Daily Market Analysis and Forex News

Week Ahead: 3 events that could move EURUSD over 100 pips

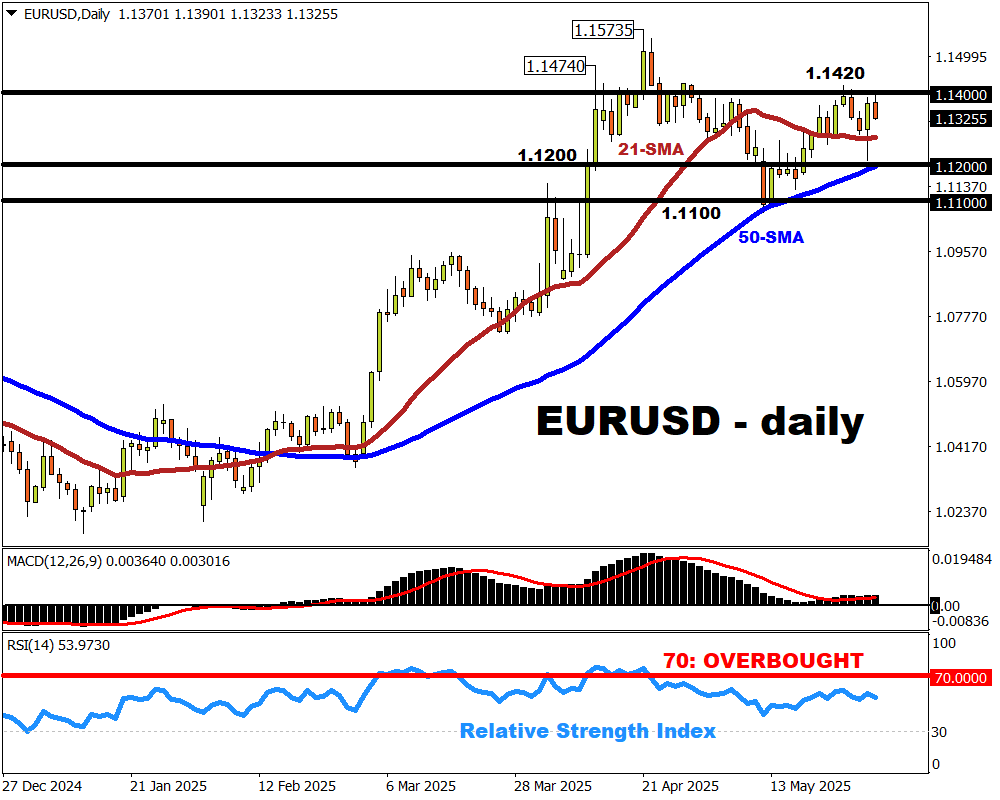

- EURUSD set to end May unchanged; mostly kept to 1.11 – 1.14 range this month

- June 3: Eurozone inflation (CPI) expected to slow in May

- June 5: European Central Bank set to cut rates again, signal future cuts

- June 6: US jobs report may add to US risks - fiscal deficit, tariff rollout, etc.

- Bloomberg model: 74% chance EURUSD trades between 1.118 - 1.149 next week

The euro is flat against the US dollar this month.

At the time of writing, EURUSD is right back where it began May 2025, with just hours remaining in the last trading day of the month (though the US PCE data is still due prior to the weekend).

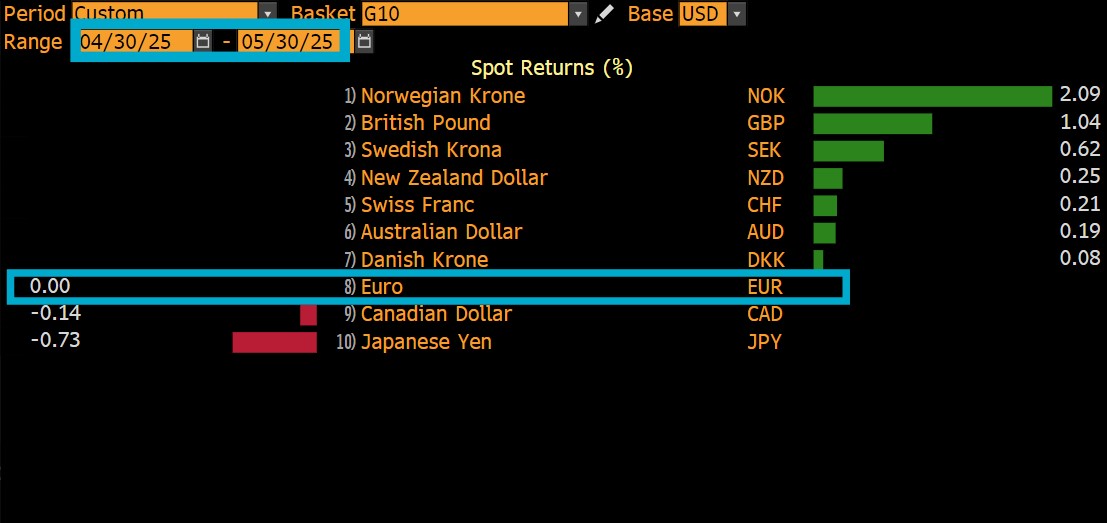

The euro has clearly lagged behind its G10 peers’ performance against the USD:

(IMPORTANT: The data below was generated before the US PCE data is released)

FX markets still gripped by Trump policies

As we enter the first week of June, of course markets remain watchful over:

US fiscal deficit

The Senate is set to have their take on the tax and spending legislation, which had already been passed by the House, and stoked fears of a widening fiscal deficit (US government spending more than it earns from taxes)

US tariff policies

President Trump’s on-then-off tariff rollout, along with the shifting percentage numbers, have rocked markets.Although the shock-and-awe from these tariff-related developments have waned of late, they still warrant constant vigilance.

