Daily Market Analysis and Forex News

Week Ahead: Dollar set for Tuesday turmoil?

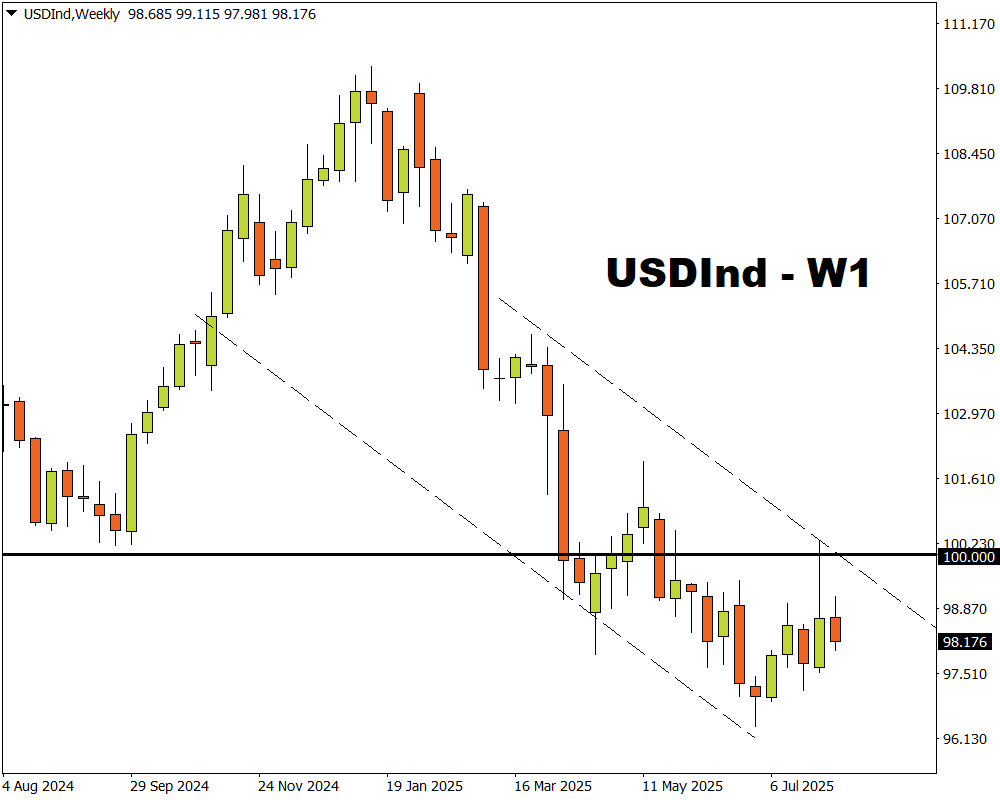

FXTM’s USDInd ↓ almost 2% MTD

US CPI report + US-China truce deadline = opportunity?

90-day US-China trade truce expires on Tuesday 12th August

Over past year US CPI triggered moves of ↑ 0.3% & ↓ 0.4%

Technical levels: 98.80, 50-day SMA & 97.20

A string of high-impact data releases and ongoing developments concerning global trade may inject financial markets with fresh volatility!

The week ahead features the RBA decision, key US inflation data and expiration of a preliminary US-China trade truce:

Saturday, 9th August

- CN50: China PPI, CPI

Monday, 11th August

- MXN: Mexico industrial production

- ZAR: South Africa manufacturing production

Tuesday, 12th August

- AUD: RBA rate decision

- GER40: Germany ZEW survey expectations

- ZAR: South Africa unemployment, mining output

- OIL: OPEC monthly oil market report.

- GBP: UK employment

- USDInd: US CPI, Richmond Fed President Tom Barkin speech

- Preliminary trade truce between the US and China expires

Wednesday, 13th August

- CHINAH: Tencent earnings

- GER40: Germany CPI

- JP225: Japan PPI

- ZAR: South Africa retail sales

- USDInd: Atlanta Fed President Raphael Bostic speech

Thursday, 14th August

- CHINAH: JD.com earnings

- AUD: Australia unemployment

- EUR: Eurozone GDP, industrial production

- UK100: UK industrial production, GDP

- US500: US PPI, initial jobless claims, Richmond Fed President Tom Barkin speech

Friday, 15th August

- CAD: Canada manufacturing sales, existing home sales

- CN50: China retail sales, industrial production, fixed asset investment

- JPY: Japan industrial production, GDP

- NZD: New Zealand food prices, BusinessNZ manufacturing PMI

- USDInd: US retail sales, University of Michigan consumer sentiment, industrial production, Empire State manufacturing

The spotlight shines on FXTM’s USDInd which is down almost 10% year-to-date.

