Daily Market Analysis and Forex News

Week Ahead: 3 assets primed for big moves – Brent, USDInd, and AUDUSD

Saturday, July 5th: OPEC+ meeting may rock oil benchmarks

Tuesday, July 8th: Will RBA rate cut trigger AUDUSD selloff?

AUDUSD has 74.2% of trading within 0.6472 – 0.6646 over 1-week period

Wednesday, July 9th: US dollar vulnerable to Trump’s tariff deadline

USDInd: Technica levels – 97.70, 97.00 and 95.20

After an intense session on Capitol Hill, the US Congress passed Donald Trump’s big, beautiful bill before the July 4 deadline.

With Trump set to sign the $3.3 trillion bill on Friday, focus is back on global trade developments and key data.

Trump’s tariff deadline, the OPEC+ meeting & antipodean central bank decisions could present fresh opportunities in the week ahead:

Satruday, 5th July

- OIL: OPEC+ meeting on production levels

Monday, 7th July

- GER40: Germany industrial production

- EUR: Eurozone retail sales

- CHF: Sweden CPI

Tuesday, 8th July

- AUD: Australia rate decision

- JPY: Japan current account

- TWN: Taiwan CPI, trade

Wednesday, 9th July

- CN50: China PPI, CPI

- NZD: New Zealand rate decision

- USDInd: US FOMC minutes, wholesale inventories

- Trump’s 90-day pause on reciprocal tariffs expires

Thursday, 10th July

- JPY: Japan PPI

- ZAR: South Africa manufacturing production

- US400: US initial jobless claims, Fed speech

Friday, 11th July

- CAD: Canada employment

- GER40: Germany CPI, Merz’s €46 Billion Tax-Breaks Package

- NZD: New Zealand Business, manufacturing PMI

- UK100: UK industrial production, trade balance

- USDInd: US federal budget balance

Here are 3 assets that could experience significant price swings:

