Daily Market Analysis and Forex News

Week Ahead: 3 assets that may hit new highs – Bitcoin, GBPUSD, and US500 index

- Mon, May 26th: US, UK markets closed

- Tue, May 27th: Positive signals out of Bitcoin 2025 conference may send Bitcoin to fresh record highs

- Wed, May 28th: Better-than-expected Nvidia earnings could boost US500 index above 6k

- Wed, May 28th: US dollar also sensitive to FOMC meeting minutes, Fed speak

- Fri, May 30th: Weaker USD could send GBPUSD above 1.360 on higher-than-expected US PCE data, contentious US-Japan trade talks

Recent days have seen major assets claim new heights:

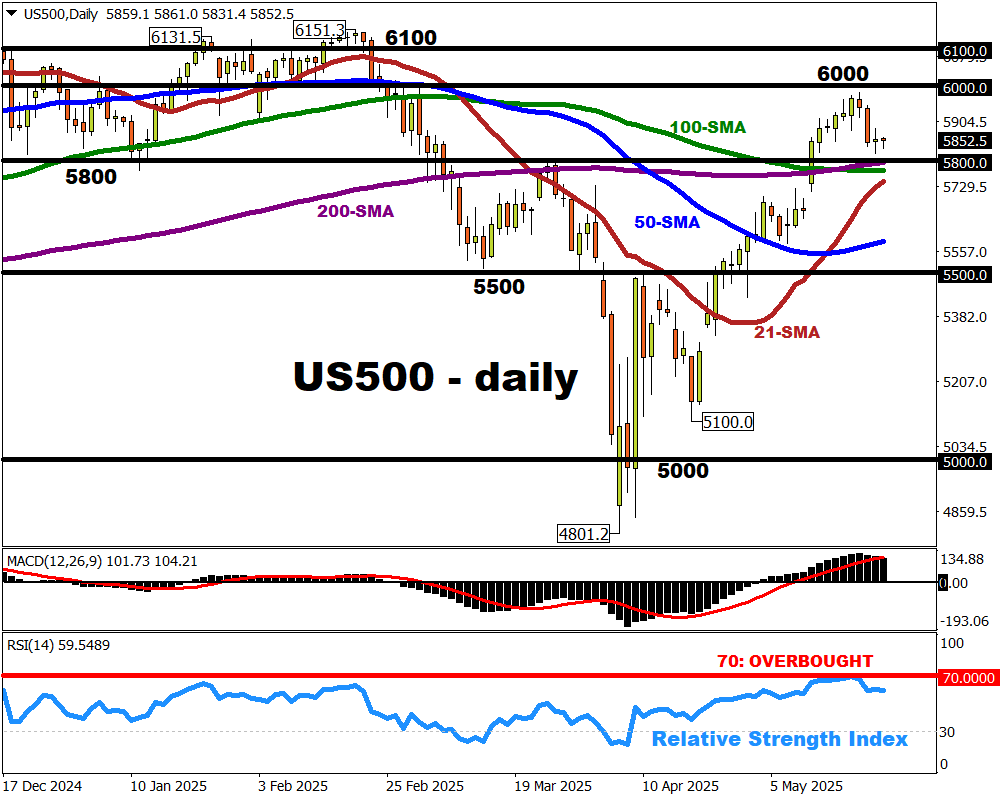

Tuesday, May 20: US500 stock index got close to 3-month high

The US500 index got to within 0.3% of the psychological 6k level - a level not reached since late-February - before paring gains.

Tiring optimism that the worst of the US-led trade war is now behind us eventually gave way mid-week to concerns about the US fiscal deficit (the gap between US government's spending and income) prompted some profit taking on the benchmark US stock index.

