingly, gold was pressured by the positive market mood, but a weaker dollar cushioned downside losses.

With easing trade tensions, Fed cut bets and hopes around Trump-Putin talks lifting the market mood, risk-on could remain the name of the game.

Here is your market round-up:

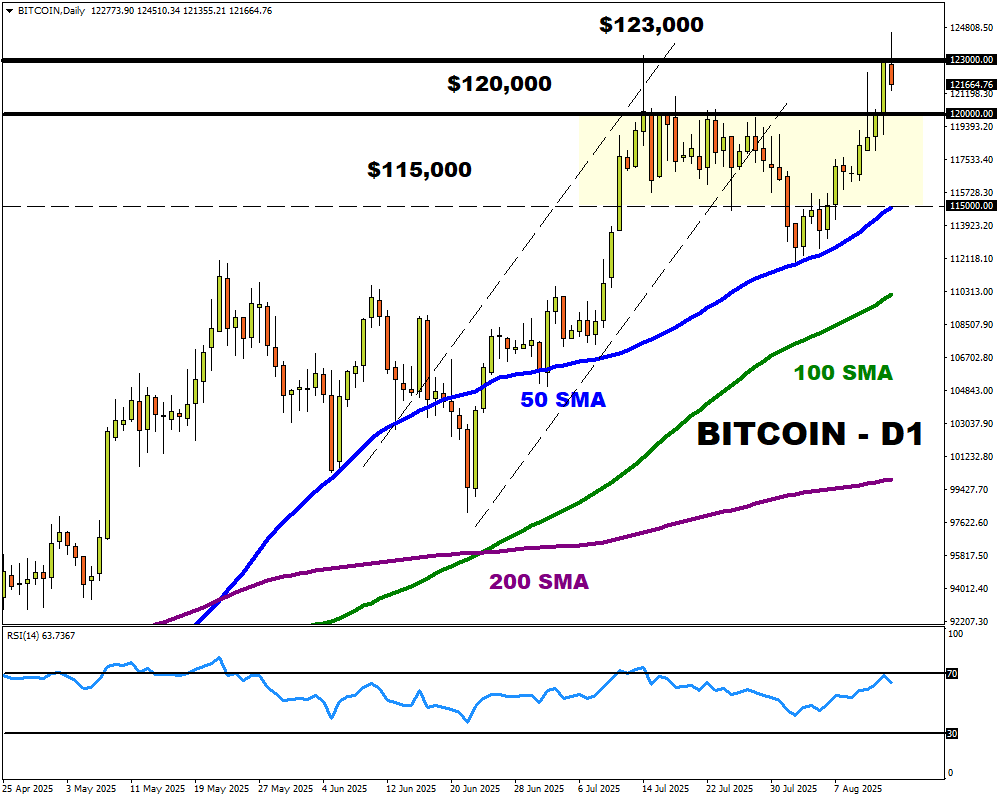

Bitcoin surges to fresh records

Bitcoin surged to a record high on Thursday amid the risk-on rally. Prices peaked at above $124,000 before slipping amid profit-taking. Given the positive market mood and bullish fundamental themes, the crypto could see further upside.

Looking at the charts, prices are bullish above the $120,000 support level.

Should this level prove reliable support, a rebound back toward $123,000 and higher could be on the cards.

Weakness below $120,000 may trigger a decline toward $115,000.