Growing bets around lower US interest rates amid soft data have weighed on the dollar in recent days. Prices are down almost 2% this month, trading around the 98.00 region.

Here are 3 forces that may rock the dollar:

1) US July CPI report – Tuesday 12th August

The incoming US Consumer Price Index (CPI) may influence monetary policy expectations.

Markets are forecasting:

CPI year-on-year (July 2025 vs. July 2024) to rise 3.0% from 2.9%.

Core CPI year-on-year to rise 2.8% from 2.7%.

CPI month-on-month (July 2025 vs June 2025) to cool 0.2% from 0.3%.

Core CPI month-on-month to rise 0.3% from 0.2% in the prior month.

Signs of creeping inflationary pressure may cool bets around the Fed cutting interest rates, supporting the dollar as a result.

Traders are currently pricing in a 90% chance of a Fed cut by September with the odds of another cut by October at 54%.

Note: Speeches from Fed officials and other key data, including the US retail sales, consumer sentiment and industrial production may impact the USDInd after the CPI report on Tuesday.

USDInd is forecast to move 0.3% up or 0.4% down in a 6-hour window after the US CPI report.

2) US-China trade truce deadline

A preliminary 90-day trade truce between the United States and China is set to expire on Tuesday 12th August.

There have been reports of a potential extension, with Trump stating that he was “getting very close to a deal”. However, nothing has been officially confirmed.

If both sides are unable to agree on an extension before the deadline, the US could revert to 145% tariffs on Chinese goods, and Beijing might reinstate its 125% duties on US goods.

Should both sides agree to extend the deadline, this could tame fears around a global recession and support the USDInd.

If the deadline expires, fears around the US economic outlook in the face of higher tariffs may drag the USDInd lower.

3) Technical forces

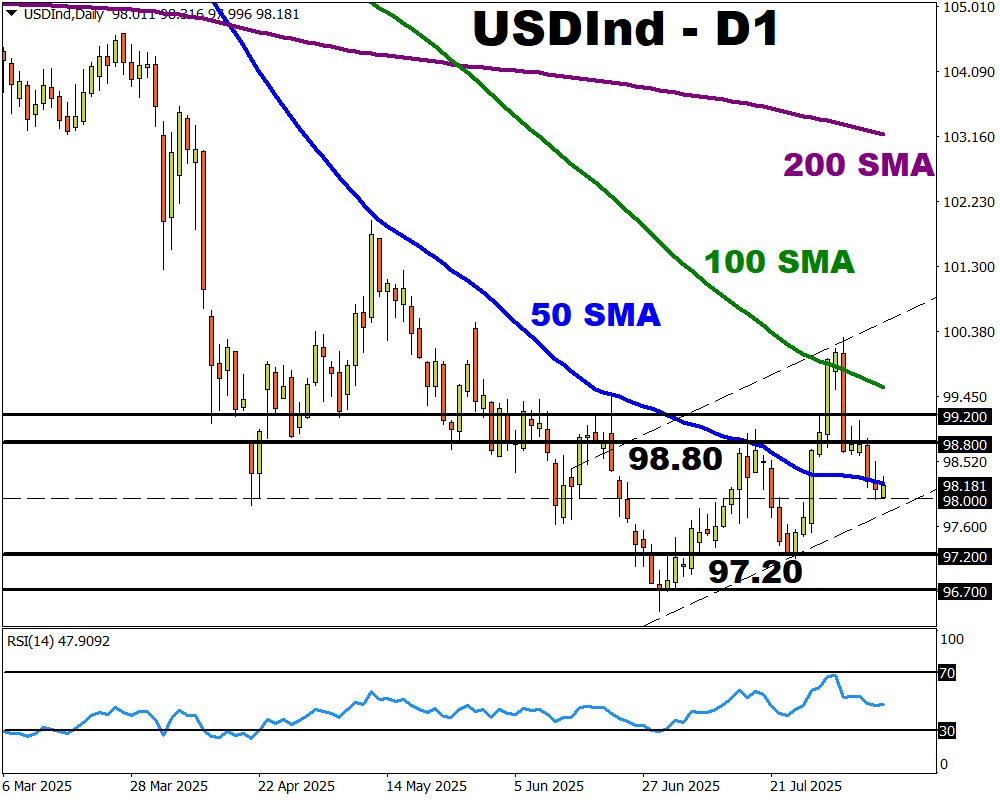

FXTM’s USDInd is under pressure on the daily charts with price hovering near the 50-day SMA.

Should the 50-day SMA prove reliable support, prices may rebound back toward 98.80 and 99.20.

A solid break and daily close below 98.00 could signal a move back toward 97.20 and 96.70.

Ready to trade with real money?

Open accountChoose your account

Start trading with a leading broker that gives you more.