Daily Market Analysis and Forex News

Week Ahead: Dollar ready to flex its muscles?

FXTM’s USDInd ↑ 2.5% from 2025 low

US-China trade talks over weekend could rock USD

US CPI + data dump + Powell Speech = more USD volatility?

US CPI sparked moves of ↑ 0.4% & ↓ 1.0% over past year

Technical levels: 102.20, 100.00 & 99.20

The United States has struck a “breakthrough” deal with the United Kingdom, marking the first trade agreement since Trump announced sweeping tariffs last month.

And this has left markets buzzing with anticipation ahead of US-China trade talks in Geneva this weekend.

Beyond global trade developments, high-impact data, including the latest US CPI, corporate earnings and speeches by policymakers will be in focus:

Saturday, 10th May

- CN50: China PPI, CPI

- USDInd: US-China trade talks in Switzerland

Monday, 12th May

- JP225: Japan current account

- MXN: Mexico industrial production

- EUR: EU finance ministers meet in Brussels

Tuesday, 13th May

- CHINAH: JD.com earnings

- AUD: Australia consumer, business confidence

- GER40: Germany ZEW survey

- ZAR: South Africa unemployment

- GBP: UK jobless claims, unemployment

- USDInd: US April CPI, Trump visits Saudi Arabia, Qatar and United Arab Emirates

Wednesday, 14th May

- CHINAH: Tencent earnings

- GER40: Germany CPI

- JPY: Japan PPI

- US500: Fed Vice Chair Philip Jefferson, San Francisco Fed President Mary Daly speech

Thursday, 15th May

- CHINAH: Alibaba earnings

- AUD: Australia unemployment

- CAD: Canada existing home sales, housing starts

- EU50: Eurozone GDP, industrial production

- NZD: New Zealand food prices

- UK100: UK GDP, industrial production

- US30: Walmart earnings.

- USDInd: US retail sales, PPI, Empire manufacturing, industrial production, jobless claims, Fed Chair Jerome Powell speech

Friday, 16th May

- JP225: Japan GDP, industrial production

- NZD: New Zealand Business, NZ manufacturing PMI

- US500: US housing starts, University of Michigan consumer sentiment, import prices

