Daily Market Analysis and Forex News

Market round-up: Tariff rollout, BoE cuts, Putin-Trump Summit

US tariffs on dozens of countries come into force

BoE cuts rates by 25bp, 5-4 vote split

Putin proposes summit with Trump

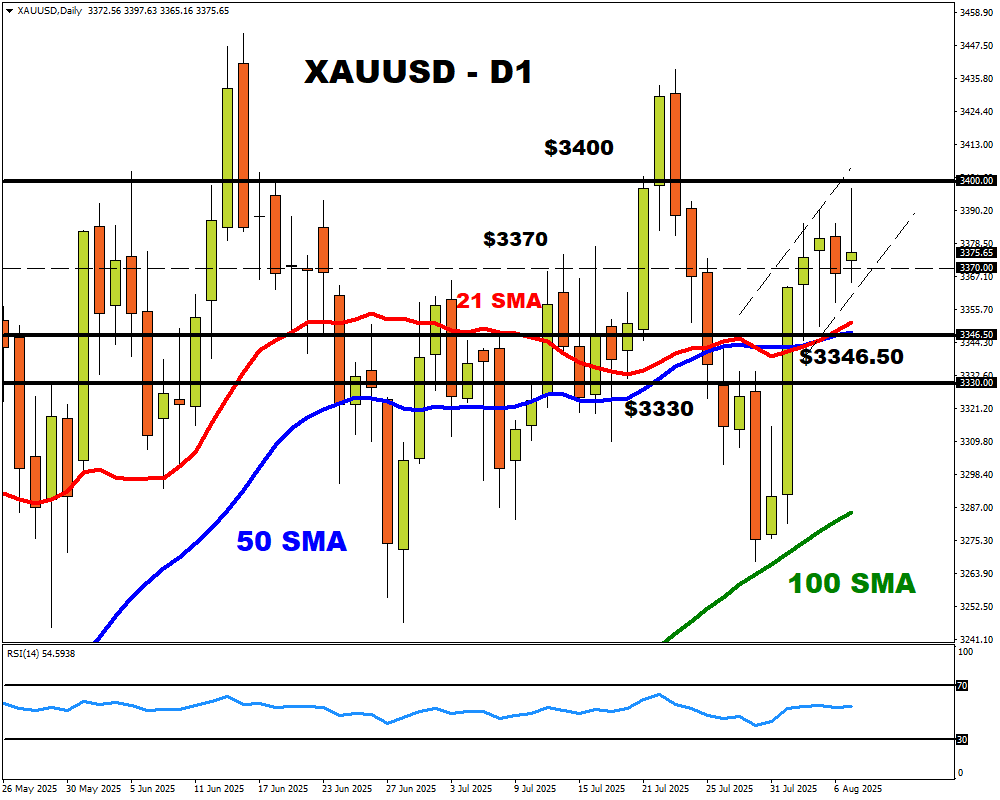

XAUUSD wobbles above $3370 amid conflicting themes

Trump’s sweeping new tariffs against dozens of countries have officially come into effect.

Markets offered a mixed response, but investors remain cautious as they assess the implications for the global economy. Ongoing uncertainty around trade may remain a theme for weeks to come.

In the FX space, the dollar has depreciated against most G10 currencies, while gold almost touched $ 3,400 before giving back gains. The Bank of England cut interest rates by 25 basis points. On a brighter note, Russia and the US have agreed to meet for summit talks within the next few days.

Here is your market round-up:

Trumps Tariff Tsunami To Trigger Trade Turmoil?

At 12:01 AM New York time on Thursday, new reciprocal tariffs of 10% to 41% on nearly 70 countries went into effect.

Trump’s actions will push the average US tariff rate to 15.2% according to Bloomberg Economics estimates.

One of Trump’s highest tariffs is now in effect on Switzerland, with its government holding an emergency meeting today. A 39% tariff might knock off 1% of Switzerland’s GDP, according to Bloomberg Economics. Should other countries face similar dilemmas, this could fan fears over slowing global growth.