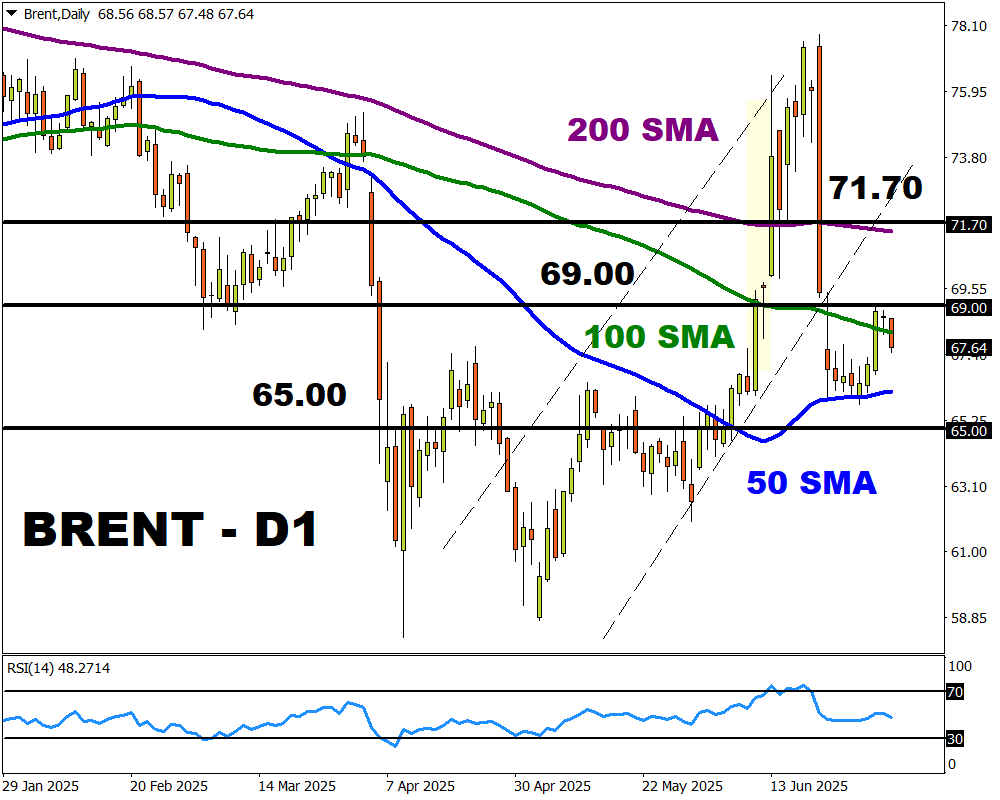

1) BRENT: OPEC+ meeting on production levels

On Saturday, 5th July, OPEC+ will meet to discuss August production levels.

Back in May, the cartel decided to increase oil production levels for July by 411,000 barrels per day – the third consecutive month of such a massive increase.

Markets are expecting OPEC+ to deliver another big production hike for August, which may raise fears around oversupply in the markets. This comes after geopolitical risk sparked heightened levels of volatility in June.

Brent may fall if OPEC+ pushes for faster production hikes with any signs of internal disputes fuelling downside pressures. Weakness below $69.00 may open a path toward the 50-day SMA at $65.00.

Should OPEC+ surprise by slowing down or pausing output hikes, this could boost oil prices as oversupply fears cool. A breakout above $69.00 could trigger a move toward the 200-day SMA at $71.70.

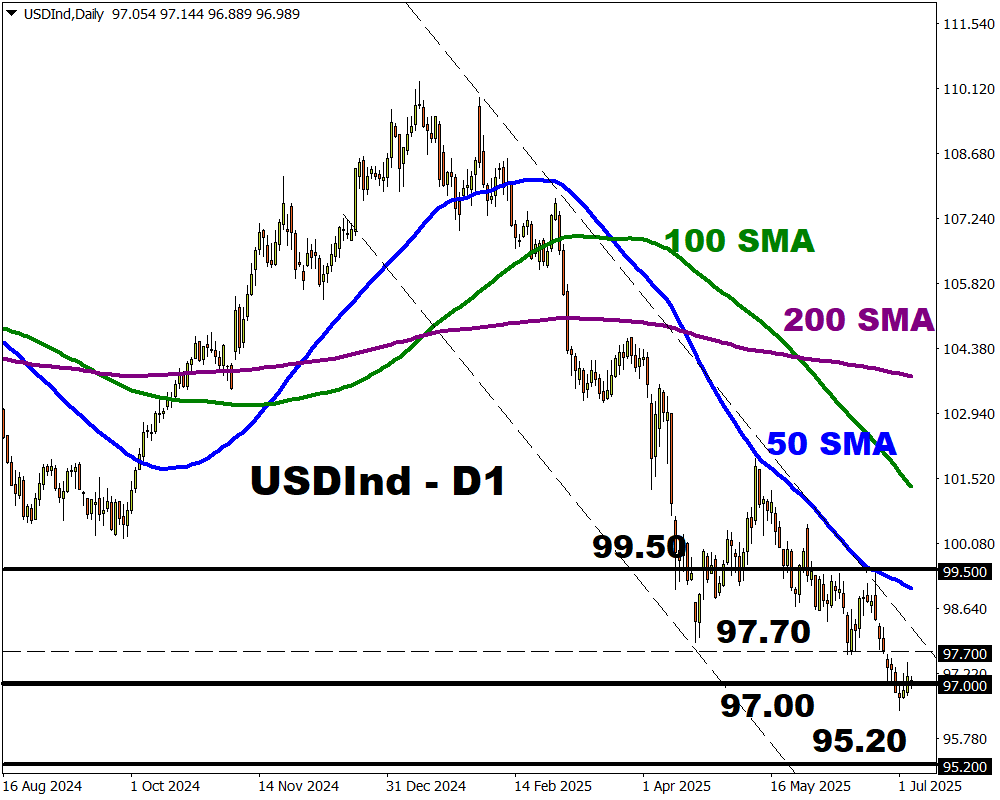

2) USDInd: Trump’s tariff deadline

The 90-day pause in reciprocal tariffs is set to expire on Wednesday, 9th July.