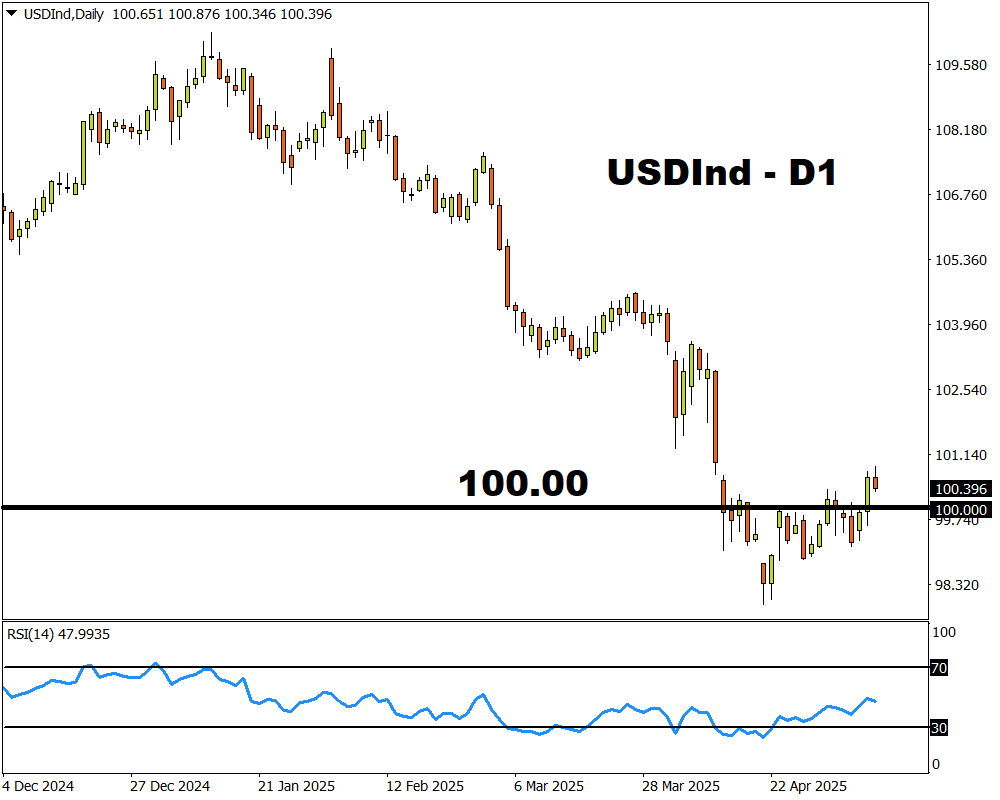

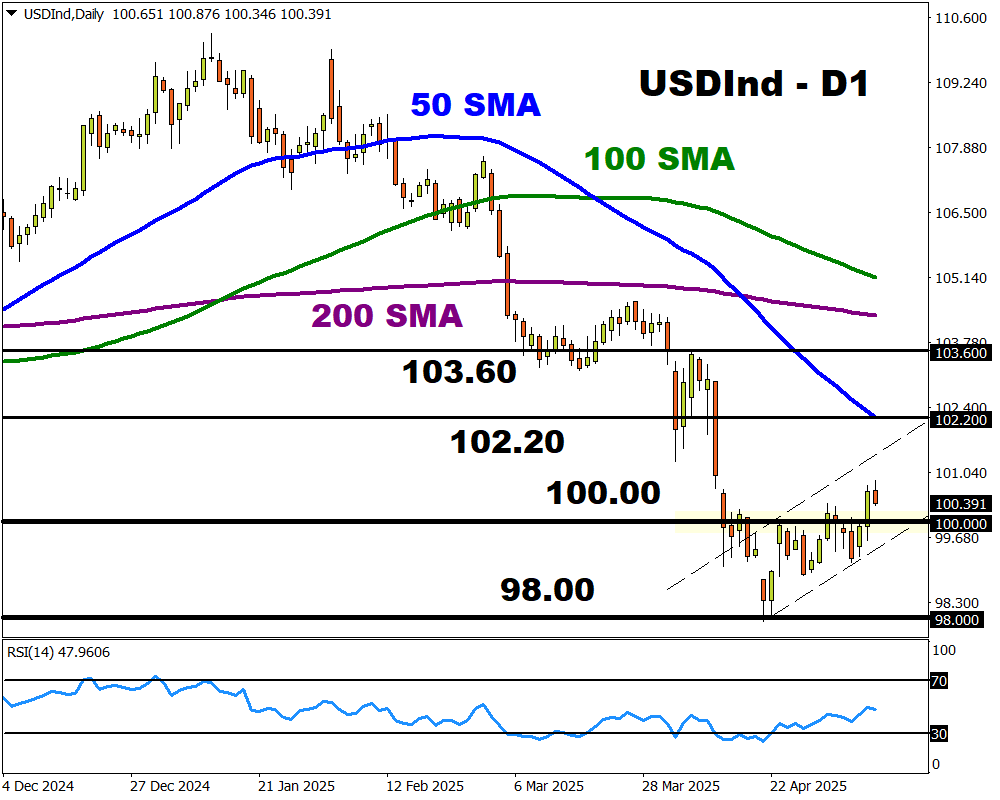

FXTM’s USDInd is under the spotlight after securing a solid daily close above the psychological 100.00 level.

The USDInd tracks the dollar’s performance against a basket of six different G10 currencies, including the Euro, British Pound, Japanese Yen, and Canadian dollar.

The dollar has appreciated against most currencies this week thanks to Powell’s hawkish tone and easing trade tensions.

Another major move could be brewing for the USDInd and here are 4 reasons why:

1) US-China trade talks in Switzerland

Over the weekend, US and Chinese officials will engage in talks to de-escalate trade tensions between the world’s two largest economies.

According to reports, the Trump administration is considering a significant tariff reduction to temper economic pain and soothe tensions. However, China has adopted a more defensive approach toward trade talks, reiterating its call for the US to cancel unilateral tariffs.

- Should the talks end on a positive note and open doors to further negotiations, the dollar could rally as US recession fears cool.

- If the talks end on a sour note and result in fresh trade uncertainty, the dollar may weaken as US recession fears mount.

2) US April CPI report

The April Consumer Price Index (CPI) published on Tuesday 13th May could influence Fed cut bets.

Markets are forecasting:

CPI year-on-year (April 2024 vs. April 2025) to remain unchanged at 2.4%

Core CPI year-on-year to remain unchanged at 2.8%

CPI month-on-month (April 2025 vs March 2025) to rise 0.3% from -0.1% in the prior month

Core CPI month-on-month to rise 0.3% from 0.1% in the prior month

Over the past 12 months, the US CPI has triggered upside moves of as much as 0.4% or declines of 1.0% in a 6-hour window post-release.

A hotter-than-expected US CPI print could push the USDInd higher as Fed cut bets cool.

Should the inflation report print below forecast, this may drag the USDInd lower.

3) US data dump + Powell speech

A string of key US economic data and speeches by numerous Fed officials could inject the dollar with more volatility.

Investors will direct their attention towards the latest US retail sales report, Producer Prices Index (PPI), and industrial production among other data releases, to gauge the health of the US economy. Speeches by various Fed officials, including Fed Chair Jerome Powell may provide fresh clues on the Fed’s next move.

Should overall US economic data print above forecasts and Fed speakers strike a hawkish note, this could boost the USDInd.

Soft US economic data and dovish-sounding Fed officials may weigh on the USDInd.

4) Technical forces

The USDInd could be gearing up for further upside but this will depend on whether the 100.00 level proves to be reliable support. Prices are trading above the 50, 100 and 200-day SMA and respecting a bullish channel.

Should 100.00 prove reliable support, prices may venture toward the 50-day SMA at 102.20 and 103.60.

Weakness below 100.00 may encourage a decline back towards 99.20 and 98.00.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.