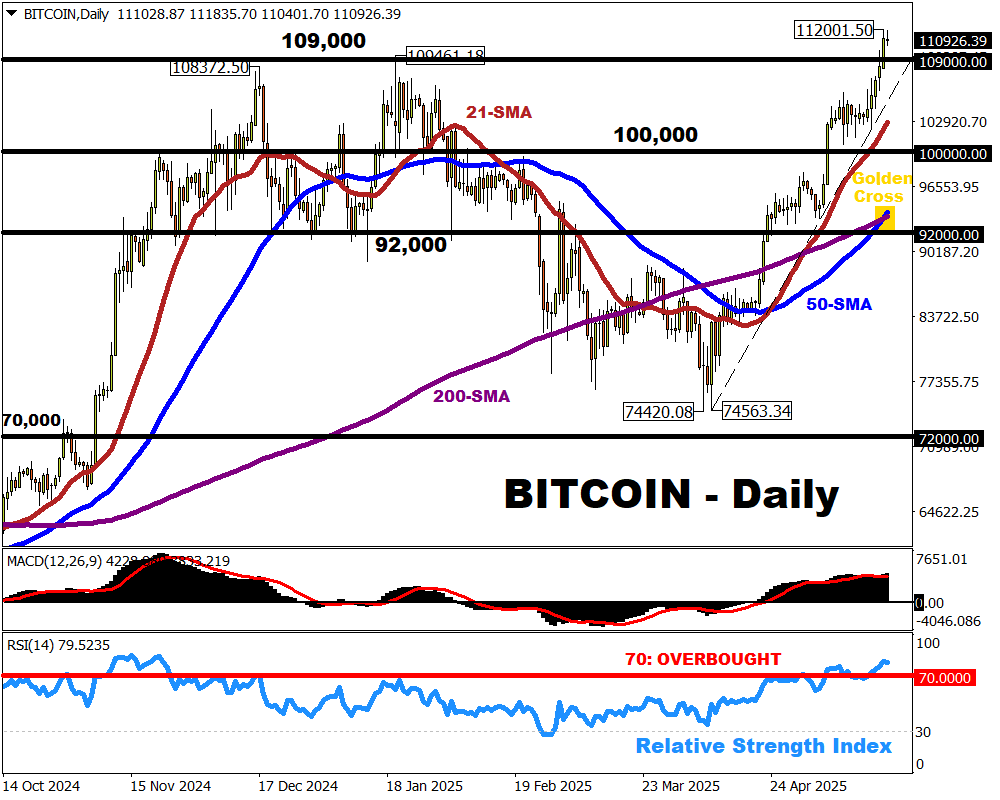

Thursday, May 22: Bitcoin hits new record high

Bitcoin touched the $112,000 mark for the first time in its history on Thursday, May 22nd.

This ascent to a new all-time peak was fuelled by optimism that new US stablecoin legislation (potentially to be passed by the US House today - Friday, May 23rd) will lead to greater mainstream adoption of the world’s oldest and biggest cryptocurrency.

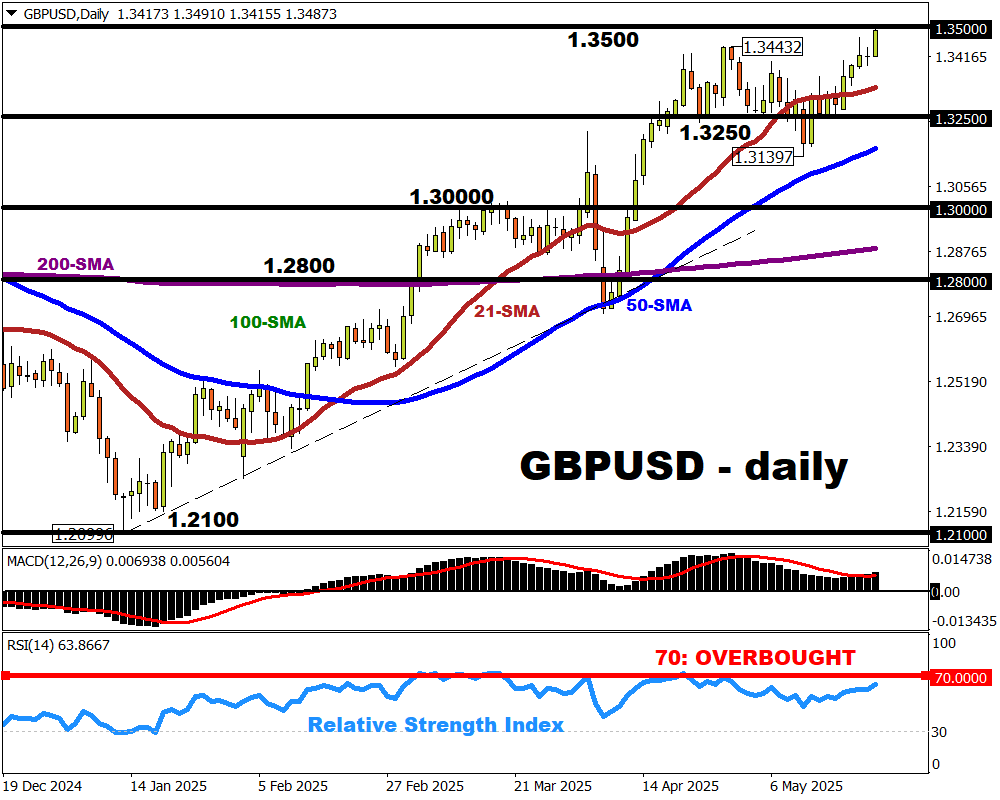

Friday, May 23rd: GBPUSD punches up to 3-year high

This FX pair nickname “cable” is closing in on the psychological 1.3500 level, reaching its highest levels since February 2022.

This comes after stronger-than-expected UK economic data releases:

- Wed: May 21: higher-than-expected inflation data

- Fri, May 23: stronger-than-expected retail sales figures

These figures suggest a more resilient-than-expected UK economy, potentially delaying more rate cuts by the Bank of England (BoE), which in turn supports the British Pound.