Trump has said that he is not planning to extend the deadline and threatened to begin issuing letters to countries outlining unilateral tariff rates.

Here is the issue: the US has only managed to close a handful of deals with countries including the UK, China and Vietnam. Talks are still ongoing with Europe, Japan and Canada among many other countries.

So, the administration could be back at square one when the deadline expires.

The dollar could weaken if US recession fears make a return in the face of higher tariffs.

Should Trump decide to extend the 90-day pause, this may support the dollar as recession fears are kept a bay.

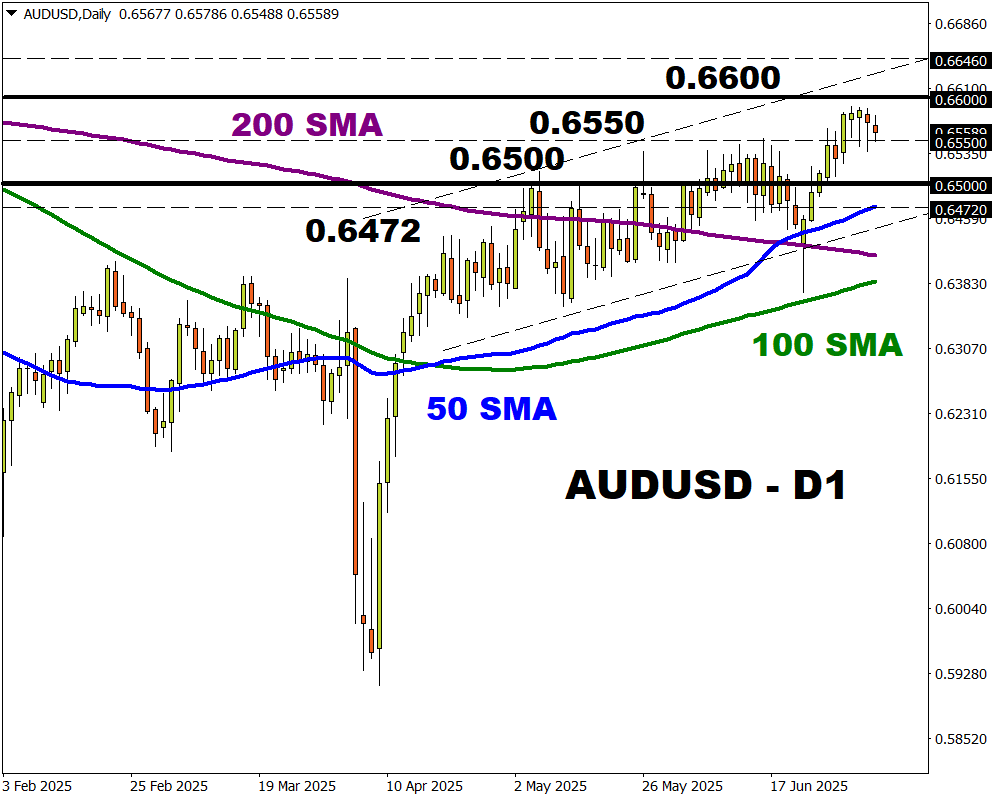

3) AUDUSD: RBA rate decision

The Reserve Bank of Australia (RBA) is expected to cut interest rates by 25 basis points on Tuesday, 8th July.

This is based on Australia experiencing softer-than-expected inflation, slow GDP and weak job gains. Beyond July, traders are pricing in another 2 more rate cuts by the end of 2025.

Should the RBA cut interest rates and strike a dovish note, this may drag the AUDUSD toward 0.6500.

Should the RBA surprise by leaving rates unchanged and sound hawkish, the AUDUSD may rebound toward 0.6600.

Bloomberg’s FX model forecasts a 74.2% chance that AUDUSD will trade within the 0.6472 – 0.6646 range, using current levels as a base, over the next one-week period.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.