The above-listed factors will be a common theme during a week that features all these economic events:

Monday, June 2

- SGD: Singapore May PMI

- US30 index: US May ISM manufacturing

- USDInd: Speeches by Fed Chair Jerome Powell, Fed Governor Christopher Waller, Dallas Fed President Lorie Logan, Chicago Fed President Austan Goolsbee

- NAS100 index: US Senate to hash out Trump’s tax and spending bill this week?

Tuesday, June 3

- AUD: RBA meeting minutes; Australia 1Q current account balance

- CN50 index: China May manufacturing PMI

- EU50 index: Eurozone May CPI; April unemployment rate

- US400 index: US April JOLTS job openings, factory orders

- USDInd: Chicago Fed President Austan Goolsbee, Dallas Fed President Lorie Logan speech

Wednesday, June 4

- AU200 index: Australia 1Q GDP

- SG20 index: Singapore May PMI

- CAD: Bank of Canada rate decision

- USDInd: Speeches by Atlanta Fed President Raphael Bostic and Fed Governor Lisa Cook

Thursday, June 5

- AUD: Australia April trade balance

- CHINAH index: China May services, composite PMI

- TWN index: Taiwan May CPI, PPI

- EU50 index: Eurozone April PPI; Germany April factory orders

- EUR: ECB rate decision

- US30 index: US weekly initial jobless claims

- USDInd: Fed Governor Adriana Kugler, Philadelphia Fed President Patrick Harker speech

Friday, June 6

- EU50 index: Eurozone April retail sales; 1Q GDP and employment (final)

- EUR: Germany April industrial production, trade balance

- CAD: Canada May unemployment

- US500 index: US May nonfarm payrolls

3 scheduled events that could rock EURUSD

For EURUSD in particular, these scheduled events could have a major say on whether the world’s most-traded FX pair could get a catch-up boost:

1) Tuesday, June 3: Eurozone May consumer price index (CPI)

Economists predict that Eurozone inflation eased lower in May:

- CPI year-on-year (May 2025 vs. May 2024): 2%

If so, that would lower than April’s 2.2% y/y print

- CPI month-on-month (May 2025 vs. April 2025): 0%

Unchanged from April

- Core CPI year-on-year (excluding energy, food, alcohol, tobacco prices): 2.4%

If so, that would lower than April’s core 2.7% y/y print

Slower-than-expected inflation, closer to the ECB’s 2% target, should pave the way for more rate cuts. Such prospects could keep the euro on the backfoot.

However, a surprise uptick in the CPI figures may boost EURUSD.

EURUSD is expected to react with a 0.44% climb or a 0.25% drop in the 6 hours after this CPI release.

2) Thursday, June 5th: European Central Bank (ECB) rate decision

The ECB is widely expected to again lower its rates by a further 25-basis points – anything else would be a shocker.

More importantly, forward-looking traders and investors are eager to get more clues about the timing of the next ECB rate cut.

Markets currently predict that, after the June policy meeting, there’s a 78% chance that the ECB will cut rates again in September – the final cut for 2025.

EURUSD could get a lift if the ECB pushes back against such forecasts, setting the bar higher for future rate cuts.

However, if the ECB next week opens the door wide open and hints at more-than-one cut (after next week) by end-2025, that could soften the euro.

EURUSD could move 0.36% up or 0.23% down in the 6 hours after ECB's rate decision.

3) Friday, June 6th: US May nonfarm payrolls (NFP)

Here are what economists predict for this always-pivotal monthly jobs report out of the world’s largest economy:

- May headline NFP number: 130,000

If so, that would be lower than the 177k new jobs added in April

- May unemployment rate: 4.2%

Unchanged from April

The US dollar could weaken/EURUSD could rise on a weaker-than-expected US jobs report (fewer-jobs added/higher unemployment) that makes for a more challenging economic outlook.

However, a still-robust US labour market could strengthen the buck and drag EURUSD lower.

EURUSD could move 0.27% up or 0.8% down in the 6 hours after this US NFP release.

Potential Scenarios

According to the Bloomberg FX forecast model ...

EURUSD is likely (74% chance) to trade between 1.118 – 1.149 next week.

- BULLISH: If EURUSD can break above the stubborn resistance around 1.1420, then bulls can set their sights on the 1.1490 region – the upper bound of Bloomberg’s FX forecasted range.

A major bout of US dollar weakness may encourage EURUSD bulls (those hoping prices will go higher) to revisit the 1.157 peak in April – also the highest levels since November 2021.

- BEARISH: A daily close below its 21-day simple moving average (SMA) – a critical support in recent days – may see EURUSD re-testing support around the 1.1200/50-day SMA.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.