GBPUSD also got a helping hand from the weaker US dollar, amid rising concerns about the US fiscal deficit, fuelled by President Trump’s “big, beautiful bill” narrow approval by the House, featuring tax cuts.

But there's bound to be more market action in the final week of May 2025.

(despite US and UK markets being closed on Monday, May 26th)

The coming week features many potential market-moving events:

Monday, May 26

- SG20 index: Singapore April industrial production

- US, UK markets closed

Tuesday, May 27

- CN50 index: China April industrial profits

- USDJPY: Speeches by Bank of Japan Governor Kazuo Ueda and Minneapolis Fed President Neel Kashkari

- EU50 index: Eurozone May economic confidence; Germany June consumer confidence

- US30 index: US May consumer confidence

- Bitcoin 2025 conference

Wednesday, May 28

- AUD: Australia April CPI

- NZD: RBNZ rate decision

- TWN index: Taiwan 1Q GDP

- GER40 index: Germany May unemployment

- USDInd: FOMC May meeting minutes; speeches by New York Fed President John Williams, Fed Governor Christopher Waller, and Minneapolis Fed President Neel Kashkari

- Nvidia earnings

Thursday, May 29

- ZAR: South Africa rate decision

- US400 index: US 1Q GDP (second estimate); weekly initial jobless claims

- USDInd: Speeches by Chicago Fed President Austan Goolsbee, Dallas Fed President Lorie Logan, Richmond Fed President Tom Barkin, San Francisco Fed President Mary Daly

Friday, May 30

- JPY: US-Japan trade talks; May Tokyo CPI

- JP225 index: Japan April industrial production, jobless rate, retail sales

- AU200 index: Australia April retail sales

- EUR: Germany May CPI

- MXN: Mexico April unemployment rate

- CAD: Canada 1Q GDP

- US500 index: US April PCE, personal income and spending

Now, we zoom in on specific events that could either determine if Bitcoin, the US dollar, and the US500 can extend their uptrend, or be forced to pull back:

1) Tuesday - Thursday, May 27-29: Bitcoin 2025 Conference

Although US President Donald Trump will not repeat his attendance from last year’s conference, there will be speeches by:

- JD Vance, US Vice President

- David Sacks, White House AI & Crypto Czar

These speeches come as a major stablecoin legislation is, at the time of writing, about to be passed by the Senate.

If Vance and Sacks, along with other crypto luminaries can further stoke optimism that even greater mainstream crypto adoption is in store, that could send Bitcoin closer to $120k this week.

2) Wednesday, May 28 (after US markets close): Nvidia earnings

With a market cap of US$ 3.24 trillion, Nvidia is now the 2nd biggest company by market cap on the benchmark S&P 500 index (tracked by FXTM’s US500) – just behind Microsoft’s US3.38 trillion market cap.

Nvidia is set to release its Q1 fiscal 2026 earnings (3 months ending April 30th) after US markets close on Wednesday, May 28th.

After this pivotal announcement, Nvidia’s shares are forecasted to react with a 1-day move of 6.5% up/down, when US markets reopen on Thursday, May 29th.

Using the closing price from Thursday, May 22nd as the base, a post-earnings 6.5% move to the upside on May 29th could launch Nvidia’s shares back above the $140 level, and even possibly the US500 above the 6,000 line!

Given that Nvidia alone accounts for about 6% of the S&P 500, the market’s reaction to Nvidia’s earnings is bound to move the broader US500 index as well.

3) Friday, May 30: US April PCE (personal consumption expenditure)

This is the Fed’s preferred way of measuring US inflation (as opposed to consumer price indexes – CPI – typically released mid-month).

Economists currently predict:

- PCE month-on-month (April 2025 vs. March 2025): slight uptick to 0.1% vs. the 0% m/m figures in March 2025

- PCE year-on-year (April 2025 vs. April 2024): slight cooling of 10 basis points respectively for PCE (2.2% y/y) and Core PCE (2.5% y/y).

Traders and investors will be relying next on these PCE figures to determine the timing of the next Fed rate cut.

Markets currently predict an 82% chance that the Fed will next cut rates in September.

Higher-than-expected PCE data may fuel fears of a US stagflation (stubborn inflation accompanied with sluggish economic growth).

US stagflation could in turn prevent the Federal Reserve from cutting interest rates despite a darkening US economic outlook.

Greater prospects of US stagflation could weaken the US Dollar and allow GBPUSD bulls (those hoping prices go up) to seek prices above 1.360.

According to Bloomberg's FX model, there's a 75.6% chance that GBPUSD will trade between 1.334 - 1.365 over the coming week.

Besides the PCE data, the US dollar is also set to react to more clues about the Fed’s rate cuts via:

- May 27-29th: 7 different Fed officials making scheduled public comments from Tuesday through Thursday

- May 28th: FOMC’s May meeting minutes release

- May 30th: US-Japan trade talks, inflation data out of major economies (Japan, Germany).

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.