Daily Market Analysis and Forex News

Market round-up: Soft US CPI, Geopolitical Risk, Dollar weakness

Soft US CPI boosts Fed cut bets; 2 cuts priced in for 2025

Trump says deal with China is “done” but trade uncertainties persist

Dollar hits fresh 2025 low, Bitcoin capped below $110k

Gold boosted by risk-off mood, ↑ 29% YTD

It was a week defined by rising geopolitical tensions and cautious optimism around US-China trade talks.

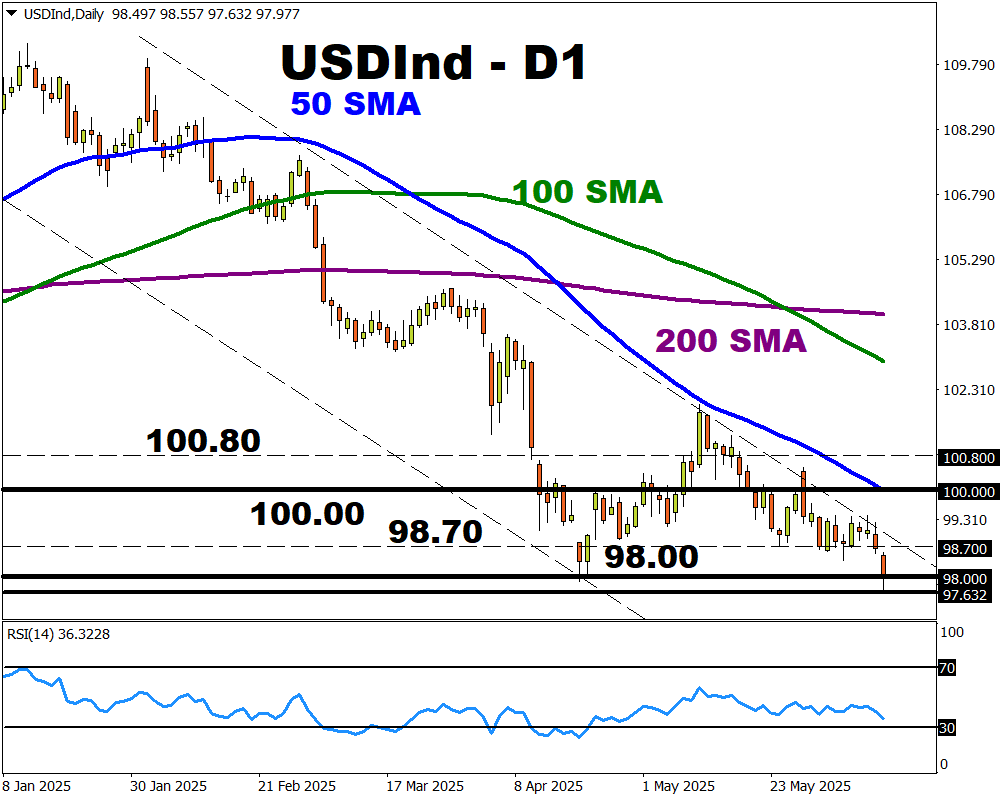

On Wednesday, the latest inflation report in the United States revealed that prices were cooling. This offered some support to US equities while dragging the USDInd to fresh 2025 lows. Bitcoin was capped below $110k amid the risk-off mood while the EURUSD jumped to levels not seen since October 2021.

Regarding trade developments, Trump stated that a deal with China is ‘done’. However, he later warned that tariffs on imported automobiles would be raised in the future.

Cool US CPI boosts Fed cut bets

US consumer prices increased less than expected in May thanks to cheaper gasoline prices.

Inflation increased 0.1% last month after rising 0.2% in April, while rising 2.4% annually. Signs of cooling price pressure have boosted bets around lower US interest rates, with traders pricing in two cuts in 2025. Although this CPI figure is unlikely to influence the Fed’s decision next week, it may spark early discussions around a possible move in July.

To be clear, traders are only pricing in a 24% probability of a July cut, but another round of disappointing data could boost these odds.

Looking at the charts, the USDInd tumbled to a fresh 2025 low at 97.632. Prices remain bearish on the daily charts with the next key psychological support at 97.00.

Gold jumps on geopolitical risk

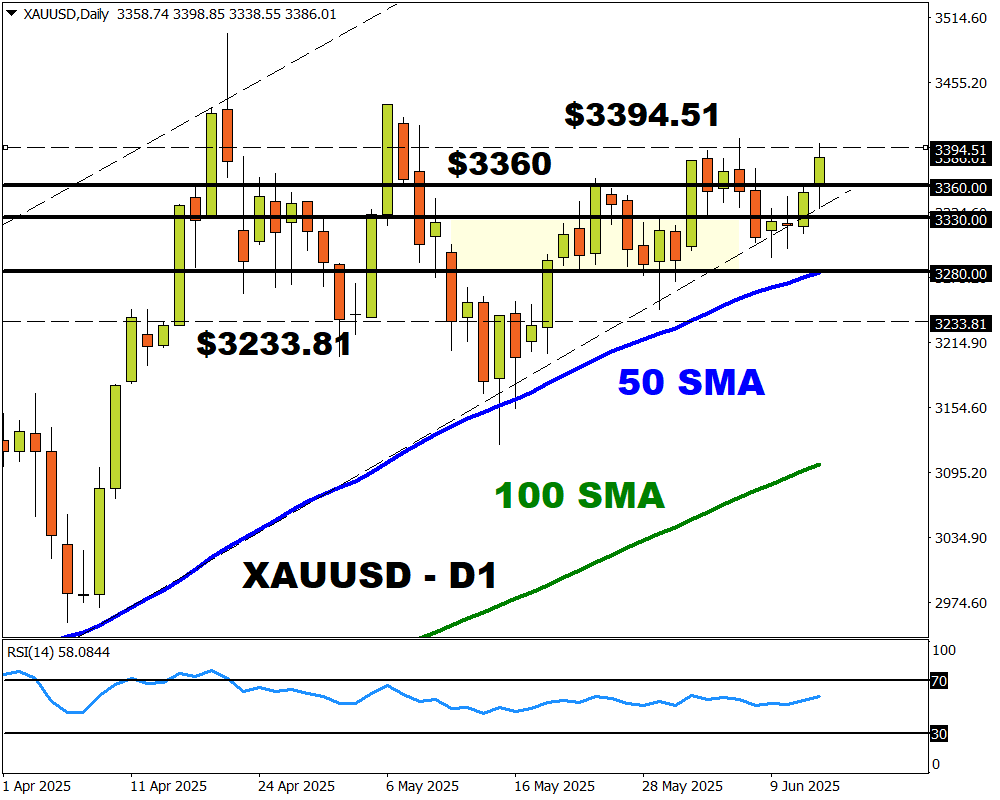

Gold punched above $3395 on Thursday, boosted by another soft inflation report and rising geopolitical tensions.

Investors flocked toward safe-haven destinations following reports that Israel was ready to launch an operation aimed at Iran. Uncertainties over global trade also contributed to the risk-off mood, boosting gold’s allure.

Looking at the charts, prices are turning bullish with key resistance at $3400. A solid breakout and daily close above this point may signal a rally back toward the all-time high.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.