To add to the uncertainty, Trump threatened 100% tariffs on chip imports but would exempt companies moving production back to the United States.

BoE cuts rates on close vote split

The Bank of England cut interest rates by 25 basis points to 4% as expected. But it was a close call with a 5-4 vote split, meaning 5 voted for a 25 basis point cut while 4 voted for a hold.

This development has boosted the Pound with traders paring BoE cut bets for the year. Traders are now only pricing a 50% probability that the central bank will cut rates again by November.

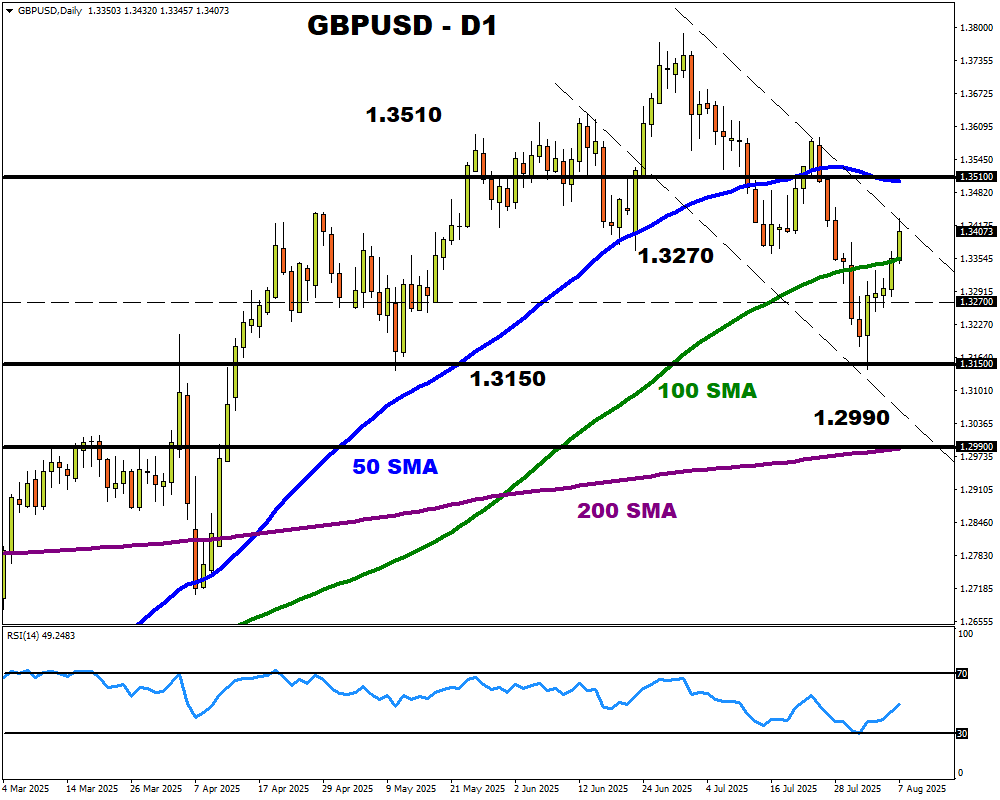

The GBPUSD rallied toward 1.34 following the decision, with bulls eyeing resistance at 1.3510 – where the 50-day SMA resides.

Trump-Putin meeting

President Vladimir Putin and Donald Trump are expected to meet for summit talks within the next few days.

Although the details of the meeting remain unclear, this development lifted sentiment and raised hopes for an end to Russia’s war in Ukraine. It’s worth noting that Trump has threatened to hit buyers of Russian oil with secondary tariffs unless Putin agrees on a truce by Friday.

This development may influence gold prices, especially if risk sentiment jumps. However, uncertainty over Trump’s tariff could limit downside losses. Key technical levels on gold can be found at $3400, $3370, and the 50-day SMA.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.