Daily Market Analysis and Forex News

Market round-up: UK-US Trade Deal, BoE vote split, Bitcoin surpasses $100k

UK-US trade deal sparks risk-on mood

BoE vote split catches markets off guard

Bitcoin surges past $100,000, ↑ 7% MTD

USDInd breaks above 100.00, Gold tumbles to $3300

Risk-on was the name of the game on Thursday after President Donald Trump announced a trade deal with the United Kingdom.

Market sentiment was also lifted by growing optimism around US-China trade talks in Geneva this weekend.

US equities opened higher with US500 and NAS100 gaining over 1%.

In the FX space, FXTM’s USDInd pushed above the psychological 100.00.

Bitcoin blasted through $100,000 for the first time since February.

Safe-haven gold took a hit, dipping toward the $3300 level.

UK and US secure breakthrough trade deal…

The United Kingdom and the United States have secured a trade deal expected to cut US tariffs on cars, steel and aluminum. This is Trump’s first trade deal since sparking a global trade war that has rocked financial markets. To add to the overall positivity, Trump mentioned that China tariffs could be lowered if talks go well over the weekend.

If this development opens doors to more negotiations with various countries, risk sentiment could receive a major boost as trade war fears cool.

BoE “hawkish cut” & vote split supports Sterling

Earlier on Thursday, Sterling jumped despite the Bank of England cutting interest rates as widely expected.

Markets were caught off guard by the three-way-vote split, which showed 5 members voting for a 25-basis point cut, two members voting for a 50-basis point cut and 2 members voting for rates to remain on hold.

Overall, the Bank of England struck a more hawkish note and suggested that the global impact of US tariffs remained a threat to the UK economy.

Note: This was said before the Trump administration announced a trade deal with the United Kingdom.

Traders are now pricing in only two more BoE rate cuts in 2025 with the probability of a third one by December at 20%.