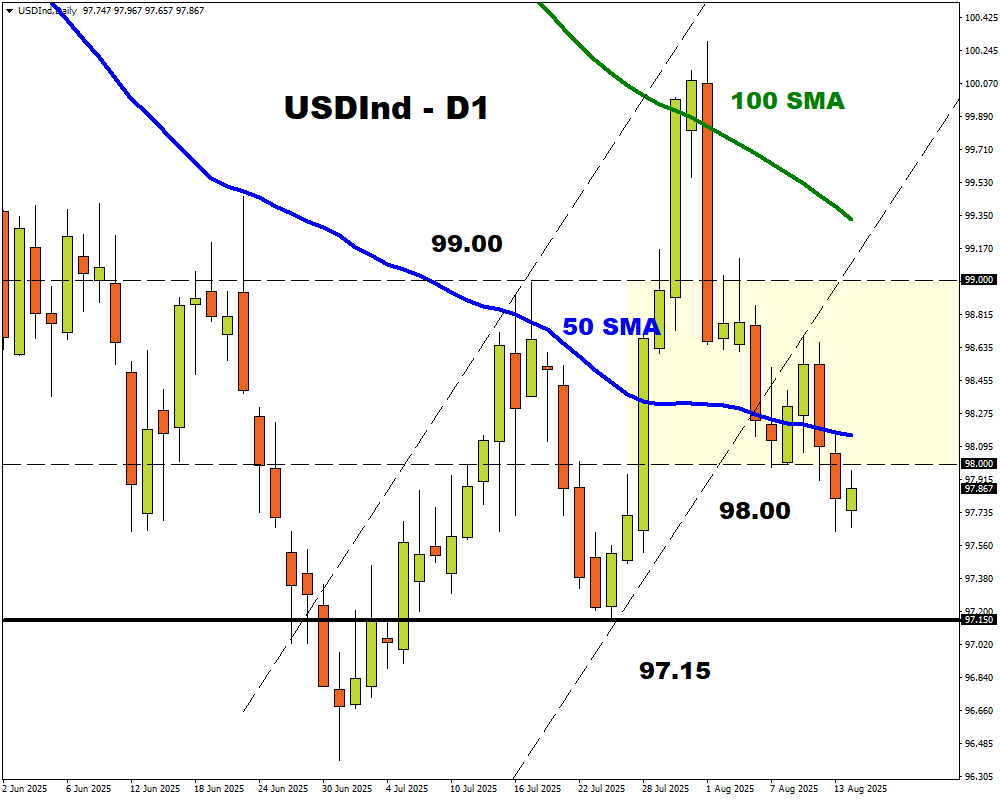

More pain ahead for USD?

The dollar has depreciated against almost every single G10 currency this week.

FXTM’s USDInd closed below 98.00 for the first time since mid-July, dragging MTD losses to over 2%. Incoming US data may reinforce these bets, further weighing on the US dollar.

Looking at the charts, a move back above 98.00 may trigger a rebound back toward 99.00.

Sustained weakness below 98.00 could see prices test 97.15 and 96.70.

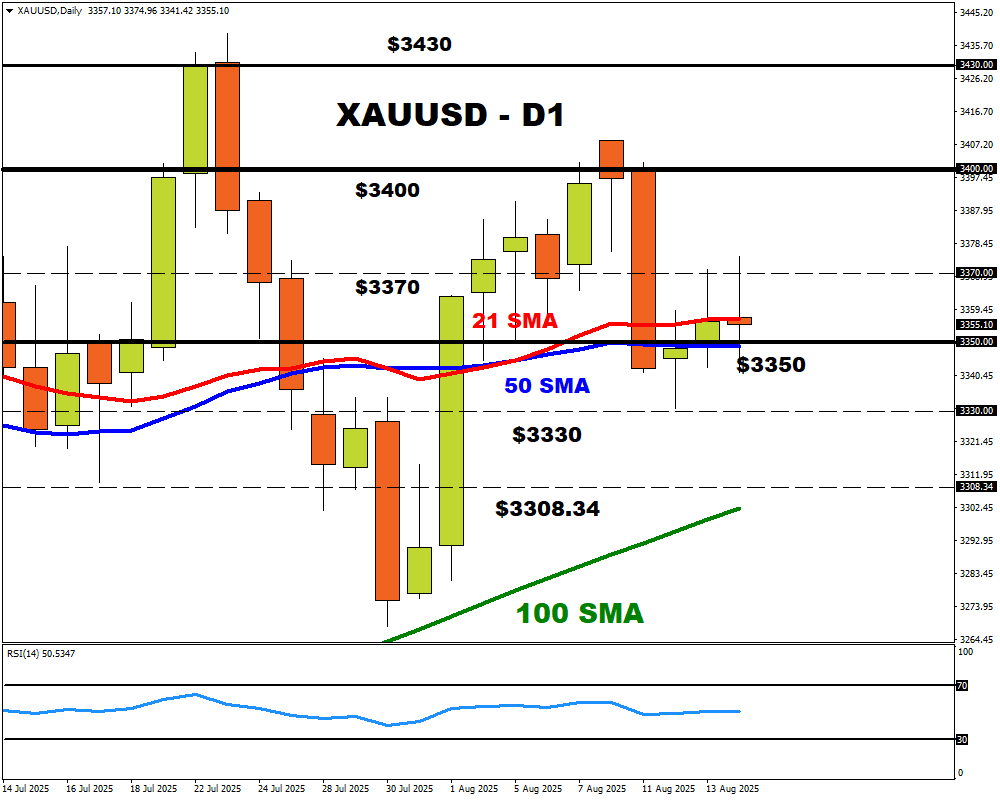

Commodity spotlight: Gold

Gold prices were pulled and tugged by conflicting forces on Thursday with prices trading above the 50-day SMA.

The precious metal’s outlook may be impacted by incoming US data and the outcome of Trump’s talks with Putin on Friday.

Should $3350 prove reliable support, prices may rebound back toward $3370 and $3400.

Weakness below $3350 could trigger a decline back toward $3330 and $3308.34.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.