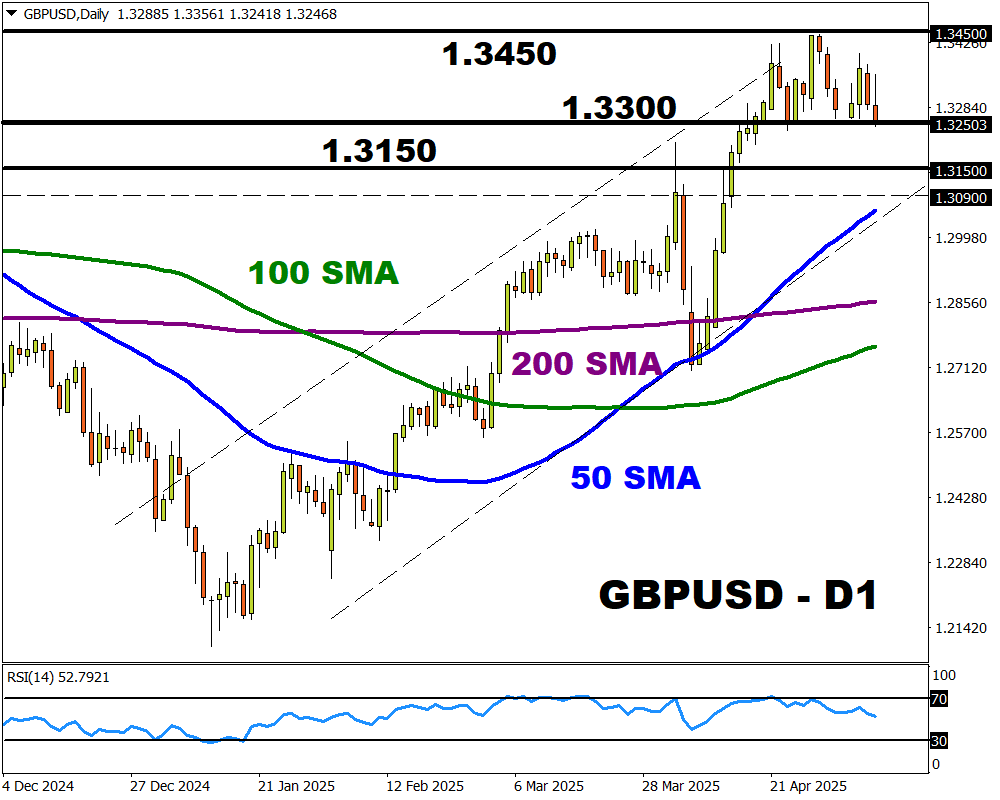

Looking at the charts, the GBPUSD has surrendered its post-BoE gains thanks to an appreciating dollar. Prices remain in a range with support at 1.3250 and resistance at 1.3450.

- Sustained weakness below 1.3250 may trigger a decline toward 1.3150 and 1.3090.

- Should 1.3250 prove reliable support, prices may rebound toward 1.3450.

Bitcoin surges above $100,000

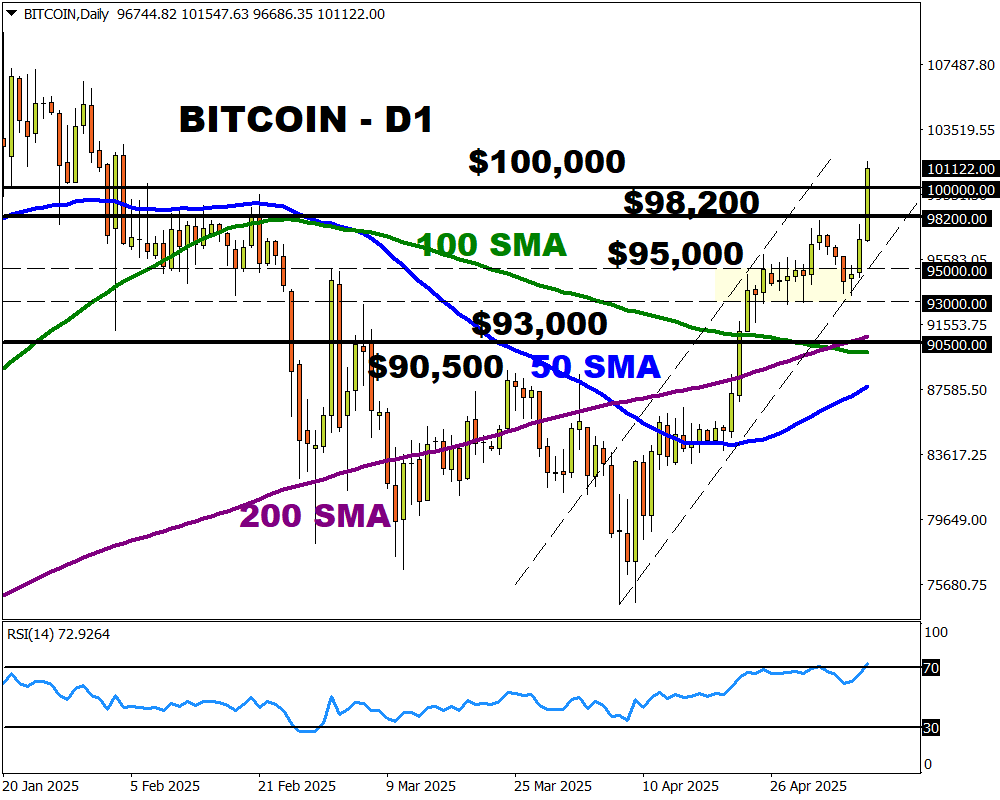

Bitcoin rallied above the $100,000 psychological level for the first time since February as risk appetite returned with a vengeance.

Easing trade tensions has injected investors with fresh confidence, rekindling appetite for riskier assets. Bitcoin is firmly bullish and could venture higher if bulls secure a daily close above $100,000.

- Should $100,000 prove reliable support, prices may venture toward $106,000.

- Sustained weakness below $100,000 may take prices back toward $98,200 and $95,000.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.